The price of crude oil declined slightly after Trump asked OPEC members to boost production. On Friday, he sent a tweet saying that he had talked with some OPEC members, who were ‘in agreement’ about raising crude production. However, according to OPEC secretary general, no such conversation had taken place. He said that the cartel will determine whether to boost production in their meeting in March. For months, Donald Trump has criticised OPEC for cutting production, with the aim of boosting prices. However, some of his actions, like cutting-off Iran and putting sanctions on Venezuela have contributed to the high prices.

The euro rose slightly against the USD ahead of a busy week. Today, Europe will release some data that will help measure the performance of the economy. The industrial sentiment is expected to decline to minus 2.0 from the previous -1.7. The services sentiment is expected to decline to 11.1 from the previous 11.3 while the consumer confidence is expected to remain unchanged at minus 7.9. The business and consumer survey is expected to drop to 105 from the previous 105.5. Meanwhile, Belgium will release its CPI data.

Today, traders will receive the PCE data ahead of the Fed’s interest rates data and NFP data. The core PCE price index for March is expected to rise by 1.7%. On a MoM basis, the core PCE data is expected to rise to 0.1%. In March, personal income numbers are expected to rise by 0.4% from the previous 0.2%. The personal spending is expected to rise by 0.7%. This data will come a few days after the US released better-than-expected first-quarter GDP numbers. This week, the Fed will make its decision while the Labor Department will release the jobs data.

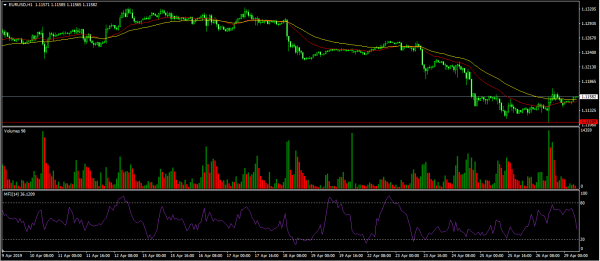

EUR/USD

The EUR/USD pair rose slightly today to a high of 1.1156 from last week’s low of 1.1110. On the hourly chart, the price is slightly above the 25-day and 50-day moving averages. The volumes are relatively low while the money flow index has declined to a low of 36. The pair will likely continue to consolidate along these prices ahead of the FOMC decision on Wednesday.

XTI/USD

The XTI/USD pair extended Friday’s declines to reach an intraday low of 62.9. On the four-hour chart, the price is slightly below the 50-day and 25-day moving averages. The two averages are doing an intersection, which could lead to lower prices. The RSI has dropped to below 30 while the Stochastic Indicator has started to move up. The pair could resume its upward trend because OPEC is unlikely to yield to Trump’s pressure.

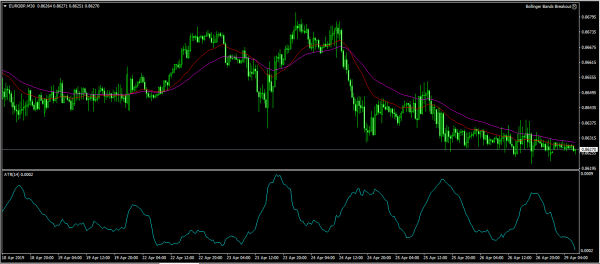

EUR/GBP

In the past few weeks, the EUR/GBP pair has been in consolidation mode as shown on the 30-minute chart below. The pair is trading along the 0.8626 level, which is slightly above last week’s low of 0.8620. The price is slightly below the 50-day and 25-day moving averages. The Average True Range (ATR) has continued to drop. Today, the pair will likely react to the data from the EU and a statement by Governor Mark Carney.