Monday March 4: Five things the markets are talking about

Global stocks have started the week on the front foot on signs of progress in U.S-China trade negotiations. News of trade progress is also boosting oil prices, which snapped a two-week winning streak when they fell last week.

This is a busy week for central bank’s monetary policy announcements. Investors will be looking to see if growth forecasts are cut by the ECB, whether the RBA’s is fearful of its housing weakness growth and if the Bank of Canada become slightly more ‘dovish’ and worried about slowing growth.

Dovish signals from the European Central Bank (ECB) and the Fed in recent weeks is also helping equities bounce off its December slump. Downgrades to the ECB’s staff forecasts should provide the backdrop for an announcement of extra bank funding.

In currencies, sterling has found support as some members of the European Research Group are conditionally prepared to back PM Theresa May’s Brexit deal. An immediate Brexit crash out is appearing less and less likely and the March 29 deadline looks to be pushed back.

Stateside, Friday’s payrolls report is the highlight for U.S economic data releases this week, and investors will also get a look at the latest Beige Book on Wednesday.

A number of Fed officials take the stage this week – Mar 5 – Kashkari and Barkin, Mar 6 – Williams and Mester, Mar 7 – Brainard – and on Friday evening Fed Chair Powell discusses monetary policy normalization and review.

On tap: Reserve Bank of Australia (RBA) monetary policy announcement (Mar 4/5), AUD GDP (Mar 5), CAD Trade balance, Bank of Canada (BoC) rate announcement & AUD retail sales (Mar 6), European Central Bank (ECB) rate announcement (Mar 7), U.S non-farm payrolls (NFP) & CAD employment release (Mar 8).

1. Stocks get the green light

Equities have certainly had a big bounce this year. The Dow Jones Industrial Average has gained +11.1% during the first two-months of 2019, its best two months since August 2009, while the S&P 500 has also rallied +11%, its best two-months since October 2010.

In Japan, the Nikkei rallied to a fresh three-month high overnight, as companies with exposure to China found support on signs Beijing and Washington are closing in on a trade deal to end their bitter year-long tariff dispute. The Nikkei share average gained +1.02%, while the broader Topix gained +0.7%.

Down-under, Aussie shares climbed to a six-month closing high overnight as investors hailed a possible end to the Sino-U.S trade conflict. The S&P/ASX 200 index rallied +0.4%, extending gains for a fourth consecutive session. The benchmark also advanced +0.4% on Friday. In S. Korea, the Kospi stock index fell -0.2% overnight after the summit between North Korea and the U.S collapsed last week, and investors moved to the Chinese market.

In Asia, Chinese shares were the biggest gainers, with the blue-chip index up as much as +3%, while in Hong Kong, the Hang Seng index added +0.7%.

Note: China’s CSI300 index rallied last week after index provider MSCI quadrupled its weighting for mainland shares in its global benchmarks.

In Europe, regional bourses trade higher across the board following a ‘green’ light session in Asia and higher U.S futures.

U.S stocks are set to open in the ‘black’ (+0.2%).

Indices: Stoxx600 +0.45% at 371.42, FTSE +0.51% at 7,123.39, DAX +0.09% at 11,610.89, CAC-40 +0.51% at 5,290.46, IBEX-35 +0.42% at 9,170.09, FTSE MIB +0.04% at 20,450.50, SMI +0.44% at 9,395.50, S&P 500 Futures +0.20%

2. Oil prices rise on trade deal hopes, OPEC supply cuts, gold higher

Oil prices start the week higher, supported by output cuts by OPEC+ and on reports that the U.S and China are close to a trade deal to end a bitter tariff row that has slowed global economic growth.

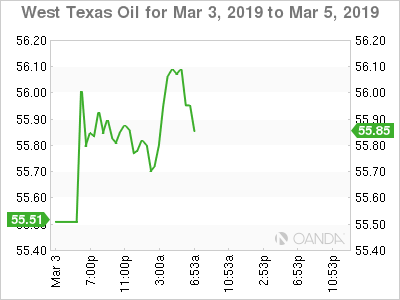

Brent crude futures are at +$65.25 a barrel, up +18c, or +0.3%, from Friday’s close. U.S West Texas Intermediate (WTI) crude futures are at +$55.94 per barrel, up +14c, or +0.3%.

A recent survey by Reuters shows supply from OPEC+ fell to a four-year low in February, as top exporter Saudi Arabia and its allies over-delivered on the group’s supply pact while Venezuelan output registered a further involuntary decline – data shows that exports are off by -1.5M bpd since last November.

Stateside, there are signs that the oil production boom, which has seen crude output rise by more than +2M bpd since early 2018 to more than +12M bpd, may slow down. U.S energy firms last week cut the number of oil rigs looking for new reserves to the lowest in almost nine months. Some producers are looking to cut back on spending.

