US stocks pared the earlier gains yesterday after trader worries reappeared. This is after a report noted that there were unfinished issues in the trade talks. A source said that China is not likely to comply with a number of the points discussed in the talks. As a result, US officials, including Robert Lighthizer and Steve Mnucchin, will travel to China in a bid to hammer a final deal. These officials have been in contact with China’s Liu He through video communications but the remaining details require face-to-face negotiations. After gaining by triple digits, the Dow ended the day 27 points lower. The Australian and New Zealand dollar declined as well.

The dollar index continued to decline ahead of the Federal Reserve interest rates decision. The FOMC will release the decision and hold a press conference later today. The indications are that the committee will leave interest rates unchanged. Other than that, traders will want to know the Fed’s view on the US economy, the progress on the balance sheet reduction and the outlook for rate hikes this year. This decision comes at a time when a few prominent analysts believe that the Fed will be forced to cut rates this year.

The sterling was little moved in today’s trading as the March 29 deadline neared. In recent weeks, the parliament has been deadlocked after failing to find a way forward. The members have rejected Theresa May’s deal because they believe it gives national sovereignty to the European Union. It has also voted to extend the exit period if a deal is not made. Yesterday, the European Union hardened its stand on whether the country will get an extension. Chief negotiator, Michael Barnier said that there was no need to extend the deal because the MPs will still vote against her deal. France too has expressed doubts about an extension. The country is worried that an extension will lead to extended uncertainty in the European Union. Yesterday, Theresa May wanted to write a letter to Donald Tusk requesting an extension but she was held up by a fierce row in cabinet and Downing Street about the wording.

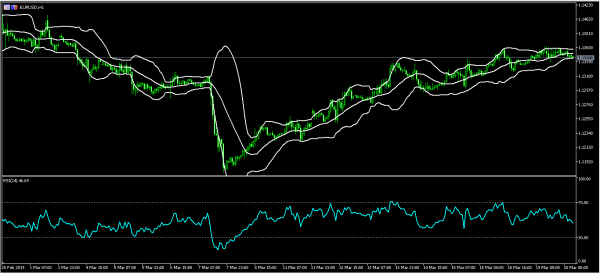

EUR/USD

The EUR/USD was relatively unmoved as traders look forward to the Federal Reserve. The pair is now trading at 1.1345, which is slightly below the day’s high of 1.1360. On the hourly chart, the Bollinger Bands indicator has consolidated along the price as the RSI drops. At this point, there is a likelihood that the price will breakout in either direction after the Fed delivers its decision.

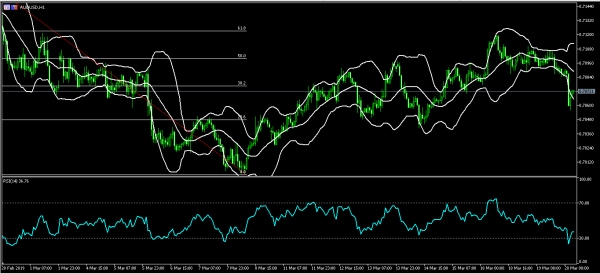

AUD/USD

The Australian dollar dropped sharply after trade jitters re-appeared. The Australian dollar is exposed to China’s performance as it accounts for two-thirds of all its trade. The pair reached a low of 0.7056. In the Asian session, it pared some of those losses and is currently trading at 0.7070. On the hourly chart, this price is slightly below the 38.2% Fibonacci Retracement level and slightly above the lower line of the Bollinger Bands. The RSI has emerged from the oversold level and is currently at 36. The pair will likely recover as China and the US defend the deal they are negotiating.

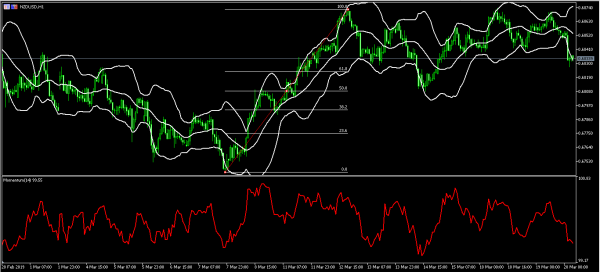

NZD/USD

The NZD/USD pair declined after the news on US-China talks. The pair reached a low of 0.6827, which was the lowest level since March 15. On the hourly chart, this price was along the 61.8% Fibonacci Retracement level. The current price is along the lower band of the Bollinger Bands while the momentum indicator has fallen sharply. Like with the Aussie, the pair will likely recover today but this could change due to the Fed decision.