U.S. Highlights

- Financial markets extended their gains this week. The re-opening of the U.S. government, the dovish FOMC statement, progress in the U.S.-China trade talks and a strong January payroll report all helped to boost sentiment.

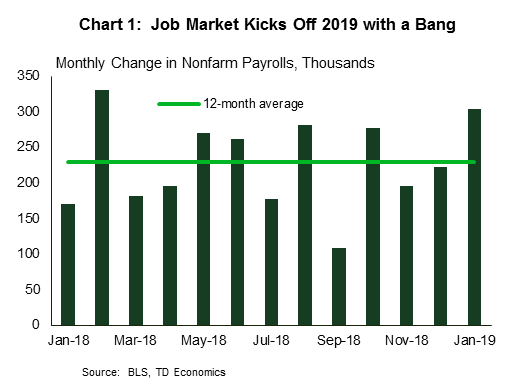

- Global growth concerns persisted this week, but the U.S. economy continued to move along nicely. The labor market added 304k new jobs in January, and the ISM manufacturing index improved after a sharp decline in December.

- Even as domestic economic performance remains solid, global growth slowdown did not go unnoticed by the FOMC. The Committee left the fed funds rate unchanged, and went to great lengths to emphasize patience.

Canadian Highlights

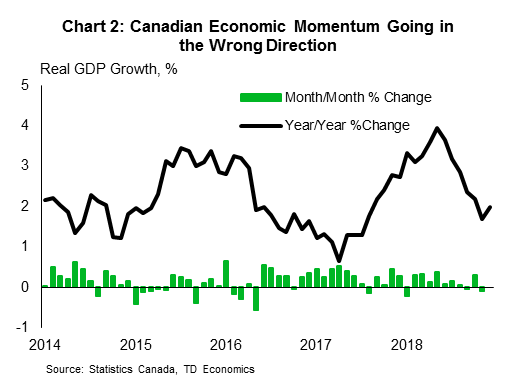

- Canada’s economy contracted 0.1% in November as the energy sector weighed on growth. Real GDP is tracking a modest 1% (annualized) for the fourth quarter as a whole.

- A “patient” Federal Reserve will mean an even more patient Bank of Canada. Canada’s outlook is even cloudier than that stateside, providing numerous reasons for caution from the central bank.

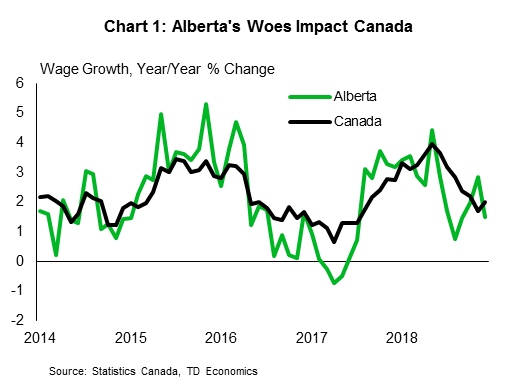

- In a speech this week, Deputy Governor Wilkins noted that the oil shock is coming through not only on the unemployment rate but also the pace of wage growth. Until there is some clarity on the path of global growth, expect the Bank of Canada to remain on the sidelines.

U.S. – The Fed’s Rate Hikes: A Pause or A Stop?

Concerns about slowing global growth continued to linger this week. Even so, financial markets had a lot to be cheerful about: the U.S. government re-opened, the FOMC was dovish, the U.S.-China talks made progress and January payroll report showed blockbuster job growth. After a brutal December, this week’s trading capped the best monthly performance for the S&P 500 since October 2015.

Top of the list, the longest shutdown in U.S. history has ended – for now. A short-term spending bill keeps the government funded until February 15th. Still, the damage has been done. Various estimates suggest that the shutdown has shaved between 0.2-0.4 percentage points off first quarter GDP growth, which is tracking 1.6% (annualized). While most of the lost economic activity will be recouped in the following quarter, some of the loss will be permanent.

The impact of the government shutdown was also apparent in today’s payroll report. The unemployment rate move up a tick to 4.0%, lifted by government workers who were furloughed, and the broader measure of unemployment which includes people working part-time for economic reasons (the U6) has jumped up from 7.6% to 8.1%. Aside from those temporary distortions, it was a stellar report. The labor market added an impressive 304k new jobs in January, marking a record-setting 100th straight month of payroll gains. Wages continued to advance at above-3% pace, and the core age participation rate kept moving higher, rising 0.5 percentage points over the past year.

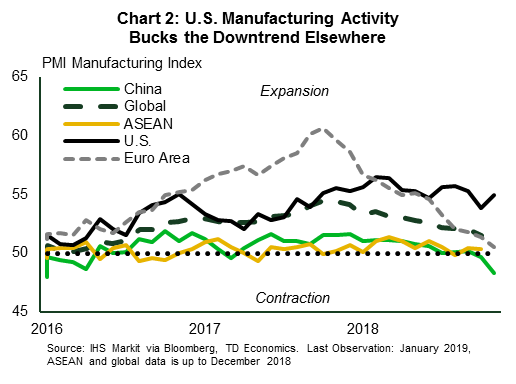

Meanwhile, across most other major economies, performance is shifting into lower gear. China’s economy is weakening: last year’s auto sales declined for the first time in decades, and manufacturing activity is contracting. That impact is being felt acutely by China’s major trading partners and American companies with significant exposure to the region. The export-oriented Euro Area economy also ended 2018 on a weaker footing, growing at the slowest pace in four years. Clearly, the toll on global growth from the U.S.-China trade dispute is rising, and the time to reach a deal before possible further escalation after the March 1st deadline is running out. President Trump was upbeat about the progress during this week’s negotiations, but important issues remain unresolved and any deal is unlikely until the two presidents meet in person later this month.

