Wednesday April 10: Five things the markets are talking about

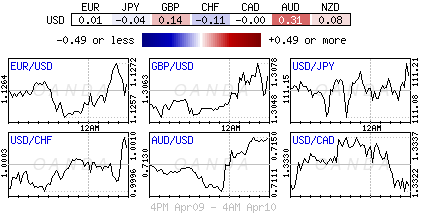

Global equities are mixed overnight on growth concerns and an escalation in trade tensions. Sovereign bond yields have fallen while the ‘big’ dollar trades steady.

The market will focus on a number of major events today, the ECB monetary policy announcement, EU summit Brexit extension announcement, the FOMC minutes and U.S inflation data.

The ECB meeting is likely to be rather calm. After having played with policy last month, any additional changes are probably sometime away. Expect key interest rates to remain on hold, while the central bank reaffirms its new ‘extended forward guidance’ under which it aims to leave rates.

The market does not expect the ECB to announce any further details of the built-in incentives for the next TLTRO. Investors should expect them to continue with the balancing act between demonstrating that it is not running out of ammunition while still keeping everything close at hand. The ECB is considered to be in a ‘wait and see mode.’ As per usual, expect today’s focus will be on questions and answers at President Mario Draghi’s press conference (08:30 am EDT).

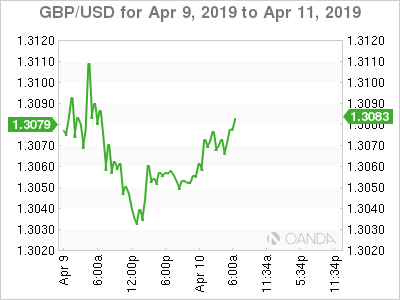

All sterling position holders are waiting for some fresh news from the EU summit on the U.K’s extension request. Yesterday, U.K parliament approved PM May’s plan to ask for a Brexit extension to June 30. Currently, the market expects the U.K to get another Brexit extension, but longer, up to 12-months and not the short June request by PM May. Under this scenario a general election in the U.K is seen as the most likely scenario.

Note: The U.K is technically due to exit the EU on Friday.

On tap stateside: U.S banks will soon begin Q1 reporting. The spring meetings of the World Bank Group and the IMF continue in Washington, while the FOMC will release minutes of its March meeting (2:00 pm EDT).

1. Equities looking for a growth sign

In Japan, the Nikkei dropped to a one-week low overnight as escalating trade tensions between the U.S and EU and worries about the global growth outlook-tired investor confidence. The Nikkei share average ended -0.5% lower, the lowest closing level since April 3. The broader Topix dropped -0.7%.

Down-under, Aussie stocks hardly moved overnight, despite investor appetites taking a sharp hit after the IMF downgraded its global growth forecast a third time since October. The S&P/ASX 200 index, largely unmoved for a second consecutive session, inched up +0.03%. In S. Korea, the Kospi index (+0.5%) saw a late uptick, extending its recent winning streak further into a second week. The Kospi has risen 9 straight days.

In China, stocks ended higher overnight, supported by strength in consumer and healthcare companies. The blue-chip CSI300 index rose +0.3%, while the Shanghai Composite Index closed up +0.1%.

In Hong Kong, stocks ended lower overnight, amid worries over slower global economic growth and trade tensions. The Hang Seng index fell -0.1%, while the China Enterprises Index lost -0.4%.

In Europe, regional bourses are trading mostly higher, coming off earlier lows after a mostly weaker session in Asia overnight. U.S Index futures point a stronger open recouping some of the losses seen Tuesday.

U.S stocks are set to open in the ‘black’ (+0.13%).

Indices: Stoxx600 +0.08% at 386.44, FTSE -0.07% at 7,420.50, DAX +0.40% at 11,898.49, CAC-40 +0.35% at 5,455.42, IBEX-35 +0.32% at 9,437.90, FTSE MIB +0.22% at 21,719.50, SMI +0.40% at 9,579.50, S&P 500 Futures +0.13%

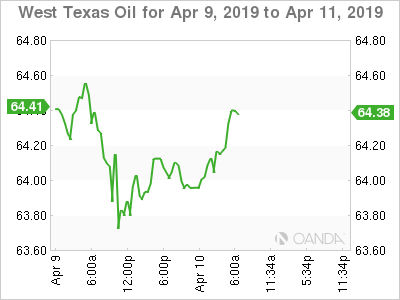

2. Oil edges up amid tightening supply, but economic slowdown caps gains

Oil prices have again inched up overnight amid supply cuts by OPEC+ and U.S sanctions on oil exporters Iran and Venezuela but pressured by expectations that an economic slowdown could soon impede fuel consumption.

