Asia-Pacific equities were mixed after the timing of the US-China trade deal was postponed. In an interview, Donald Trump said that there were still some pending issues, which could push the announcement of the deal to the next four weeks. Traders were expecting a deal to be announced shortly, after the current round of negotiations ends. In Tokyo, the Kospi index rose by 0.4% and in Australia, the ASX 200 dropped by almost a percentage point. Chinese stocks are closed for the Ching Ming Festival.

In Japan, the yen was little moved against the US dollar after the release of weak economic data. The average cash earnings declined by minus 0.8%, which was below the expected gain of 0.9%. In February, the household spending rose by an annualized rate of 1.7%, which was lower than the expected 1.9%. On a MoM basis, spending slumped by -2.0%, which was lower than the expected decline of -0.5%. These numbers come at a time when the unemployment rate is at just 2.5% and inflation rate is below the BOJ target of 2.0%. Therefore, it will be unlikely for the BOJ to hike rates this year.

Today, traders will focus on the German industrial production data for March. They expect the numbers to show an increase of 0.6%, which will be better than the previous month’s decline of 0.8%. In Spain, the industrial production for February is expected to have increased by 0.2%.

In the United States, the Labor Department is expected to release the employment numbers. The non-farm payrolls numbers for March are expected to rise to 170K, which is higher than the 20K released in March. The private nonfarm payrolls are expected to increase to 170K. The unemployment rate is expected to remain at 3.8% while the average weekly hours is expected to remain at 34.5. The average hourly earnings are expected to remain unchanged at 3.4% while the U6 unemployment rate is expected to remain at 7.6%. Today’s jobs numbers will be very important to the markets, because of how unexpected the previous release was.

In Canada, the unemployment rate is expected to remain at 5.8% while the participation rate is expected to decline to 65.7%.

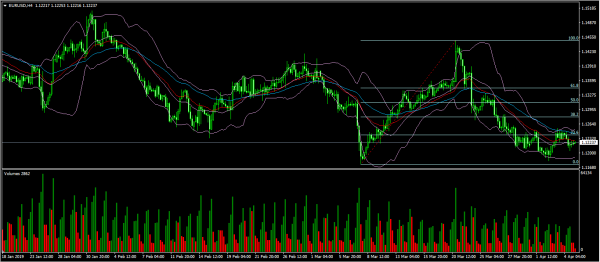

EUR/USD

The EUR/USD pair moved up slightly in overnight trading as traders wait for data from the EU and America. It is trading at 1.1223, which is slightly higher than yesterday’s low of 1.1204. On the four-hour chart, the pair’s price is slightly above the 25-day and 50-day moving averages while the volumes have decreased. The price is along the middle line of the Bollinger Bands and below the 23.6% Fibonacci Retracement level. Today, the pair could make huge swings especially after the release of US jobs numbers.

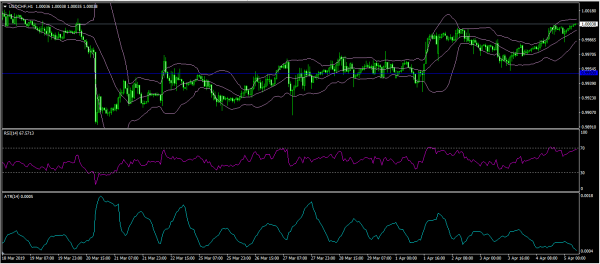

USD/CHF

The USD/CHF pair started an upward rally on March 20, when it reached a low of 0.9893. Today, the pair moved higher ahead of the US jobs numbers. It is trading at 1.0003, which is known as the parity level. On the hourly chart, this price is slightly below the upper band of the Bollinger Bands, while the RSI has moved to the overbought level and the Average True Range indicator has moved to the lowest level since March. While the pair could continue the upward climb, it could also test the previous support of 0.9950, which provides an important support.

USD/CAD

The USD/CAD pair was little moved in overnight trading and is currently trading at the 1.3360 level, which is higher than the previous low of 1.3295. On the hourly chart, the pair is slightly above the middle line of the Bollinger Bands and closer to the upper line of the Envelopes indicator. The RSI has moved slightly lower from the overbought level of 70. The pair will likely consolidate before the jobs numbers are released.