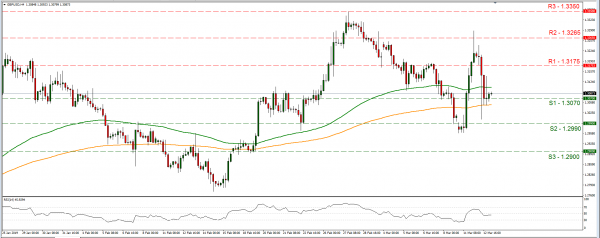

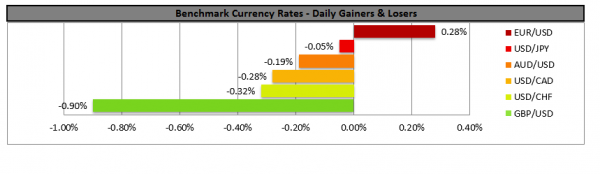

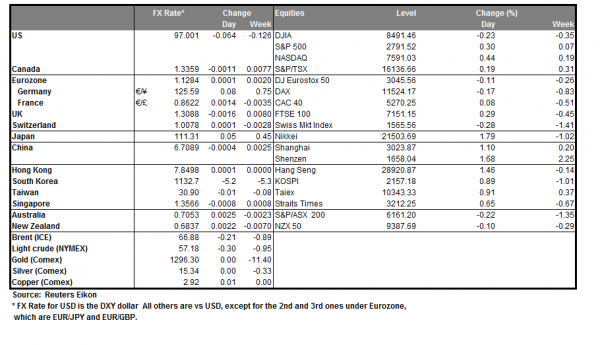

The pound tumbled against a number of its counterparts, as UK’s Attorney General had stated that legal risks arising from the revised Brexit deal remained the same, strengthening argumentation of hard Brexiteers. The revised plan was rejected by the UK parliament late in the evening by a strong majority, practically putting an end to Theresa May’s efforts. The UK Parliament is to have a second vote tonight as to whether it wants to leave the EU without a deal or on an agreed basis. Our base scenario is for the UK Parliament to reject a no deal departure from the EU as past votes seem to increase the probabilities for such an outcome, yet uncertainty remains. Theresa May has promised Tory MPs a “free vote”, so a number of Conservative MPs could be voting against a no deal Brexit. Should the UK Parliament reject the no deal scenario as well, then a third vote will be taking place tomorrow on whether to ask for an extension of the Brexit date currently being the 29th of March. Despite the UK Parliament closing the door on Theresa May’s deal, we see the case for new opportunities opening for the UK. We expect volatility to be maintained for the GBP. Cable tumbled yesterday with the drop reaching 200 pips at some points, yesterday breaking the 1.3175 (R1) support level (now turned to resistance), yet managed to land above the 1.3070 (S1) support line. We could see the pair strengthening today in anticipation of the UK Parliament’s decision, yet the actual decision per se could provide further support should it be a rejection of a no deal departure of the UK from the EU and vice versa. Should the market favor the pair’s long positions as expected, we could see it breaking the 1.3175 (R1) resistance line. On the other hand should the pair come under the selling interest of the market, we could see cable’s price action, breaking the 1.3070 (S1) support line and aim for the 1.2990 (S2) support barrier. Please be advised that should the UK Parliament vote in favor of a no deal Brexit, we could see the pound tumbling once again and the pair could break all of our support levels aiming for lower grounds, having an asymmetrically strong negative reaction to the news. Also some volatility could be present during the release of the US financial data and the presentation of Philip Hammond’s Spring Forecast statement in the UK Parliament.

USD remains rather steady at modest growth of US retail sales

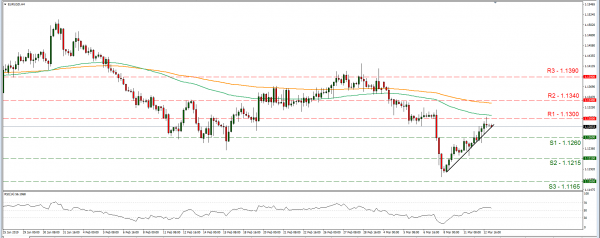

The USD weakened yesterday as soft US inflation data were released for February. The USD was also weakened as the US treasury yields dropped somewhat, taking off some of yesterday’s shine from the greenback. Analysts point out that risk sentiment seems to be back off and that the USD may weaken even further, albeit it should be noted that the USD’s direction seems indecisive currently, as all the spotlights are on the Brexit procedures. We expect some volatility to be maintained and today’s financial release to be of importance regarding the USD’s direction. EUR/USD rose yesterday breaking the 1.1260 (R1) resistance line (now turned to support). We maintain a bullish outlook for the pair and for our view to change in favour of a sideways movement, we would require a clear breaking of the upward trendline incepted since the 8th of March. Should the bulls maintain their control over the pair’s direction, we could see it breaking the 1.1300 (R1) resistance line and aim for higher grounds. Should the bears take over we could see the pair breaking the prementioned upward trendline, the 1.1260 (S1) support line and aim lower.

Today’s other economic highlights

In today’s European session we get Eurozone’s industrial production growth rate for January. In the American session we get the US durable goods orders growth rates for January, the PPI rate for February and the EIA crude oil inventories figure. In tomorrow’s Asian session, we get a number of Chinese data, yet the Industrial output growth rate for January seems to stand out. As for speakers, ECB’s Yves Mersch and Benoit Coeure speak. Do not forget also the UK Parliament’s votes tonight, and the Spring Forecast statement by Philip Hammond.

GBP/USD

Support: 1.3070 (S1), 1.2990 (S2), 1.2900 (S3)

Resistance: 1.3175 (R1), 1.3265 (R2), 1.3350 (R3)

EUR/USD H4

Support: 1.1260 (S1), 1.1215 (S2), 1.1165 (S3)

Resistance: 1.1300 (R1), 1.1340 (R2), 1.1390 (R3)