Wednesday March 27: Five things the markets are talking about

Global equities traded mixed overnight as investors deal with some disappointing economic signals this month, along with a plethora of central banks decisively turning towards accommodation, shying away from rate normalization for the foreseeable future.

A number of sovereign yields have plummeted to new year lows while risk aversion trading strategies have tended to dominate proceedings as U.S/China trade talks (Mar 28/29) remain a focus along with U.Ks Brexit next steps. U.S recessions fears are being stoked by the inversion of U.S three-month bill rates and the benchmark U.S 10-year note curve.

Today’s proceedings will be dominated by the U.Ks House of Commons who are attempting to break its Brexit deadlock with votes on alternatives to PM May’s divorce deal with the EU.

There are potentially eight Brexit options the U.K. parliament could vote on:

- To exit without a deal;

- Sign a deal similar deal to the one Canada has;

- Request a long extension to Article 50;

- Accept PM Theresa May’s deal;

- Remain in the customs union;

- Stay in the single market;

- Hold a second referendum;

- Or revoke Article 50.

On tap: CAD trade balance & NZD business confidence (Mar 27), U.S final GDP (Mar 28), GBP current a/c, CAD GDP (Mar 29).

1. Stocks mixed results

In Japan, the Nikkei fell overnight, pressured by companies going ex-dividend. The Nikkei share average ended down -0.2%, while the broader Topix dropped -0.5%. The Japanese market has been very volatile this week, tumbling -3% Monday and rebounding yesterday. Investor sentiment has been hit hard by fixed income concerns about a possible U.S economic recession due to the partial inversion of the U.S yield curve.

Down-under, Kiwi shares rallied to a record high overnight after the Reserve Bank of New Zealand (RBNZ) blindsided the market by raising the possibility of a rate cut as its next move (see below), while in Australia the materials sector helped its market eke out modest gains. New Zealand’s benchmark S&P/NZX 50 index climbed +1.3%, while in Australia, the S&P/ASX 200 index inched about +0.1% higher at the close. In S. Korea, the Kospi index fell, as foreigners booked profit from the previous session. The index ended down -0.15%.

In China and Hong Kong, stocks closed higher following two straight sessions of losses, as a rebound Tuesday stateside aided investor sentiment, while weak industrial profit data fuelled hopes for more stimulus. The blue-chip CSI300 index ended up +1.2%, while the Shanghai Composite Index gained +0.9%. In Hong Kong, the Hang Seng advanced +0.6%.

In Europe, regional indices are trading mixed, following on from another mixed session in Asia overnight and higher U.S futures this morning.

U.S stocks are set to open in the ‘black’ (+0.20%).

Indices: Stoxx600 +0.11% at 377.62, FTSE +0.14% at 7,206.30, DAX +0.07% at 11,427.47, CAC-40 +0.04% at 5,309.37, IBEX-35 +0.16% at 9,197.67, FTSE MIB +0.43% at 21,229.50, SMI -0.12% at 21,229.50, S&P 500 Futures +0.20%

2. Oil prices mixed, demand concerns cloud outlook, gold steady

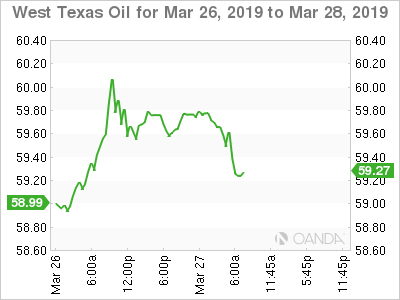

Oil prices are trading mixed this morning, with Brent extending yesterday’s rise, but gains are somewhat capped amid growing fears over the impact of a global economic slowdown on consumer demand.

Brent has added +16c, or +0.2%, to +$68.13 and is not far off its year-to-date high of +$68.69 reached last week. U.S crude futures are down -3c at +$59.91. The U.S benchmark rallied +1.9% Tuesday.

Oil rallied in yesterday’s session following a massive power blackout at Venezuela’s main oil export port of Jose on Monday – it was the second in a month.

Crude oil is on course for its best quarter in a decade, with the latest jump coming after Russian Energy Minister Novak indicated that his country will reach its pledged output cut of -228K bpd by the end of March.

Oil prices have been supported for much of this year by efforts of OPEC+, who have pledged to withhold around +1.2M bpd of supply this year to prop up markets.

