Asian stocks declined as traders start to worry about China’s growth. This is after the country released weak PMI data for April. During the month, the Markit manufacturing PMI declined to 50.1 from the previous 50.5. Traders were expecting the PMI to rise to 50.7. Data released by Caixin showed that the manufacturing PMI declined to 50.2 from the previous 50.8. The non-manufacturing PMI declined to 54.3 from the previous 55. This data comes after impressive Q1 GDP growth in the country.

The euro rose slightly ahead of the release of key economic data from Europe. In Germany, the unemployment rate is expected to remain unchanged at 4.9. In Italy, the unemployment rate is expected to drop slightly to 10.6% from the previous 10.7%. In Europe, the GDP for the first quarter is expected to remain at 1.1%. On a QoQ basis, the GDP is expected to rise by 0.3%. In Germany, the headline CPI is expected to rise by 1.6% from the previous 1.3%. Harmonized inflation is expected to rise by 1.7%.

The Canadian dollar was little moved ahead of key economic growth numbers. The numbers are expected to show that the country’s economy grew by 1.4% in the first quarter. This will be slightly lower than the previous growth of 1.6%. On a quarterly basis, the economy is likely to grow by 0.1%, lower than the previous 0.3%. The Industrial product price index should have grown by an annualized rate of 0.7% while raw materials prices are expected to have grown by 3.9%.

EUR/USD

Since Friday, the EUR/USD pair has risen from a low of 1.1109 to a high of 1.1192. On the hourly chart, this price is along the 38.2% Fibonacci Retracement line. It is slightly above the 25-day and 50-day moving averages while the volumes indicator remained significantly low. The momentum indicator has continued to rise. There is a likelihood that the pair will continue moving higher, potentially to the 50% Fibonacci Retracement level of 1.1215.

USD/CAD

The USD/CAD pair was little changed ahead of the Canadian economic data. The pair is trading at 1.3460, which is slightly lower than the previous high of 1.3520. On the four-hour chart, the price is along the 25-day moving averages and above the 50-day moving averages. The price is also between the 100% and 61.8% Fibonacci Retracement line. There is a likelihood that the pair will resume the upward trend, to test the previous high of 1.3520.

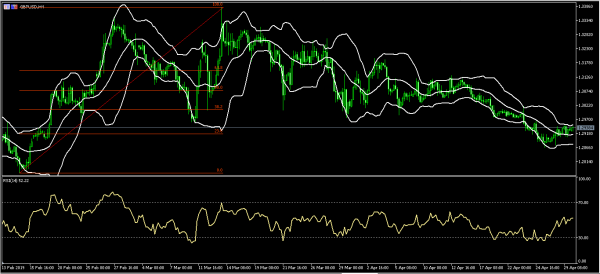

GBP/USD

The GBP/USD pair paused the downward trend that started in mid-March. It is now trading at 1.2938, which is slightly above the previous low of 1.2860. On the chart below, this is along the upper line of the Bollinger Bands while the RSI has continued moving higher. The pair will likely continue moving higher to test the 50% Fibonacci Retracement level of 1.3075.