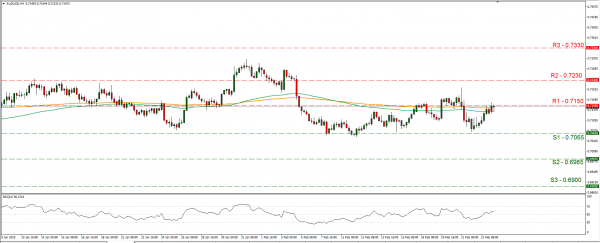

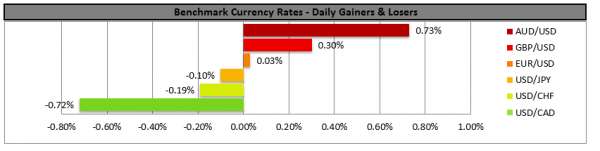

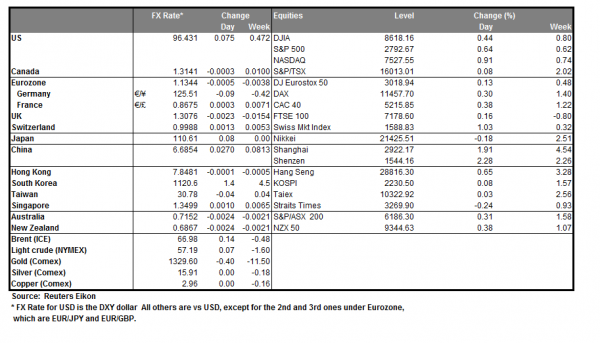

The USD weakened against a number of its counterparts yesterday, while the Aussie strengthened as US President Trump delayed additional tariffs. US President Trump stated that he will delay increasing tariffs on Chinese imports on March 1st, after mentioning “substantial progress” in the US-Sino negotiations. According to media, the US President also stated that he would plan a summit meeting with Chinese President Xi, to conclude the agreement assuming that the trade talks make further progress. Analysts point out that the delay may not come as a total surprise for the markets and that focus could turn to global economic fundamentals once again. Should there be further positive headlines reeling in about the US-Sino relationships, we could see the USD weakening and the Aussie along with the Kiwi strengthening. AUD/USD continued its rise testing the 0.7150 (R1) resistance level on Friday and during today’s Asian session. We could see the pair rising even further today and renew its bullish run, especially should there be further positive headlines about the US Sino negotiations. Should the pair find fresh buying orders along its path, we could see it breaking the 0.7150 (R1) resistance line and aim for the 0.7230 (R2) resistance level. Should on the other hand the pair come under the selling interest of the market, it could aim for the 0.7065 (S1) support line.

Pound awaits Brexit for further direction

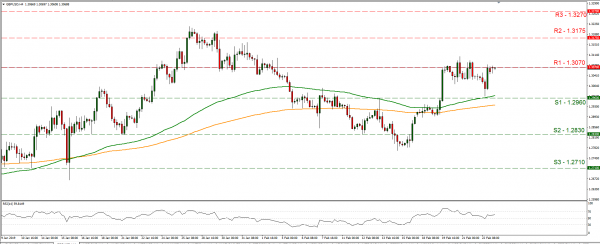

The pound remained relatively stable after a push on Friday, as a fog of uncertainty clouds the Brexit outlook. Media report that UK’s PM delayed a vote in the UK parliament about Brexit until the 12th of March, just 17 days before Brexit, increasing the stakes. Also according to media, Theresa May could be considering delaying Brexit by two months, while the EU seems to warn that the alternative may be a substantial delay of Brexit. Analysts point out that without a clearer outlook for Brexit, it may prove difficult for the pound to push substantially higher than its current levels. Cable got a push on Friday however proved unable to break the 1.3070 (R1) resistance level during the Asian session today. Any further positive headlines about Brexit could provide some support for the pound and push the pair higher, otherwise we could see the pound remaining under pressure. If the bulls take over again, we could see the pair breaking the 1.3070 (R1) resistance line and aim for the 1.3175 (R2) resistance hurdle. Should on the other hand the pair’s direction be dictated by the bears, we could see it aiming for the 1.2960 (S1) support line.

Today’s other economic highlights

It’s a rather slow Monday, as no major financial releases are expected today.

As for the rest of the week

On Tuesday, from Germany we get the Gfk Consumer Sentiment for March, from the US the CB Consumer Confidence for February and Fed’s chairman Jerome Powell testifies before the Senate. On Wednesday, we get from the US the Core Durable Goods orders for January, Canada’s CPI rates for January and the US factory orders growth rates for December. On Thursday, we get Japan’s preliminary Industrial production for January and retail sales for January, China’s NBS manufacturing PMI for February, Germany’s preliminary HICP for February and the US GDP growth rate for Q4. On Friday, we get China’s Caixin Mfg PMI for February, Germany’s unemployment data for February, UK’s Mfg PMI for February, Eurozone’s preliminary CPI for February, Canada’s GDP for Q4 and from the US the ISM Mfg PMI for February.

GBP/USD

Support: 1.2960 (S1), 1.2830 (S2), 1.2710 (S3)

Resistance: 1.3070 (R1), 1.3175 (R2), 1.3270 (R3)

AUD/USD H4

Support: 0.7065 (S1), 0.6985 (S2), 0.6900 (S3)

Resistance: 0.7150 (R1), 0.7230 (R2), 0.7330 (R3)