The Australian dollar declined after the central bank released its interest rates decision. As expected, the bank left interest rates unchanged and expressed worries about the slowing economy. The bank said it expects the economy to grow by a slower rate this year. It blamed this on a few things, such as the softening housing market and the drought that has been in some parts of the country. These issues will be offset by more public spending. Regarding inflation, the bank said that conditions remain low and stable but are expected to pick up gradually over the next couple of years. Inflation is expected to be 2% this year and 2.5% in 2020. In the near term, inflation is likely to decline due to low petrol prices.

Deadlock in the UK Parliament continued in overnight trading. Members failed to pass the so-called indicative votes as signs of more divisions in Theresa May’s cabinet emerged. The option currently gaining most support is for Britain to leave the EU while remaining in the customs union. This motion lost by just three votes. Today, Theresa May is expected to hold a five-hour cabinet meeting as she considers the next step on her own plan which has already been rejected three times.

Traders will focus on a stream of data from the US and Europe. In Switzerland, the headline CPI is expected to remain unchanged at 0.6%. In the UK, the construction PMI is expected to improve slightly to 49.8, from last month’s 49.5. In the European Union, the PPI for February is expected to climb slightly by 3.1%. In the United States, the total vehicle sales are expected to rise to 16.7 million while the core durable goods orders are expected to rise by 0.3%.

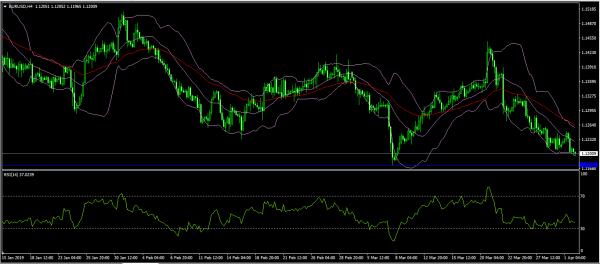

EUR/USD

After yesterday’s pause, the EUR/USD pair moved lower in overnight trading. The pair reached a low of 1.1200, which is along the lowest line of the Bollinger Bands. It is also close to the important support of 1.1175. On the hourly chart, this price is below the 50-day moving averages. The RSI has moved slightly lower. The pair will likely continue moving lower, with the next important point to watch being the 1.1175 level.

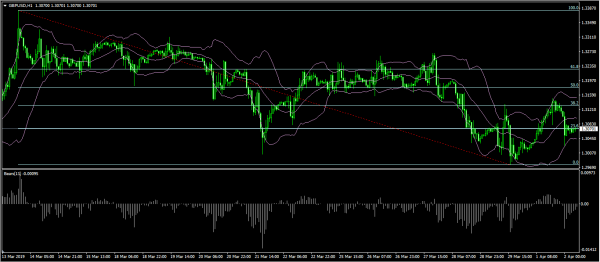

GBP/USD

Sterling declined after the UK Parliament failed to pass any of their Brexit options. The GBP/USD pair declined to a low of 1.3025. It is now trading at the 1.3070 level, which is along the 23.6% Fibonacci Retracement levels and along the middle line of the Bollinger Bands. As the pair stabilized, the Bears Power indicator moved closer to the neutral level. The pair will likely continue to be more volatile as Brexit confusion continues.

AUD/USD

The Australian dollar declined sharply after the slightly dovish statement by the RBA. The AUD/USD pair declined to a low of 0.7080, which was the lowest level since last Friday. On the hourly chart, the On-Balance Volume declined sharply to the lowest level this year. The price is along the lower line of the Bollinger Bands while the moving average oscillator continued to declined. The pair will likely continue to decline until it tests the important support of 0.7050.