Investors will take their cues from today’s weekly U.S inventory data later this morning (10:30 AM EDT).

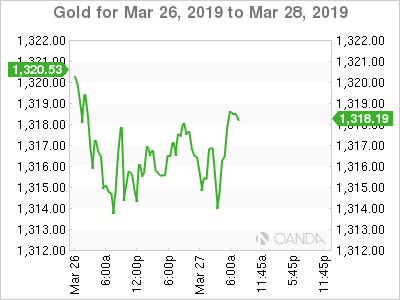

Ahead of the U.S open, gold is trading steady, after declining the most in nearly two weeks Tuesday, as a stronger U.S dollar offset the ‘yellow metals’ gains stemming from fears of a possible recession in the U.S spot gold is flat at +$1,315.11 per ounce, while U.S. gold futures are down -0.1% at +$1,313.20 an ounce.

3. Central banks ‘dovish’ messages continue

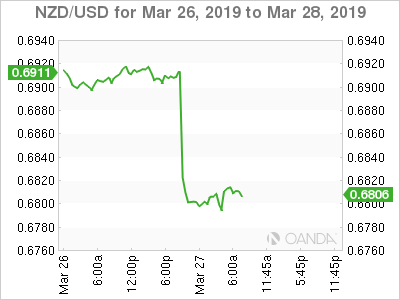

Overnight, the Reserve Bank of New Zealand (RBNZ) left their official cash rate (OCR) unchanged as expected at +1.75%. The accompanying statement indicated that the next rate adjustment is “down” as opposed to the prior statement that the “next move in official cash rate could be up or down.” Following the statement, money markets are currently pricing in a rate cut for next November 2019 versus June 2020. New Zealand 2-year yield have declined over -10 bps.

Germany’s 10-year Bund yield has fallen again, as the drop below zero accelerates. German 10’s fell over -3 bps to -0.048% against a backdrop of worries about global growth from China to the U.S. Across the euro area, 10-year bond yields are down -2 to -3 bps. They have fallen since the ECB earlier this month pushed back its guidance for a rate increase and flagged a fresh round of cheap bank loans to help the economy.

Elsewhere, the yield on 10-year Treasuries has fallen -1 bps to +2.41%, while down-under, the Aussie 10-year yield has dipped about -5 bps to +1.77%.

4. Kiwi crushed, sterling little changed

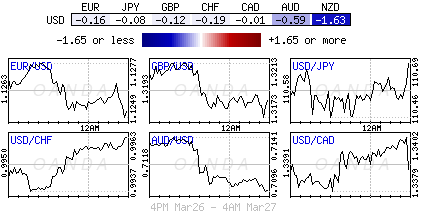

Australasian currencies, especially the NZD came under immense market pressure overnight, sinking to a new two-month low (NZ$0.6797, down -1.3% outright) after the RBNZ joined other main central banks touting their global ‘dovish’ theme (see above) by indicating that its next interest rate move will be “down.” In sympathy the AUD has been dragged lower to just shy of A$0.7100.

Sterling (£1.3198) is trading flat and is expected to remain in tight range as the U.K parliament outlines their preferred options on the path of Brexit. From those outlined options the most popular will be picked for a run-off process which is to follow early next week (expected Monday April 1). Then the most popular options among those picked should be selected and provide guidance for the future Brexit path and negotiations with the EU. EUR/GBP is flat at €0.8539.

Currently trading at €1.1260, the EUR remains on the downside, while the yen is little changed at ¥110.58 after a -0.6% fall in yesterday’s session.

5. China’s industrial profits shrink most in 8-years as economy cools

Data overnight from China showed that industrial firms posted their worst slump in profits in eight-years for the first two-months of this year. Increasing strains on the world’s second largest economy, like slowing domestic and foreign demand took a toll on businesses.

According to the National Bureau of Statistics (NBS), profits for January-February slumped -14% y/y to ¥708.01B – the biggest contraction since October 2011.

Data like this would suggest that China could see further trouble. Already, the government has lowered the economic growth target for 2019 to +6.0-6.5%, from the actual rate of +6.6% of last year.

Digging deeper, analysts said the drag profits was mainly due to price contractions in key industrial sectors such as auto, oil processing, steel and chemical industries.