- Pound drops as Brexit angst deepens, but prospect of long extension offers ray of hope

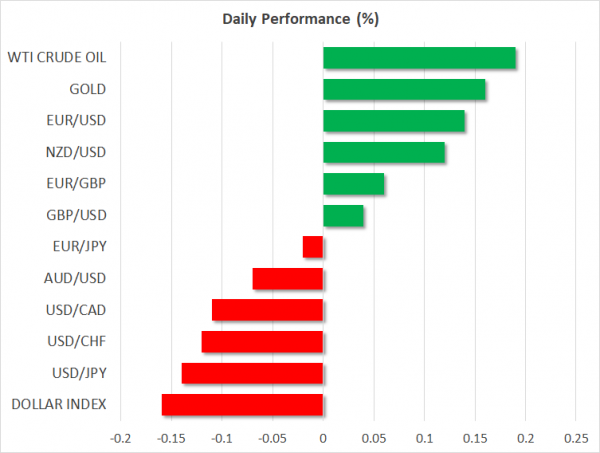

- Growing Fed rate cut expectations support risky assets, weigh on dollar

- Crude oil continues to march higher

UK House speaker vetoes third Brexit vote – long extension in scope

UK politics made headlines yet again on Monday after the Speaker of the House of Commons, John Bercow, ruled out allowing the government to bring its Brexit deal to Parliament for a third time unless it was changed ‘substantially’. This plot twist likely blindsided PM May’s administration, with government officials indicating they weren’t warned. The pound, which was already under selling pressure, fell further on the news but managed to recover some of its losses later in the session.

Where does this leave Brexit and sterling? A delay is now all but inevitable, so the real question is how long any extension will be, and what strings will be attached to it. In this respect, the fact that the UK government likely won’t be able to put its deal to another vote for now decreases the likelihood of PM May asking for a short extension, as she said she would if MPs approved her deal, and increases the odds of a longer one. While a long extension would keep uncertainty elevated and hence continue to hurt growth via investment decisions being postponed, it could also imply the UK ultimately ends up with a softer Brexit, or that another referendum may be held along the way. Therefore, at this stage, a lengthy extension seems like the most bullish outcome for the pound.

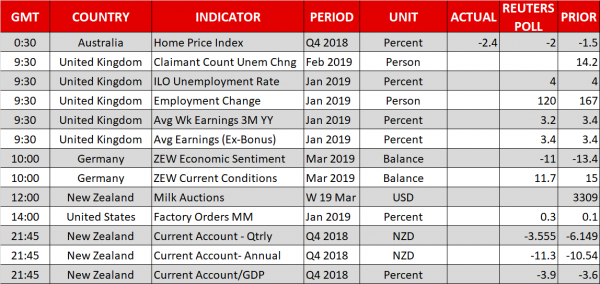

Today, UK employment data are due, though politics will likely to continue to eclipse economics in driving the pound.

Risk-on atmosphere lingers in the absence of news

In the broader market, risk appetite remained elevated, with US equity markets closing modestly in the green, again without any material news to drive price action. Perhaps sentiment is being supported, on the margin, by the slow albeit consistent increase in Fed rate-cut expectations that has been going on lately. Whereas just a few days ago market pricing was practically neutral, indicating little probability for either cuts or hikes this year, it has now moved firmly towards cuts, with futures markets assigning a ~30% for a quarter-point rate reduction by December.

In the FX market, this may have also been the key driver behind the dollar’s recent underperformance. Traders seem to be bracing for a dovish Fed tomorrow, perhaps on anticipation the Committee could revise down its rate forecasts to the point of signaling no more hikes, and are thus reducing their exposure to the dollar. That said, influential officials like Bill Dudley, who recently left the NY Fed, have been quite vocal lately in indicating that another hike in 2019 is possible. This implies that the Fed may opt to retain some optionality and keep a hike on the table, a signal that could come as a ‘rude awakening’ for markets given current dovish expectations.

Crude oil continues its slow grind higher

Oil prices continued their march higher yesterday, with WTI touching highs last seen in mid-November, crossing above the $59/barrel level. The latest leg higher was seemingly fueled by some signals from Saudi Arabia that OPEC’s compliance with its output cuts will exceeded 100% in the coming months, though the broader risk-on environment likely helped as well.

In the somewhat bigger picture, the latest downward revisions in the EIA’s forecasts for US production have also been a tremendous factor behind the latest uptrend. Alas, in the context of slowing global growth, it’s increasingly questionable how much further this rally can go, unless something drastic changes on the supply side of the equation