The all-important US employment report for February will hit the markets on Friday at 13:30 GMT. Forecasts point to yet another solid report and if so, that could make investors more confident the Fed will raise rates again later in 2019, thereby helping the dollar to extend its latest gains. That being said, the reserve currency is now very close to levels it has consistently failed to overcome in recent months, so buyers should tread lightly.

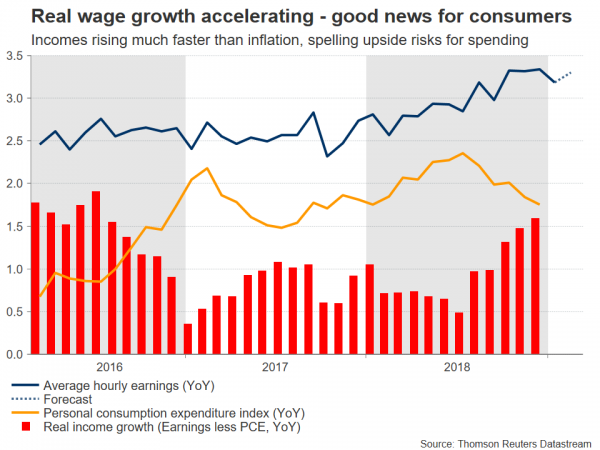

The labor market remains the bright spot in the US economy, continuing to record robust gains month after month even despite a slowdown in growth and inflation cooling somewhat. In fact, the jobs market is so strong that there are now more job openings than there are unemployed people in the US, something that is starting to attract previously discouraged workers back into the labor force. Perhaps more importantly, wage growth – which the Fed pays a lot of attention to as a forward indicator of inflation – has started to pick up steam. Higher wages imply higher spending by consumers and hence higher future inflation, at least in theory.

This week’s numbers are expected to confirm all the above. Nonfarm payrolls (NFP) are forecast to have risen by 180k in February, far below the remarkable 304k in January, but still a very healthy number overall. The unemployment rate is anticipated to have ticked down to 3.9% from 4.0% previously, while the all-important average hourly earnings rate is projected to have ticked up to 3.3% year-on-year, from 3.2% earlier.

Gauges of the labor market were mixed during February, so there is no clear sense of what direction a surprise may come from. For instance, both the ISM manufacturing and non-manufacturing surveys signaled a slowdown in employment growth in February, but the Markit composite PMI indicated strong job creation, consistent with an NFP print in the tune of 250k.

In any case, market focus will probably fall mainly on wages, as the Fed has made it clear it needs to see a vigorous pickup in inflation before considering any further rate hikes. On that front, expectations remain subdued. According to the Fed funds futures, the world’s most important central bank is expected to take no action at all this year, with market pricing frequently switching between cuts and hikes lately, but always staying close to neutral levels. In other words, markets don’t see a strong case for neither cuts nor hikes in 2019.

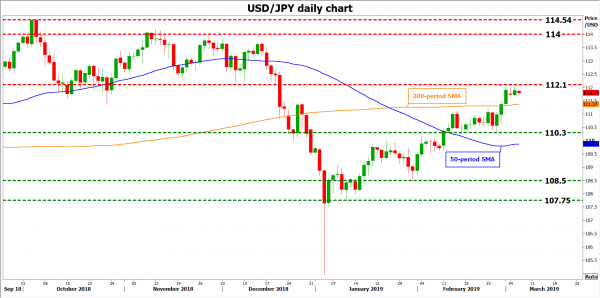

Turning to the market reaction, a strong report overall – particularly on the earnings front – could tilt market pricing towards a Fed rate hike this year, supporting the dollar. Looking at dollar/yen, immediate resistance to advances may be found at 112.20, the March 5 peak, with an upside break opening the door for a test of the 114.0 zone – defined by the November 28 high.

On the flipside, a disappointing set of data could see speculation for a rate cut gain traction, causing the greenback to give back some of its latest gains. Support to declines in dollar/yen may come at the 200-day simple moving average (SMA) at 111.37, with a bearish violation paving the way for the 110.30 area.

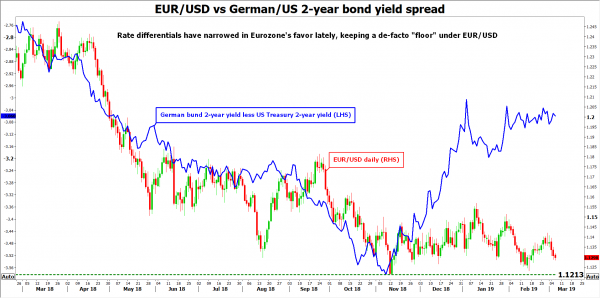

As for what the future holds for the dollar in general, while there may well be some more upside in store from current levels in the near term, a note of caution is warranted as the reserve currency is now very close to regions it has repeatedly failed to overcome recently. Specifically, declines in euro/dollar have consistently run into a wall of buy orders near 1.1250 since November, something owed to the pair receiving support from relative interest rate differentials.

The spread between short-dated EU and US bond yields has narrowed in recent months, as investors priced out Fed rate-hike expectations, and this is keeping a de-facto floor under euro/dollar. Hence, dollar bulls could find it difficult to pierce below the November lows at 1.1213 for instance, and may require some strong catalyst to do so.

Finally, besides the jobs data, some remarks by Fed Chairman Jay Powell will also attract attention. He will discuss monetary policy after the US market close, at 03:00 GMT on Saturday.