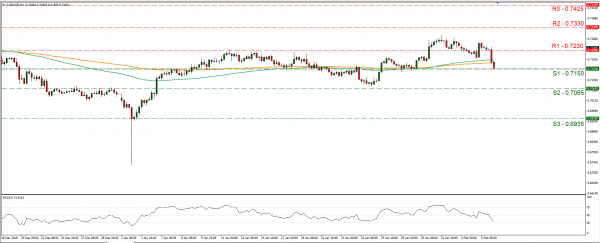

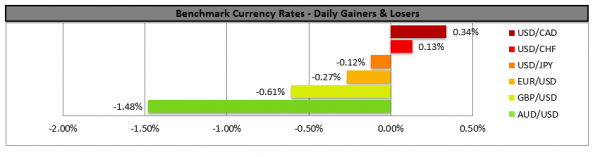

RBA governor Philip Lowe opened the door to the possibility of a rate cut in a speech during today’s Asian session. In his first speech in the year RBA Governor Philip Lowe stated that rates could go either direction, depending on the labour market and inflation. RBA had left its cash rate unchanged at +1.50% for over two years and was frequently signalling that the next move would be up. Analysts point out that the fall of the Aussie may have generated more attention and we see the case for more volatility being in the cards. We see the case for the Aussie to weaken Philip Lowe’s speech, yet investors could be looking for clues in RBA’s quarterly monetary statement on Friday. The Aussie weakened against the USD during today’s Asian session as the possibility of a rate cut by the RBA appeared and the pair dropped breaking the 0.7230 (R1) support line (now turned to resistance) and tested the 0.7150 (S1) support level. We could see the pair maintaining a downward movement for the time being and the next big date for the pair would be Friday morning when RBA’s quarterly monetary statement will be released. Should the bears continue to dictate the pair’s direction, we could see it breaking the 0.7150 (S1) support line and aim if not break the 0.7065 (S2) support level. Should on the other hand the bulls take over, we could see the pair rising and aiming if not breaking the 0.7230 (R1) resistance line.

Trump’s state of the union speech does not affect the USD

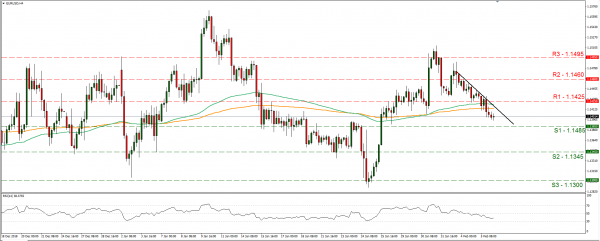

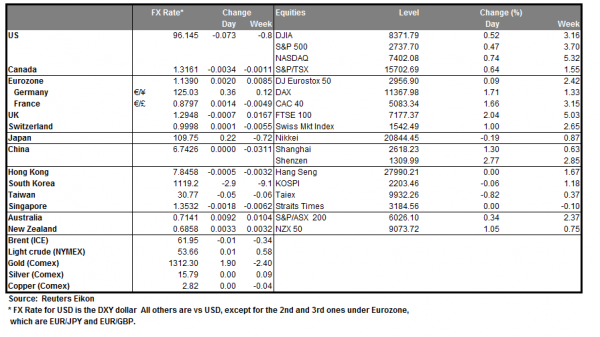

The greenback held steady against a number of its counterparts as there was little reaction to US president’s State of the Union speech. In his annual speech, Trump stated that illegal immigration was an urgent national crisis and repeated his promise to build a wall at the US southern border. He also stated that China has targeted US industries and stolen intellectual property for years. He concluded the issue by stating that a new trade deal with China, must include an end to unfair trade practices, reduce the US chronic trade deficit and protect American jobs. Despite analysts pointing out that Trump has said nothing new, concerns grow about the US-Sino trade talks as US officials are to visit China for further trade talks in a few days. After Trump’s state of the union speech, the range for flexibility for US negotiators narrows substantially, providing obstacles in the path towards striking a deal. Also the reiteration of the wall building determination on Trumps part, included a wording which could predispose for a possible declaration of a state of emergency, should there be another US government shutdown. Overall, we could see lower volatility for the USD as no US financial releases are expected today, but delayed releases (due to the shutdown) could surprise the market. EUR/USD weakened yesterday and clearly broke the 1.1425 (R1) support line, now turned to resistance. Technically, we maintain the bearish outlook for the pair, as the pair’s downward trendline incepted since Friday (01st of February) the remains intact. Should the pair remain under the selling interest of the market, we could see it breaking the 1.1485 (S1) support line and aim for the 1.1345 (S2) support barrier. Should on the other hand the pair’s long positions be favoured by the market, we could see it braking the 1.1425 (R1) resistance line and aim for the 1.1460 (R2) resistance level.

Today’s other economic highlights

In today’s European session, we get Germany’s industrial orders growth rate for December. In the Amrican session, we get Canada’s Ivey PMI for January and from the US the EIA crude oil inventories figure. Just before the Asian session starts, we get New Zealand’s employment data for Q4.

AUD/USD H4

Support: 0.7150 (S1), 0.7065 (S2), 0.6935 (S3)

Resistance: 0.7230 (R1), 0.7330 (R2), 0.7425 (R3)

EUR/USD H4

Support: 1.1485 (S1), 1.1345 (S2), 1.1300 (S3)

Resistance: 1.1425 (R1), 1.1460 (R2), 1.1495 (R3)