Thursday March 28: Five things the markets are talking about

The ‘big’ dollar remains better bid, supported by continued signs of a weakening European economy, which is spreading investor concerns about a slowdown in global growth.

Even interest rate differentials are providing the ‘greenback’ support as central banks signal, they are backing away from their desire to hike interest rates as part of their goal of bringing monetary policy in line with pre-crisis norms.

On the geo-political front, UK MP’s failed to find a majority for any alternative Brexit arrangement yesterday to PM May’s Brexit deal, but agreed by an overwhelming majority that they opposed leaving the EU without any agreement.

Parliament vote breakdown:

- U.K. Parliament Votes Against No-Deal Exit 400 to 160

- Votes against EU Single Market, Customs Union by 288 to 188

- Votes against EU Single Market by 377 to 65

- Votes against EU Customs Union by 272 to 264

- Votes Against Customs Union, Close Alignment with Single Market by 307 to 237

- Votes show no clear majority for any Brexit option

- Votes against cancelling Brexit to avoid no deal by 293 to 185

- Votes against new referendum on deal by 295 to 268

- Votes against ‘managed’ no-deal exit 422 to 139

What’s clear is that PM May’s divorce deal still does not have sufficient backing, even after she offered to quit this summer if the deal is ratified, and that support for a ‘harder’ Brexit route is weakening. Brexit’s next step remains unknown – the U.K has only a fortnight before it has to go the EU with a plan for its next steps.

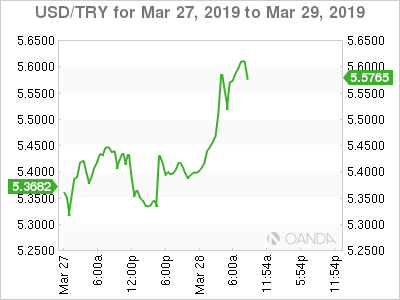

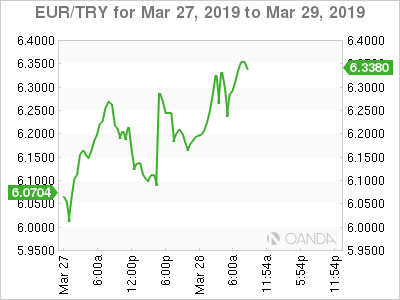

Elsewhere, Turkey remains in focus after domestic stocks suffered their biggest one day loss in three years in reaction to government measures aimed at preventing banks from facilitating deals that lead to a decline in the TRY ahead of this weekend’s elections that will test support for President Erdogan leadership.

On tap: China-U.S trade talks begin today, U.S final GDP (Mar 28), GBP current a/c, CAD GDP (Mar 29).

1. Stocks mixed signals

In Japan, the Nikkei slipped overnight as lower U.S bond yields fuelled investor fears about a slowdown in the world’s largest economy and a deepening downturn globally. The Nikkei share average closed -1.6% lower, while the broader Topix fell -1.7%.

Down-under, Aussie stocks ended higher overnight, as investors welcomed signs of possible progress towards a U.S-China trade deal, with miners and energy stocks leading the way. The S&P/ASX 200 index closed +0.7% higher. In S. Korea, the Kospi stock index closed down -0.82% overnight as investors remained cautious over global growth concerns as well as corporate earnings.

In China, stocks ended weaker overnight as lingering concerns over the domestic economy and trade weighed on investor sentiment. At the close, the Shanghai Composite index was down -0.92%, while the blue-chip CSI300 index was down -0.4%. In Hong Kong, stocks closed out in positive territory on investor hopes of a positive outcome in trade talks. At the close of trade, the Hang Seng index was up +0.16%, while the Hang Seng China Enterprises index fell -0.09%.

In Europe, regional bourses trade higher across the board, tracking higher U.S futures and mixed Asian Indices.

U.S stocks are set to open in the ‘black’ (+0.08%).

Indices: Stoxx600 +0.37% at 378.68, FTSE +0.74% at 7,247.25, DAX +0.54% at 7,247.25, CAC-40 +0.44% at 5,324.55, IBEX-35 +0.04% at 9,234.04, FTSE MIB -0.02% at 21,190.50, SMI +0.61% at 9,447.50, S&P 500 Futures +0.08%

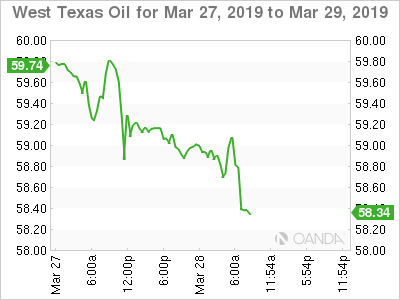

2. Oil prices ease as inventories climb, gold lower

Oil prices are down ahead of the U.S open, extending losses into a second consecutive session following a surprise rise in U.S crude inventories last week.