Brent futures are at +$70.76 per barrel, up +15c, or +0.2%, from Tuesday’s close, while U.S West Texas Intermediate (WTI) crude oil futures are at +$64.20 per barrel, up +22c, or +0.3%.

Note: Both benchmarks hit five-month highs yesterday, before easing on global growth worries.

Crude prices have been further lifted this week by escalating violence in Libya, a significant supplier of oil to Europe, which produced around +1.1M bpd of crude in March.

Elsewhere, Russia remains a reluctant participant in the supply cuts. It signaled earlier this week that it wanted to raise output when it meets with OPEC in June because of falling stockpiles.

Despite the OPEC+ led cuts and U.S sanctions, not all regions are in tight supply. Stateside, crude oil production has risen by more than +2M bpd since early 2018, to a record +12.2M bpd.

Data yesterday from the API showed that U.S crude stocks rose by +4.1M barrels in the week to April 5, to +455.8M barrels.

Expect dealers to take direction from today’s EIA report at 10:30 am EDT

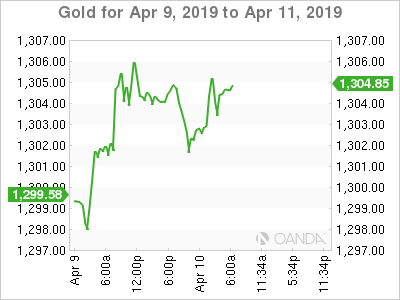

Ahead of the U.S open, gold continues to trade within striking distance of its two-week high print in yesterday’s session, as investors worry about the trade tensions between the U.S and Europe and as the IMF cut its global growth outlook again. Spot gold is down about -0.1% at +$1,303.14 per ounce, after touching its highest since March 28 at +$1,306.09 Tuesday. U.S gold futures are also down about -0.1% at +$1,307.60 an ounce.

3. Sovereign bonds poised for action ahead of ECB and E.U summit announcements

A lot of new supply has been taken down globally this week (Germany, U.S, Japan, Italy, Portugal), but despite this, dealers are poised for a busy trading day ahead of a slew of key economic data, the ECB meeting, emergency EU summit at which Brexit will be discussed and U.S inflation data.

That been said, it’s no surprise to see sovereign bond yields are lower in early trade, after weak economic growth projections from the IMF yesterday and EU-U.S trade tensions.

Peripheral and longer-dated eurozone bonds have also been helped by the strong bid for yield. Germany’s 10-year government bond yield is seen at -0.008%, whilst the yield on 10-year Treasuries has declined -1 bps to +2.49%, the lowest in more than a week.

In the U.K, the 10-year Gilt yield is unchanged at +1.104%, while in Japan, the 10-year JGB yield fell -1 bps to -0.053%.

4. FX ranges remain tight

FX markets are again quiet as traders remain on the sidelines ahead of today’s key events.

EUR/USD (€1.1274) is steady ahead of the ECB rate decision. The market is not expecting any change in policy with focus on Draghi press conference as the overall outlook had not deteriorated enough for the Governing Council to unveil major new stimulus measures.

GBP/USD (£1.3075) is a tad higher as E.U Leaders seemed poised to offer the U.K a longer extension with an exit clause to avoid a no-deal outcome.

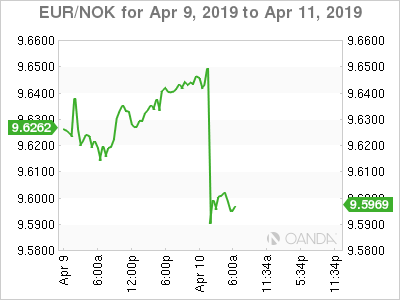

NOK (€9.5949) is a tad firmer after March CPI reading kept the outlook intact for another rate hike by Norges later this year.

5. UK economy grew steadily in February

Data this morning from the ONS showed that the U.K economy grew at a slow, but steady pace in the three months through February, aided by a pickup in demand for U.K goods from buyers worried about the effect on supplies of Brexit.

The economy grew +0.3% December through February, matching the rate of growth achieved in the three months ending in January.

According to the ONS, the expansion was fueled by growth in manufacturing and most services, which offset a drag from the construction sector.

Note: Financial services output has not risen on a monthly basis for a year, a record, exceeding even the length of the slump following the financial crisis a decade ago.

Financial services output is now -2.3% lower than it was in February 2018, ONS data shows.

The ONS said some British factories reported their customers brought forward orders from later in the year to ensure there was no disruption to supplies around the U.K.’s withdrawal from the E.U.