For the 24 hours to 23:00 GMT, the AUD declined 0.70% against the USD and closed at 0.7062.

LME Copper prices declined 1.0% or $67.0/MT to $6431.0/MT. Aluminium prices declined 1.6% or $30.0/MT to $1858.0/MT.

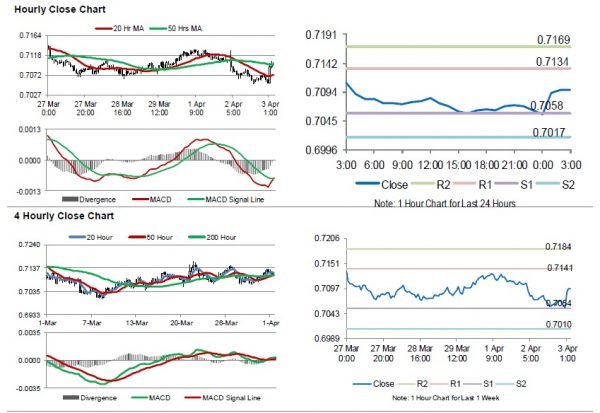

In the Asian session, at GMT0300, the pair is trading at 0.7098, with the AUD trading 0.51% higher against the USD from yesterday’s close.

Overnight data showed that Australia’s seasonally adjusted trade surplus widened to a record high level of A$4801.0 million in February, following a revised surplus of A$4351.0 million in the prior month. Market participants had anticipated the nation to record a surplus of A$3700.0 million. Moreover, the AiG performance of services index rose to a level of 44.8 in March, following a reading of 44.5 in the prior month. Also, the nation’ s seasonally adjusted retail sales hit a 15-month high level of 0.8% on a monthly basis in February, surpassing market expectations for a rise of 0.3%. In the preceding month, retail sales had recorded a rise of 0.1%. On the other hand, Australia’s CBA services PMI declined to a level of 49.3 in March, following a reading of 49.8 in the preceding month.

Elsewhere in China, Australia’s largest trading partner, the Caixin services PMI index rose more-than-expected to a level of 54.4 in March. The services PMI index had recorded a reading of 51.1 in the previous month.

The pair is expected to find support at 0.7058, and a fall through could take it to the next support level of 0.7017. The pair is expected to find its first resistance at 0.7134, and a rise through could take it to the next resistance level of 0.7169.

In absence of key economic releases in Australia today, investor sentiment would be determined by global macroeconomic events.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average