The US dollar declined sharply against its peers after the Federal Reserve delivered its interest rates decision. As expected, the bank left rates unchanged at the range of 2.25% and 2.5%. The bank also issued a somewhat dovish statement, reiterating that the unlikelihood of an interest rates this year. The bank also said that it will end the reduction of its balance sheet in September. This led to a rise in US yields and for US stocks to pare previous losses. In the current program, the Fed is allowing $30 billion in its treasuries and $20 billion from its mortgage backed securities (MBS) to roll-off and investing the rest. In May, it will drop the treasuries but continue to roll off the MBS.

After rising sharply yesterday, the New Zealand dollar declined slightly during the Asian session after the country released mixed economic data. The final reading of the fourth quarter GDP numbers showed that the economy expanded by 2.3%, which was lower than the expected 2.5%. On a QoQ basis, the economy expanded by 0.6%. The GDP expenditure in the quarter rose by 0.5%, which was lower than the expected 0.6%. These numbers, while lagging, show that the country’s economy continues to face major headwinds.

The Australian dollar dropped after the release of employment numbers. The data showed that 4.6K people were employed in February, which was lower than the expected 14.8K. The participation rate rose to 65.6%, which was lower than the previous 65.7%. These numbers continue to make the case that the RBA will be forced to cut rates later this year. On a positive note, the unemployment rate declined to 4.9%, which was better than the previous 5.0%.

Today, traders will continue to focus on the Brexit drama, the interest rates decision from the Swiss National Bank (SNB), UK retail sales, the Bank of England interest rates decision, and the Philly Fed employment numbers.

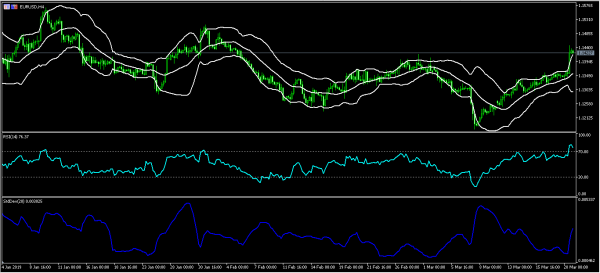

EUR/USD

After consolidating for the entire week, the EUR/USD pair broke out in an upward direction after the Fed sounded more dovish than expected. The pair rose to a high of 1.1445, which was the highest level since February this year. The pair has been on a sustained upward trend since March 8. On the hourly chart, this price is slightly below the lower line of the Bollinger Bands while the RSI is above the overbought level of 70. The standard deviation too is moving upwards. In the near-term, the pair could pare these gains and retest the previous support of 1.1350.

USD/CHF

The USD/CHF pair has been declining since early this month. The pair has dropped from a high of 1.0125 and reached a low of 0.9892 after the Fed’s decision. The strengthening of the Swiss Franc will give the SNB more headaches as it releases the interest rates decision today. The current levels are along the 50% Fibonacci Retracement level. It is also along the lower line of the Bollinger Bands. The pair could make some recoveries today, although this depends on the statement by the SNB.

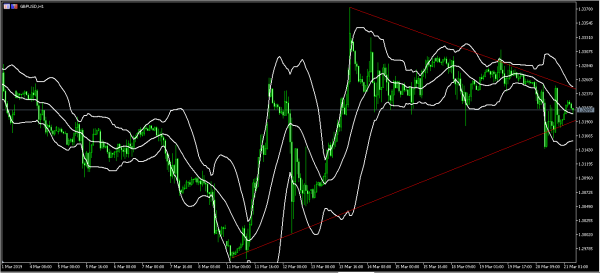

GBP/USD

Unlike other currencies that reacted sharply after the Fed’s decision, the GBP/USD pair was somewhat volatile in overnight trading. This is because traders are still concerned about indecisions over Brexit. The pair is now trading at the 1.3206 level, which is along the middle line of the Bollinger Bands. The pair is also forming an asymmetrical triangle pattern, which could continue regardless of the statement by the BOE later today.

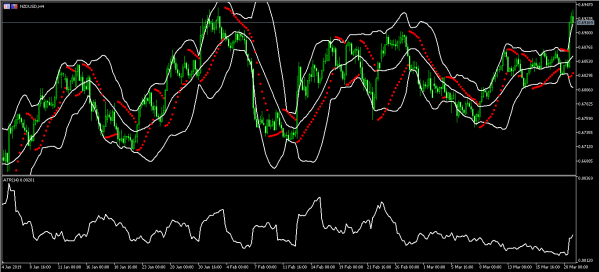

NZD/USD

After rising sharply yesterday, the NZD/USD pair declined after the weak economic numbers. It has now declined from 0.6933 to a low of 0.6912, which is along the upper line of the Bollinger Bands. The volatility of the pair has also risen after a few days of being lower. The parabolic SAR dot is currently in the lower side. The pair could continue moving lower today.