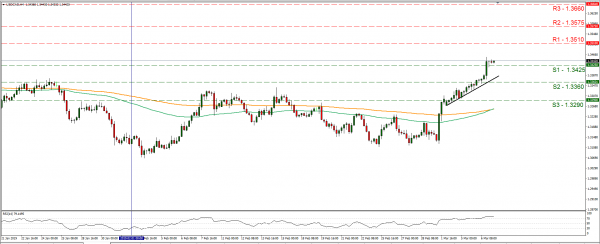

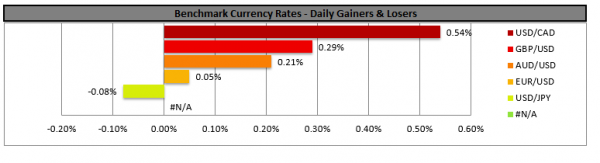

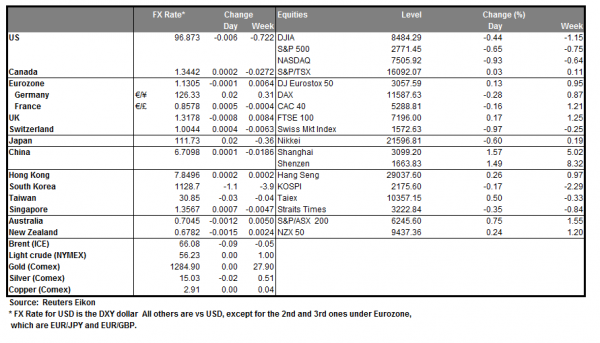

BoC remained on hold at +1.75% yesterday as was widely expected and CAD weakened as a dovish tone seemed to prevail in the accompanying statement. The bank has removed its explicit hawkish bias which was present in the past statement for a more subtle tone. Also it mentioned that global slowdown is more pronounced and widespread with trade tensions and uncertainty weighing heavily on confidence and economic activity. According to the statement the bank will continue to closely watch the household market, the oil market and global trade policy. We expect the bank’s statement to continue to weigh on the Loonie’s direction and we would like to highlight BoC Patterson’s speech today and on Friday Canada’s employment data for February. USD/CAD rose by 65 pips upon release of BoC’s interest rate decision and broke the 1.3425 (S1) resistance line (now turned to support). We maintain our bullish bias for the pair’s direction, though it should be noted that the RSI indicator has surpassed the level of 70, continuing to imply a possibly overcrowded long position for the pair. Should the pair find fresh buying orders along its path, we could see it aiming if not breaking the 1.3510 (R1) resistance level. Should the pair come under the selling interest of the market, we could see it breaking the 1.3425 (S1) support line and aim for the 1.3360 (S2) support barrier.

ECB Interest rate decision

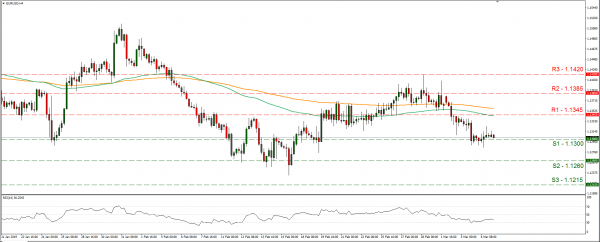

ECB is to announce its interest rate decision today (12:45, GMT) and is widely expected to remain on hold at 0.0%. Currently EUR OIS imply a probability of 92.7% for such a scenario, hence the market’s attention could turn to the accompanying statement. The bank could be adopting a more dovish tone as the GDP rate (+1.2% yoy) is rather low and the inflation rate (+1.5% yoy) remains below the bank’s target (+2.00% yoy). The big question for today’s meeting is whether the bank will signal a delay of any possible rate hikes for after 2019 and whether it will relaunch long term bank loans soon, to fight an economic slowdown in the area. Also new macroeconomic projections are due out and we could see the bank lowering its forecasts, especially about growth. Should the bank imply a possible easing of the monetary policy (ie. by delaying any future rate hikes), we could see the EUR weakening. Please be advised that we expect volatility for EUR pairs to extent during ECB President’s Mario Draghi press conference (13:30, GMT). EUR/USD continued to trade in a sideways movement yesterday, testing the 1.1300 (S1) support line. We could see the pair having some bearish tendencies today as financial releases and ECB’s interest rate decision could weaken the common currency. Should the bears dictate the pair’s direction, we could see the pair breaking the 1.1300 (S1) support line and aim for the 1.1260 (S2) support level. Should on the other hand the bulls take over, we could see the pair aiming for the 1.1345 (R1) resistance line.

Today’s other economic highlights

In today’s European session we get UK’s Halifax House Price Index for February and Eurozone’s final reading of the GDP growth rate for Q4. In the American session we get Canada’s building permits growth rate. As for speakers please note that BoE’s Tenreyro, Fed’s Brainard and BoC’s Patterson will be speaking. Also please note that Germany’s finance minister will be speaking for Brexit preparations today and could stir some interest for GBP traders.

USD/CAD

Support: 1.3425 (S1), 1.3360 (S2), 1.3290 (S3)

Resistance: 1.3510 (R1), 1.3575 (R2), 1.3660 (R3)

EUR/USD H4

Support: 1.1300 (S1), 1.1260 (S2), 1.1215 (S3)

Resistance: 1.1345 (R1), 1.1385 (R2), 1.1420 (R3)