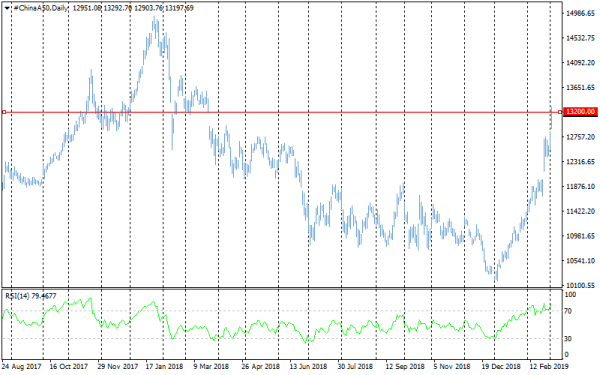

China and the United States returned to optimistic rhetoric about the trade agreement conclusion proximity and negotiations progress. Despite the fact that the initial deadline has already been passed, the markets are extremely positive about this news. The Chinese FTSE China A50 index raised 3% on Monday after almost the same growth on Friday and returned to levels almost a year ago. During the two months of rally, this stock index jumped by 30%, having fully recovered the losses due to trade wars. Such a sharp market growth, despite the US 10% duties and China’s response, is explained by the softening of the central banks’ monetary policy conditions. The Fed makes it clear that already this year it is ready to stop the balance reduction and make a pause in rate raises. The Central Bank of China softened monetary policy too, pumping the financial system with liquidity.

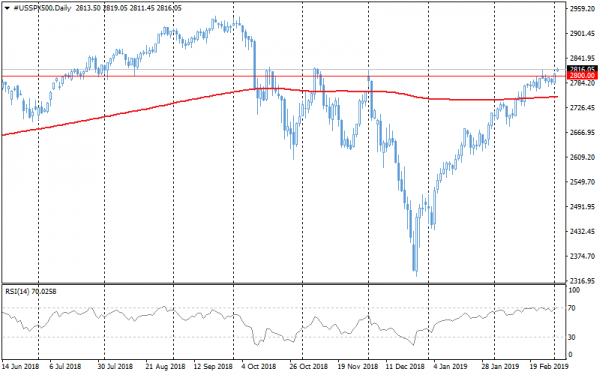

The S&P 500 price dynamic maintains a positive mood during the Asian trading session at the beginning of the day. Last week we noted the importance of the 2800 resistance on the S&P 500. On Friday, the broad market index managed to close above this level, and on Monday morning, futures are growing to local highs.

Despite the market growth momentum, it is still necessary to be cautious about joining the rally at this stage. The S&P 500 four times unfolded to decline from current levels since October last year. The popular RSI technical indicator is close to the overbought territory, indicating the risks of a quick correction. If the rollback turns out to be as deep as during the previous times, then the index may fall into the area of 2630, losing more than 6.5% of current levels. Chinese China A50 is even more vulnerable. A 30% increase in only two months very dramatically increases the risks of a rapid correction.

Moreover, during the Monday rally was closed a year-long gap related to the trade wars news. The gap closure often precedes the period of consolidation or reversal, as speculators rush to close the trading idea. In our case, this idea was negative from the trade wars. The RSI remains in the overbought area, noting an even higher risk of a quick correction.

Among the fundamental factors, it is worth noting the rotation of good and bad news related to the course of negotiations. Worse yet, the uncertainty around the two largest world economies trading conditions has been undermining economic growth, and we are increasingly often seeing deterioration of business conditions.