Mixed markets as we head into the business end of the week

Markets in Europe are once again mixed, with US indices eyeing a similar open as we head into the business end of the week.

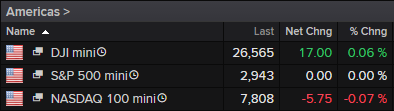

Earnings season remains a key focal point for investors and Monday got us off to a slow – albeit disappointing in the case of Alphabet – start but this should pick up in the coming days. The Fed begins its two day meeting today with the policy decision and press conference following on Wednesday, while the jobs report is also due on Friday to bring a heavy week to a close. We’re probably seeing some caution right now in anticipation of these, particularly as we’re now back at record highs in the case of the S&P 500 and Nasdaq.

The Chinese PMIs overnight won’t have spread much optimism, only a month after that very data led many to question whether they had become too pessimistic about the world’s second largest economy. It’s important to note that the manufacturing PMI remained in growth territory – just – but this was undoubtedly a setback. This is probably a sign of what we can expect in the near-term, mixed data that’s volatile from month to month.

Data from the eurozone has provided some positivity – against the backdrop of a broadly negative environment, it’s worth pointing out – with first quarter growth and unemployment figures both exceeding expectations. I don’t think anyone is kidding themselves after this data – 7.7% unemployment is still not good enough and 1.2% annual growth certainly isn’t but at a time when the data seems to be deteriorating month on month, we have to take what we can get.