Over the past month, the American currency has been developing its uptrend due to relatively strong macroeconomic data, which made dollars assets more attractive. This dynamic received a new impetus in the middle of the week after the Fed meeting.

However, the Friday’s U.S. labour market report is able to put into question, or, conversely, strengthen the USD growth trend.

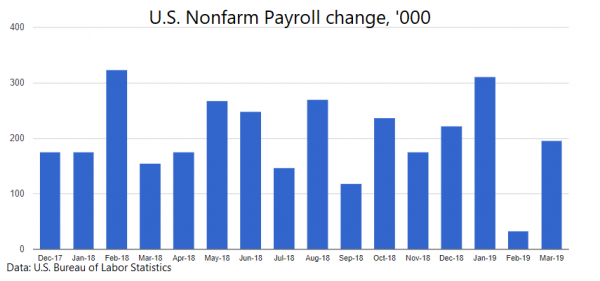

The American economy is set to create about 180K jobs in April, according average analysts’ estimates. This is insignificantly worse than the average monthly growth over the last 12 months. During the week we see some controversial data: the ADP announced a strong employment growth in the private sector, but weekly unemployment claims and Manufacturing ISM point to a cooler growth compared to previous months.

Additionally, the auto and housing markets show a decline in sales, which one more evidence of a consumer confidence drop. Thus, macroeconomic data indicates that the situation in employment is getting a little cooler. And this can be a serious obstacle to the USD growth.

Against a trade-weighted basket of 6 major currencies, the dollar rose to 2-year highs last week. But for the further dollar growth, this employment report may need to significantly exceed the expectations. However, indirect indicators are set to a “slightly worse than average” report, potentially creating space for a retreat of the USD.