Brent crude oil futures are at +$67.55 a barrel, down -28c from Wednesday’s close, while U.S West Texas Intermediate (WTI) crude futures are at +$59.21 per barrel, down -20c.

According to yesterday’s EIA report, U.S crude inventories rose last week by +2.8M barrels, compared with market expectations for a decrease of -1.2M barrels.

Demand concerns on the back of economic fears linked to the U.S-Chinese trade war have also been capping prices.

Oil prices have been supported for much of this year by efforts of OPEC+, who have pledged to withhold around +1.2M bpd of supply this year to prop up markets.

Crude oil is on course for its best quarter in a decade, with the latest jump coming after Russian Energy Minister Novak indicated this week that his country will reach its pledged output cut of -228K bpd by the end of March.

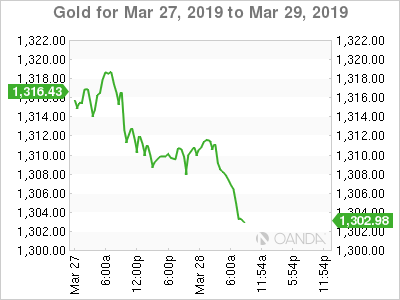

The price of gold is down -0.13% at +$1,308.11 a troy ounce, as the ‘big’ dollar edges up. U.S. Gold futures are down -0.1% at +$1,313.20 an ounce.

3. Sovereign yields on the floor

Global bond yields continue to spiral lower as recession fears feed investor expectations of more policy easing by major central banks.

Worries that the inversion of the U.S Treasury curve is signalling a future recession has only deepened as U.S 10-year yields fall to a fresh 15-month low at +2.34% yesterday. The ongoing flattening, or outright inversion of a sovereign yield curve is generally a bad sign for equities.

Germany’s 10-year Bund yield has fallen again, as the drop below zero accelerates. German 10’s fell over -3 bps to -0.048% against a backdrop of worries about global growth from China to the U.S.

Across the euro area, 10-year bond yields are down -2 to -3 bps. They have fallen since the ECB earlier this month pushed back its guidance for a rate increase and flagged a fresh round of cheap bank loans to help the economy.

Elsewhere, the U.K’s 10-year yield has eased -2 bps to +0.988%, while in Italy, the 10-year BTP yield has gained +4 bps to +2.491%.

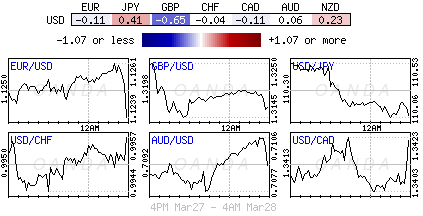

4. Dollar in demand

EUR/USD (€1.1227 down -0.27%) – European March inflation data is coming in below expectations (German states and Spain) and is supporting the ECB’s tilt from rate normalization bias back towards reflation.

GBP/USD is steady in the mid-£1.31 area as the Brexit stalemate deepens after UK Parliament failed to agree on a way forward via any of its eight proposed options yesterday. PM May is yet to decide whether to press ahead with a third meaningful vote tomorrow. The Commons speaker Bercow continues to oppose another vote.

TRY continues to be very volatile. Yesterday, Turkish market saw the overnight implied yield continuing to blow out, rising to a high of +1,350% before ending the day at +750%. The market turmoil comes before this weekend’s local elections on Sunday. The elections are seen by many as a referendum on President Erdogan and his executive powers.

Turkey’s lira ($5.6122) has plunged as much as -5% outright amid worries that the economic and geopolitical risks are on the rise again there.

5. Euro zone inflation expectation gauge hits lowest

A key market gauge of long-term euro zone inflation expectations fell this morning to its lowest level in nearly three years, reflecting growing concern the ECB will be unable to meet its inflation target.

The five-year, five-year forward, an inflation gauge tracked by the ECB, fell to around +1.31% its lowest since September 2016 and further away from the ECB’s +2% target. It is down some -10 bps this week alone as fears about the growth outlook grow and central banks turn increasingly dovish.