Potential Financial and Economic Effects of Trade Policy Uncertainty

Over the past year or so the United States has levied tariffs on roughly $250 billion of Chinese imports. This ongoing trade dispute has been on the backburner since February when U.S. Trade Representative Lighthizer notified Congress that the administration would hold off on increasing the tariff rate to 25% from 10% on March 1 as originally planned. The intention of the decision was to allow trade negotiations between the United States and China to proceed.

But the trade dispute took a new turn this weekend when President Trump tweeted, just days before a high-ranking Chinese delegation is due to arrive in Washington for the latest round of negotiations, that the increase would now go into effect on Friday, May 10. Additionally, the president announced $325 billion in new tariffs on other Chinese imported goods which would go into effect “shortly” and would be subject to the higher 25% rate.

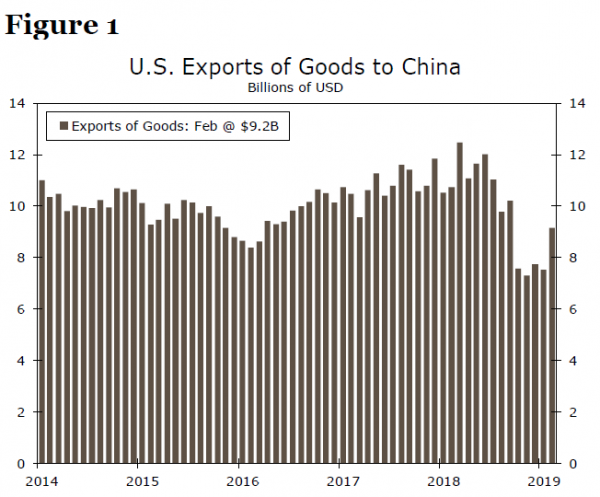

Trump’s action clearly is intended to put pressure on the Chinese to make concessions. Perhaps it will work, but miscalculation on both sides could also occur. If negotiations were to break down China could potentially respond with more retaliatory tariffs, which already have taken a toll on American exports to China (Figure 1). The value of U.S. exports to China fell to $120 billion last year from $130 billion in 2017, a 7% drop compared to the 8% rise in the total value of American exports in 2018. Although China currently levies tariffs on most U.S. goods, the Chinese government could increase the tariff rate, which would likely depress American exports further.

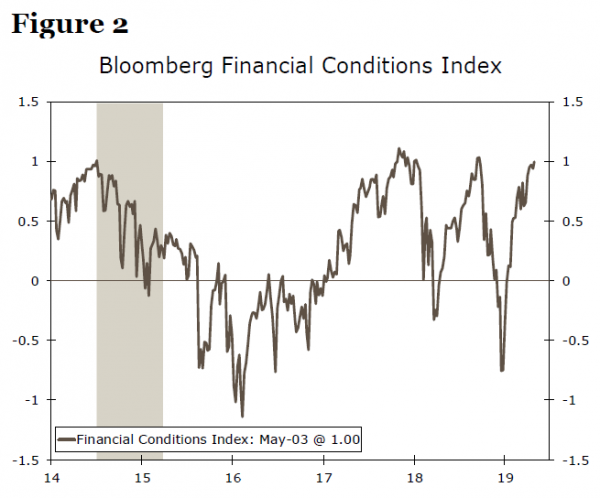

We wrote in a previous report that the direct effects of a full blown trade war with China, should one occur, would probably not bring the U.S. economy to its knees. Exports to China account for less than 1% of U.S. GDP. As we also noted, however, there could be indirect effects that could amplify the slowing effect on the economy. For starters, stock markets around the world have weakened in the wake of the president’s tweets. Generalized weakness in financial markets à la last December would represent a tightening in financial conditions (Figure 2) that could lead to slower economic growth.

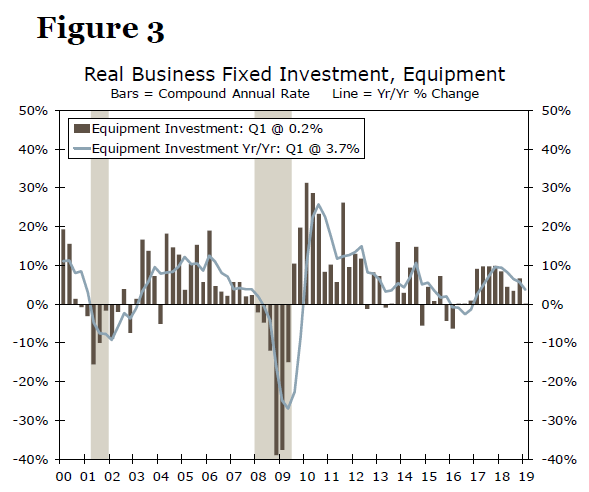

Furthermore, President Trump needs to decide by May 18 whether to impose tariffs on imported automobiles on national security grounds. The increased trade tension with China could lead some businesses to infer that the administration is potentially embarking on a more aggressive trade policy stance. The deceleration in business investment in equipment in recent quarters could reflect, at least in part, uncertainty related to trade policy (Figure 3).1 Further deceleration in business fixed investment spending would clearly lead to slower overall GDP growth.

Higher tariffs on Chinese imports, should they be levied, could impart some upward pressure on CPI inflation in the near term. In our view, however, the Federal Reserve would likely look through any temporary increase in inflation that was caused by a one-off increase in tariffs rates. Rather, any slowing effect that the trade dispute would impart on the economy likely would lead to eventual Fed rate cuts. For now, the Fed is in wait-and-see mode. But trade policy is on the front burner again, and the situation likely will remain fluid in coming days. Stay tuned.

1 A survey by the National Association for Business Economics reported that 38% of respondents in the goods-producing sector said that they have delayed investment due to trade policy uncertainty. See NABE Business Conditions Survey, October 2018.