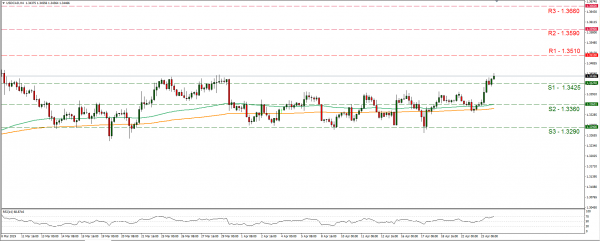

Today during the American session (14:00, GMT), Bank of Canada is expected to release its interest rate decision. The bank is widely expected to remain on hold at +1.75% and currently CAD OIS imply a probability of 100.00% for the bank to remain on hold, practically rendering the interest rate level as an open and shut case. Hence we expect the market to turn its focus on the accompanying statement, the bank’s new projections and the press conference (15:15, GMT). Analysts seem to be prepared for the bank to maintain a dovish tone, especially after the last decision, when the bank had removed its explicit hawkish bias. Yet we could see the bank trying to keep its options open, moderating its tone, as oil prices are rising and uncertainty about global growth seems to be easing somewhat. Also should the bank lower its projections, especially for the GDP rate, we could see the Loonie losing ground. Please bear in mind that volatility could be maintained throughout BoC Governor Poloz’s press conference later on. USD/CAD rose yesterday, breaking the 1.3360 (S1) and the 1.3425 (S2) resistance line (now turned to support). We could see the pair maintain some bullish tendencies today and expect it to be sensitive to the BoC interest rate decision. Also please be advised that the RSI indicator in the 4 hour chart, has touched the reading of 70 implying aa rather overcrowded long position. Should the pair find fresh buying orders along its path once again today, we could see it breaking the 1.3510 (R1) resistance line and aim for the 1.3590 (R2) resistance level. On the other hand if the pair comes under the selling interest of the market, we could see it breaking the 1.3425 (S1) support line and aim for the 1.3360 (S2) support level.

BoJ interest rate decision.

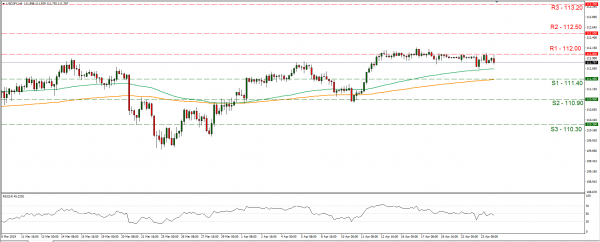

Tomorrow during the Asian session, albeit at a tentative time, Bank of Japan is expected to release its interest rate decision. The bank is widely expected to remain on hold at -0.10% and currently JPY OIS imply a probability of 96.18% for the bank to remain on hold. Hence we expect the market to turn its focus on the accompanying statement, the bank’s new projections and the press conference. Given recent statements made by a number of BoJ officials, the bank seems prepared to ease its ultra-light monetary policy in order to bring momentum for inflation to rise. Furthermore the release of BoJ’s outlook report, especially if its forecasts are lowered, could also add volatility to the release. Should the bank maintain or even enhance its dovish tone and/or revise downwards its projections, we could see the JPY weakening. Please bear in mind that volatility could be maintained throughout BoJ Governor Kuroda’s press conference later on. USD/JPY maintained a sideways movement yesterday, constantly teasing the 112.00 (R1) resistance line. We could see the pair having some bullish tendencies today, especially if the market expects the BoJ to maintain a dovish tone tomorrow. Should the bulls dictate the pairs direction, we could see it breaking the 112.00 (R1) resistance line and aim for the 112.50 (R2) resistance hurdle. On the flip side should the bears take over, we could see the pair breaking the 111.40 (S1) support line and aim for the 110.90 (S2) support barrier.

Other economic highlights, today and early tomorrow

Today during the European session we get Germany’s Ifo Business Climate for April and in the American session we get from the US the weekly EIA crude oil inventories figure.

Support: 111.40 (S1), 110.90 (S2), 110.30 (S3)

Resistance: 112.00 (R1), 112.50 (R2), 113.20 (R3)

Support: 1.3425 (S1), 1.3360 (S2), 1.3290 (S3)

Resistance: 1.3510 (R1), 1.3590 (R2), 1.3660 (R3)