The Japanese yen dropped slightly after the country released its trade numbers. The numbers showed that in January, imports contracted by 6.7%. This was lower than the expected decline of 5.8%. It was the first time since December 2016 that imports had declined. Also, it was the third month of declines. On the other hand, exports contracted by 1.2%. This was worse than the expected contraction of minus 0.9%. It was the third straight month that exports contracted also. This was mostly because of poor international demand. As a result, the country’s trade surplus grew by 0.12 trillion yen.

US futures point to a flat open today. Traders will continue to focus on the Dow index, because Boeing is a major component. This is after a report on the Sunday accident showed a close similarity with that of the Lion Air crash. As a result, Boeing will be forced to continue grounding the plane as it works on a fix. This is important because the company makes more than $30 billion a year on the 737-max model and has an order book of more than 5000 planes. Last week, the company was forced to stop shipping the plane and in response, it announced that it will release a software update in a few weeks. Today, it was also announced that federal prosecutors were investigating the development of the 737-max planes.

The sterling rose in the Asian session as traders continued to focus on the continuing Brexit debate. This is after last week’s major votes. On Tuesday, the MPs rejected Theresa May’s deal that she has negotiated for more than three years. On Wednesday, they voted to prevent a no-deal Brexit scenario, and on Thursday, they voted to extend the leaving period. Tomorrow or Wednesday, the premier is expected to table her plan again to parliament for a vote. In this attempt, she is hoping to create a deal with the Democratic Unionist Party (DUP). She has been negotiating with the party, hoping that this will also persuade the Tory Eurosceptics to back the deal. However, the vote is likely to fail because there will be no structural resolutions on the backstop.

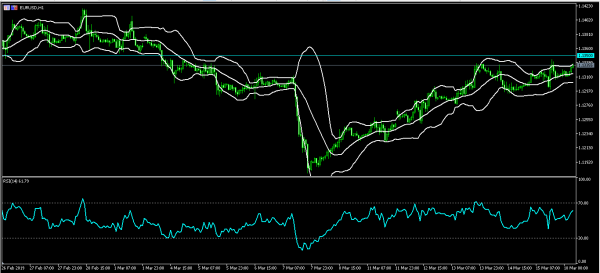

EUR/USD

The EUR/USD pair rose slightly ahead of the EU trade data and the monthly report by the German central bank. The pair reached a high of 1.1337, which was slightly lower than last week’s high of 1.1345. On the hourly chart, the pair is along the upper line of the Bollinger Bands while the RSI has reached almost the overbought level of 70. The pair could continue the upward trend, with the next important level being at 1.1350.

GBP/USD

The GBP/USD pair rose in overnight trading ahead of key developments on Brexit. The pair is now trading at 1.3295. On the hourly chart, the pair is above the 21-day and 42-day moving averages. The Relative Strength Index has flattened at the current level of 60 while the ADX indicator has also flattened at the current 22 level. The pair will likely continue the slow upward trend, although it will still be volatile on Brexit news.

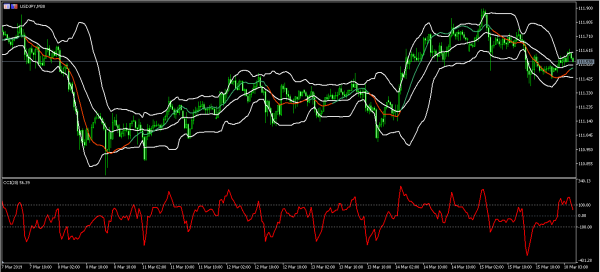

USD/JPY

The USD/JPY pair rose as traders reacted to Japan’s trade numbers. The pair reached a high of 111.62 and then pared those gains. On the 30-minute chart, the pair is slightly below the upper band of the Bollinger Bands and below last week’s high of 111.90. The pair’s CCI has moved below the overbought level of 100. There is a likelihood that the pair will resume the upward trend.