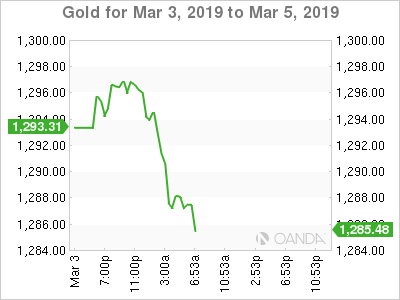

Ahead of the U.S open, gold has edged a tad higher, after falling below the critical +$1,300 level on Friday, as the ‘big’ dollar dipped on the prospect of a trade deal between China and the U.S. Spot gold is up about +0.3% at +$1,296.52 per ounce, after printing its lowest price in four-weeks at +$1,289.91 on Friday. U.S gold futures are down -0.2% at +$1,297.10 an ounce.

Note: The ‘yellow’ metal fell -2.6% last week on a firmer dollar.

3. Greek bond yields hit 12-year low on Moody’s ratings boost

Greece’s benchmark 10-year government bond yields dropped to their lowest in 12-years this morning after Moody’s raised its rating last Friday, encouraging investor optimism towards the eurozone’s most “indebted” country. Moody’s lifted Greece’s issuer ratings to B1 from B3, citing the effectiveness of the country’s reform programme. Greece’s 10-year yield dropped to +3.622%.

Broader eurozone yields are generally flat to slightly lower, though still trade atop of their recent two-week highs on signs of a possible U.S-China trade deal. Germany’s 10-year Bund yield is a tad lower at +0.18%, down from a four-week high of +0.208% last Friday.

Elsewhere, the yield on 10-year Treasuries has backed up less than +1 bps to +2.75%, while in the U.K, the 10-year Gilt yield has rallied +1 bps to +1.306%.

Note: The U.S Treasury will auction bills this week: 3- and 6-month bills today and 4- and 8-week bills on March 7.

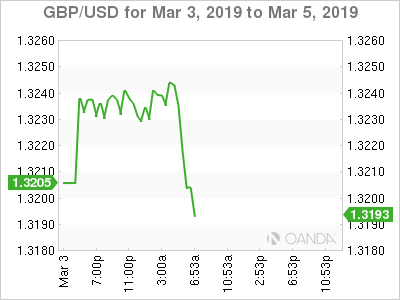

4. Rising odds of May’s deal succeeding is supporting the pound

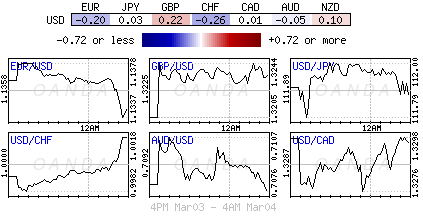

The fact that some members of the European Research Group are conditionally prepared to back U.K PM Theresa May’s Brexit deal is helping the pound, which is last up +0.3% at £1.3241. However, the probability of her deal being voted through remains below +50%. Many expect Article 50 will need to be extended for further negotiations.

Note: Tomorrow’s U.K services PMI (4:30 am ET), is more important for the pound short-term direction given that the U.K economy relies on the dominant services sector.

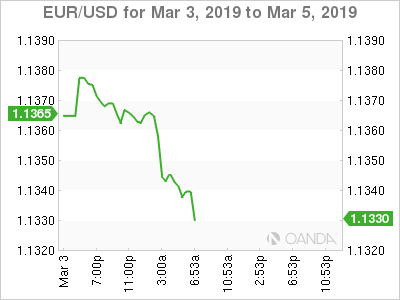

EUR/USD is under pressure, down -0.5% to €1.1337, pulling further away from last week’s peak of €1.1422, though the pair is still trading within the range it’s been in for the past several months. Weak eurozone data of late and the Fed taking a break from hiking interest rates has many investors unsure on the future direction and content in sitting on the sidelines.

Elsewhere, the Japanese yen has declined less than -0.05% to ¥111.93, the weakest in almost 11-weeks, while the offshore yuan has gained +0.3% to ¥6.6972, the largest gain in a week.

5. Eurozone producer prices rise slightly faster than expected

Data this morning showed that eurozone producer prices rose slightly faster than expected last month, pushed up by a jump in energy and capital goods.

Eurostat said prices at factory gates in the 19 countries sharing the ‘single unit’ rose +0.4% m/m for a +3% y/y increase. Market consensus had expected a +0.3% monthly rise and a +2.9% annual gain.

Digging deeper, Eurostat said energy prices rebounded in January, rising +0.4% after a -2.7% fall in December. Capital goods prices rose +0.6% after no change in December.