The Canadian dollar is weaker against the US dollar o Wednesday despite an improvement of monthly GDP data in March. Oil prices continue to suffer from glut concerns as the efforts of the Organization of the Petroleum Exporting Countries (OPEC) and other producers to cut production are being offset by non members such as the US and even by members such as Libya who has ramped up production after a disruption in its largest oil field.

The Canadian economy great at a 3.7 percent pace in the first quarter of 2017. The annualized per quarter growth was lower than expected but the monthly figures for March beat estimates by showing a 0.5 percent growth when 0.2 was anticipated. The third and fourth quarters of last year were revised upwards with a final 4.2 percent for Q3 and 2.7 percent for Q4.

Mexico Economy Minister Ildefonso Guajardo said earlier today that he is seeking to finish NAFTA talks with US by December 15. The Trump administration has started the process that could start talks in late August. Guajardo is foreseeing negotiations to take place in the last quarter of the 2017. On May 11 the Mexican minister stated that he will send a delegation to China in September to seek other alternatives. Mr. Guajardo has also said that if duties are part of the agreement Mexico could walk out of the negotiations. The Conference Board of Canada said today that the US softwood lumber duties will have a $700 million impact to Canadian exports and a loss of 2,200 jobs. The negative impact to the Canadian economy of a bad renegotiation of NAFTA would be massive given the high percentage of exports that head south.

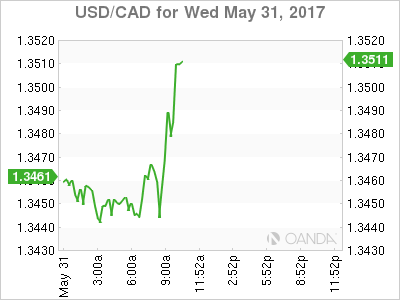

The USD/CAD lost 0.275 percent in the last 24 hours. The currency pair is trading at 1.3449 after the stronger than expected monthly GDP data was not enough to offset the trend that made the quarterly data came in below expectations. The growth of the Canadian economy in the last two quarters of 2016 was revised upward which makes the first quarter more solid than before, but the high correlation between oil prices and the loonie put downward pressure on the currency. US political turmoil has the dollar in a daze, not able to capitalize on the positive comments from voting Fed members.

Dallas Fed Chief Robert Kaplan said yesterday that the 3 percent growth targets from the Trump administration are too aggressive and the US will probably growth at 2 percent. Fed Kaplan favours balance sheet reduction by this year with a gradual pace to take the process years to complete. Kaplan foresees two more rate hikes in 2017, in line with many of his colleagues and for the time being at least one more than the market is pricing in. The CME FedWatch tool has been slightly below 90 percent in probability of a June rate hike leaving the fed funds rate at 100 to 125 basis points. Political uncertainty and monetary policy are too evenly matched at this point and the dollar will need some clarity from economic data if its go give the monetary policy divergence edge to the greenback.

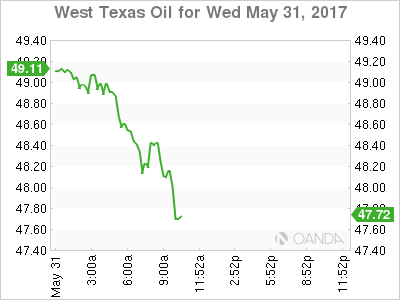

The price of oil fell 1.675 percent in the last 24 hours. The West Texas Intermediate is trading at $48.36 after the supply disruption in Libya has been sorted and the OPEC member nation is now reporting a daily production of 827,000 barrels, before the problems at the country’s biggest oilfield, El Sharara, had production at 794,000. Oil prices are at three week lows despite the efforts from the OPEC and other producers to cut production to stabilize prices.

With the meeting in Vienna on May 25 now in the past traders are not sure the OPEC is doing enough as it followed the script set by the dual press release form Saudi Arabia and Russia earlier in the month. US production is still on the rise and even the OPEC members outside of the deal are ramping up production giving traders concerns about how much of the glut can really be reduced, when the actual demand for energy has not increased.

Market events to watch this week:

Thursday, Jun 1

- 4:30 am GBP Manufacturing PMI

- 8:15 am USD ADP Non-Farm Employment Change

- 8:30 am USD Unemployment Claims

- 10:00 am USD ISM Manufacturing PMI

- 11:00 am USD Crude Oil Inventories

Friday, Jun 2

- 4:30 am GBP Construction PMI

- 8:30 am CAD Trade Balance

- 8:30 am USD Average Hourly Earnings m/m

- 8:30 am USD Non-Farm Employment Change

- 8:30 am USD Unemployment Rate

*All times EDT