March’s employment report for Canada is likely to attract investor’s attention on Friday at 1230 GMT as the Canadian dollar has been gaining some ground over the past week on the back of rising oil prices. Stronger figures in employment may provide some more relief to the domestic currency, sending dollar/loonie even lower.

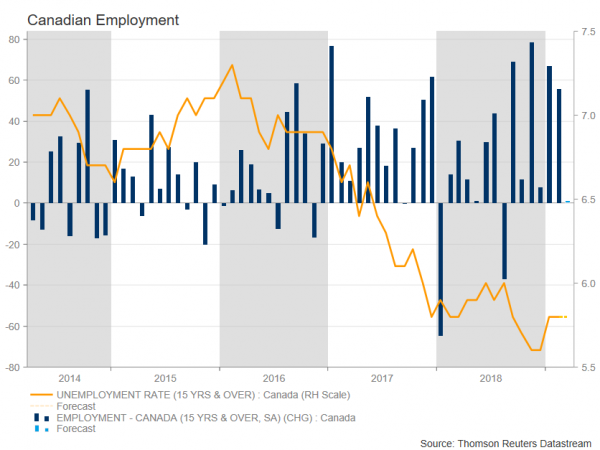

The unemployment rate is forecasted to stay at 5.8% in March, the highest level since October, while the net change in employment is expected to show that the economy added only 1,000 jobs from an impressive 55,900 jobs in February. However, the participation rate is expected to drop to 65.7% versus 65.8% previously, while there could be some gains ahead for the loonie if wage growth and employment numbers show some improvement in the labour market.

However, a weak employment report could shift policymakers’ decision more dovish at their next meeting. The Bank of Canada (BoC) left its interest rates unchanged at 1.75% on March 6, as widely expected. It is the highest rate since December 2008. Policymakers said that the outlook continues to warrant a policy interest rate that is below its neutral range. The Committee added that they would turn their attention on household, oil markets and global trade policy developments as there is uncertainty about the timing of future rate hikes. Turning to domestic GDP growth rate, the economy rose by 0.1% quarter-on-quarter in the last quarter of 2018, slowing from a 0.5% expansion in the prior period. It was the weakest growth rate since the second quarter of 2016. Also, the annualized rate expanded by 0.4% from a 0.2% gain in the third quarter.

In a speech on Monday, BoC Governor Stephen Poloz seemed confident in his speech. He expressed that Canada is adjusting to the challenges in the domestic and global economies and noted that “we can see many areas of encouraging economic growth”.

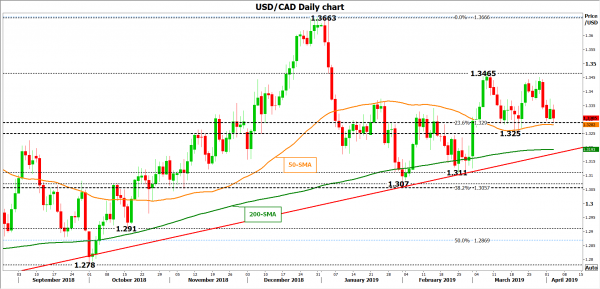

In FX markets, the Canadian dollar lost considerable ground against the dollar in the previous month, helping USDCAD to touch a two-month high of 1.3465. However, a weaker-than-predicted jobs report on Friday, could reduce chances for a rate hike and drive USDCAD to test the 19-month high of 1.3663 strong resistance area, identified by the peaks on December 31.

In the alternative scenario, if the employment report shows growth or/and the unemployment rate shifts lower, the pair could return to the 1.3250 support area, penetrating the 50-day simple moving average (SMA), while steeper declines could also revisit the long-term ascending trend line around the 200-day SMA.

However, the loonie would probably struggle to make any notable gains given the BoC’s dovish tilt.