There was confusion in the United Kingdom as MPs failed to pass any alternative Brexit solutions in Parliament. This came after the Prime Minister announced that she will step down if her Brexit proposal is passed. This measure itself has somewhat backfired as Northern Ireland’s Democratic Unionist Party (DUP) announced that it won’t support her proposal. All this introduces uncertainty for the country because no one really knows what will happen next.

After declining sharply yesterday, the price of crude oil stabilized in the Asian session. The price had dropped after the EIA released inventories data that missed expectations. Data showed that over the past week, crude oil inventories rose by 2.8 million barrels. This was much higher than the expected drawdown of more than 1.1 million barrels. Earlier on, the numbers from the American Petroleum Institute (API), showed that inventories rose by 1.9 million barrels.

Focus will remain in the euro after yesterday’s statement by Mario Draghi. At a conference in Frankfurt, he said that the bank was ready to extend its planned period of raising interest rates. In line with this, traders will focus on key data from the region, such as Spanish CPI, private sector loan growth in the EU, Germany CPI, and sentiment data from the region.

Traders will also focus on the final reading of the US fourth quarter GDP numbers. The numbers are expected to show that the economy expanded by 2.4%, which will be lower than the previously reported 2.6%. The GDP price index is expected to have risen by 1.8%, which is lower than the previous 2.0%, while the core PCE price is expected to remain unchanged at 1.70%.

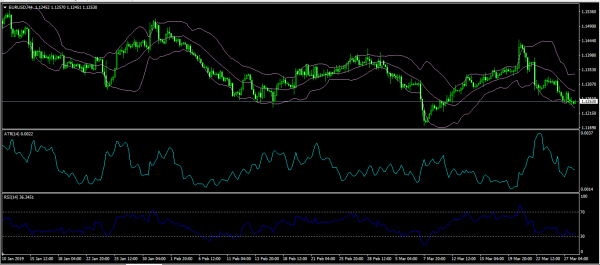

EUR/USD

The EUR/USD pair continued to decline, reaching a low of 1.1240 today. This is the lowest it has been this week and is sharply lower than the week’s high of 1.1447. On the four-hour chart, this price is along the lower line of the Bollinger Bands while the ATR has dropped sharply from the day’s high. The RSI has moved almost close to the oversold level. There is a likelihood that the downward momentum will continue as the pair tries to test the important support of the 1.1210 level.

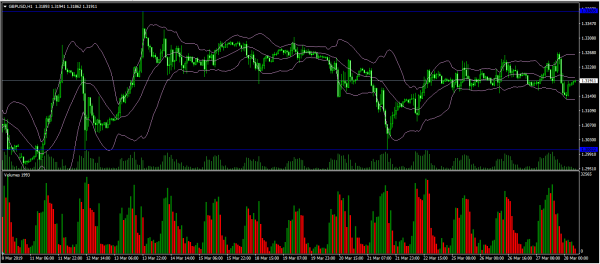

GBP/USD

The GBP/USD pair continued trading within a narrow range as traders waited for a way forward on Brexit. The volumes have dropped as evidenced by the volumes indicators below. This is because no one really knows what will happen and how it will affect the country. The pair is now trading at 1.3193, which is slightly lower than yesterday’s high of 1.3270. It is also along the middle line of the Bollinger Bands.

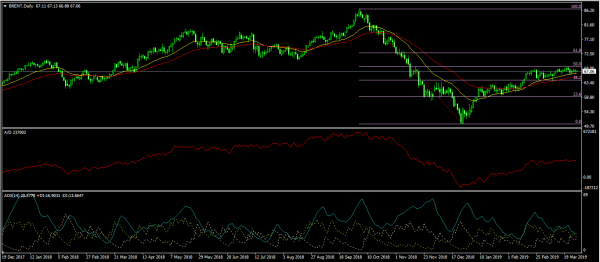

XBR/USD

After dropping yesterday, the XBR/USD pair stabilized at the current price of 67. On the daily chart, the pair has been on an upward trajectory this year. It has risen from a low of 50 and reached a high of 68.50. This price is slightly above the 21-day and 50-day moving averages. The Accumulation and Distribution indicator has continued to move up while ADX has moved slightly lower. It is also close to the 50% Fibonacci Retracement level. There is a likelihood that the pair could continue the upward trend.