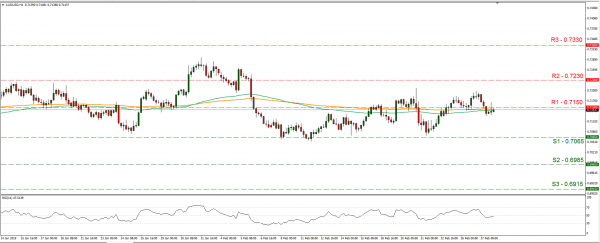

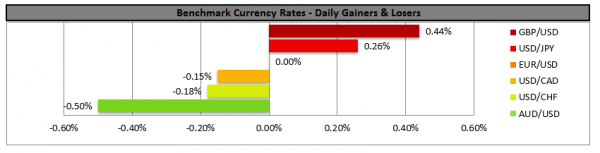

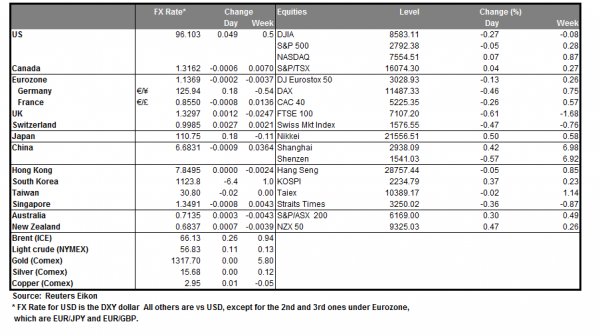

The USD remained rather steady against a number of its counterparts, as worries for the US-Sino trade talks grew. According to media, US trade representative Robert Lighthizer stated in a congressional hearing that it was too early to predict an outcome for the US-Sino trade talks. We would like to add that the soft factory data released during today’s Asian session from China and Japan, indirectly strengthen arguments that the US-Sino dispute continues to take its toll on global economic growth. Also the recent confrontation between India and Pakistan, seems to have pushed some investors in the relative safety of the USD, according to analysts. We could see volatility rising for the USD, as the long awaited US GDP growth rate, along with other financial data is due out today. AUD/USD dropped yesterday and stabilised during today’s Asian session below the 0.7150 (R1) support (now turned to resistance). We could see the pair remain under pressure today, yet should today’s financial releases weaken the USD, we could see the pair having some bullish tendencies. If the bears dictate the pair’s direction, we could see it aiming for the 0.7065 (S1) support line. If on the other hand the bulls take over, we could see the pair breaking the 0.7150 (R1) resistance line and aim for the 0.7230 (R2) resistance level.

GBP locks gains after UK Parliament’s vote

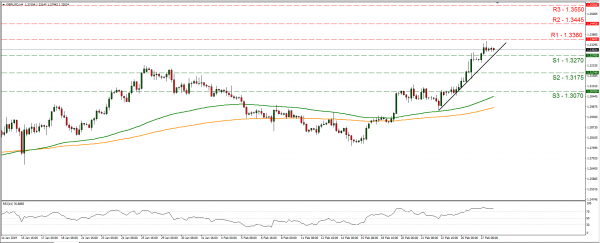

The sterling strengthened and steadied yesterday against the USD, as the UK parliament backed Theresa May’s Brexit strategy in a non-binding vote. Theresa May’s optimism could rely on the fact that hard Brexiteers remained rather silent regarding the possibility of a delay of the Brexit date during the sitting of the UK parliament yesterday. Also the fact that hard Brexiteers remained rather muted despite the government moving away from a no deal scenario, implied a softening of their stance. Analysts point out that the risk of a no deal Brexit has substantially fallen and we would like to add that yesterday’s Parliament sitting indirectly confirmed that direction. We could see the pound remaining Brexit driven, yet doubts could continue to cap gains or add some pressure for the currency. Cable rose yesterday, breaking the 1.3270(S1) resistance line (now turned to support) and stabilising above it during the Asian session. As mentioned before we could see the pound being under pressure, however also the USD could be under pressure due to today’s financial releases. Technically for yesterday’s bullish outlook to change, we would require the pair to clearly break the upward trendline incepted since the 22nd of February and we expect the line to be put to the test, probably today. Should the pair come under the selling interest of the market, we could see it breaking the 1.3270 (S1) support line and aim for the 1.3175 (S2) support barrier. Should on the other hand the market once again favor the pair’s long positions, we could see the pair breaking the 1.3360 (R1) resistance line and aim for higher grounds.

Today’s other economic highlights

During the European session today, we get UK’s Nationwide HPI for February, yet the market’s interest could be on Euro pair’s, as the preliminary French CPI (EU Norm.) for February, the France’s GDP rate for Q4 and Germany’s preliminary HICP for February are due out. In the American session, we get from the US the GDP growth rate for Q4 and from Canada the current account balance for Q4. As for speakers please note that Fed’s Richard Clarida, Atlanta Fed President Raphael Bostic, Philadelphia Fed President Patrick Harker and Dallas Fed President Robert Kaplan speak.

GBP/USD

Support: 1.3270 (S1), 1.3175 (S2), 1.3070 (S3)

Resistance: 1.3360 (R1), 1.3445 (R2), 1.3550 (R3)

AUD/USD H4

Support: 0.7065 (S1), 0.6985 (S2), 0.6915 (S3)

Resistance: 0.7150 (R1), 0.7230 (R2), 0.7330 (R3)