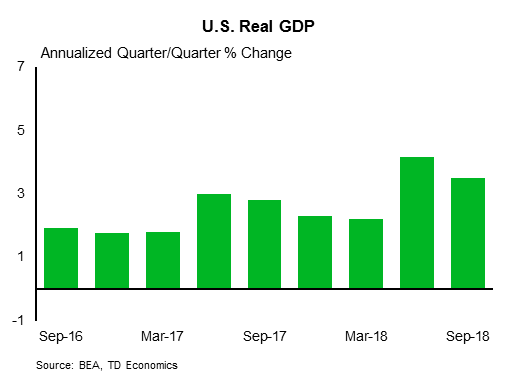

Global growth slowdown considerations did not go unnoticed by the FOMC. As widely expected, the Committee left the target range for the fed funds rate unchanged at 2.25%-2.5%, but the statement itself was very dovish. In particular, the committee acknowledged that, while domestic economic activity has been “rising at a solid rate”, risks to the outlook have increased, which would necessitate patience and flexibility on the Fed’s behalf. Any mention of “gradual” rate increases has been removed, suggesting the Fed is prepared to be patient for some time until the fog clears and its gets a better reading on global and domestic economic conditions.

Canada – Oil Sector Puts a Chill on Canada’s Growth

The impact of lower oil prices and widening spreads on Western Canadian Select was on full display in the November real GDP report, released this week. Canada’s economy shrunk by 0.1% in the month. The economy likely grew for the fourth quarter as a whole, but with the poor outturn in November, the pace is likely a modest 1% (annualized).

The pain, unfortunately, is not over. The oil shock is evident in small business confidence into January, which, according to the CFIB, pulled back dramatically in Alberta and remained at a low level nationally (edging up only slightly after a steep decline in December). Mandatory production cuts will continue to weigh on economic growth through the first quarter of this year, likely leading to a repeat performance in terms of sluggish real GDP growth in the neighbourhood of 1%. The good news is that due to the improvement in pricing, Alberta has announced a production boost in February, slightly earlier than expected. With a bit of luck, the drag will be contained to the first quarter and a healthy bounceback will take place in the second.

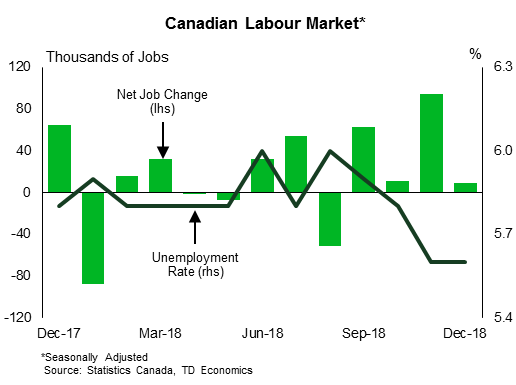

Still, ongoing economic weakness, alongside rising global uncertainty, is reason enough for a pause on interest rate increases from the Bank of Canada. Recall that the last oil shock resulted in two rate cuts from the Bank of Canada in 2015. The current situation is different from the past. For one, the energy price shock is smaller (roughly 25% versus 70% according to Bank of Canada estimates). What is more, the unemployment rate is a percentage point lower and core inflation is closer to the Bank of Canada’s 2% target. Nonetheless, below-trend growth gives little reason to expect further improvement in the country’s labour market and will mute upward pressure on inflation.

At the same time, the outlook for rate hikes from the Bank of Canada will be influenced by events outside of the country’s borders. With the Federal Reserve changing tack on future interest rate increases, there is less scope or rationale for the Bank of Canada to push higher. If the Federal Reserve has reason for patience, the Bank of Canada has a multitude. To name a few: Canada is even more tied into the softening global outlook, especially through the commodity channel, than the U.S.; the interest-rate sensitivity of households is a more pressing issue north of the border where debt levels are higher and housing valuations more stretched; and, finally, competitiveness and investment challenges are a much more pressing issue, necessitating a lower exchange rate to maintain full employment.

As Senior Deputy Governor Wilkins noted, the oil shock is coming through not only on the unemployment rate but also the pace of wage growth, which is particularly muted in oil producing regions. Other structural factors weighing on wage growth, such as increased market power of firms and lower labour market turnover, also bear watching.

The improvement in Canada’s benchmark oil prices of late is encouraging, but until global event risks subside and there is some clarity on the path of global growth, expect the Bank of Canada to remain on the sidelines.

U.S.: Upcoming Key Economic Releases

U.S. GDP – Q4 Advanced

- Release Date: TBD

- Previous: 3.4%

- TD Forecast: 2.8%

- Consensus: 2.6%

We expect the advanced release of Q4 GDP to show economic growth slowed back to a still strong 2.8% q/q pace, down from Q3’s solid burst to 3.4%. The more measured expansion rate should reflect the economy’s expected normalization as the fiscal stimulus wanes and as a result of the gradual impact of a tighter monetary stance. We anticipate consumers to remain a firm driver of economic activity during the quarter as suggested by a strong holiday shopping season, and on the back of high levels of consumer confidence and solid employment numbers. That said, we expect the stimulus driven sugar-high of 2018 to start to wane beginning in 19Q1 as the gradual normalization of output toward trend-growth continues this year.

Canada: Upcoming Key Economic Releases

Canadian Employment – January

- Release Date: February 8, 2019

- Previous: 9.3k, unemployment rate: 5.6%

- TD Forecast: 15k, unemployment rate: 5.6%

- Consensus: N/A

TD looks for the labour market to add 15k jobs in January, led by a rebound in services sector hiring. Services saw an outsized pullback in retail and public administration employment throughout December, the latter of which registered the largest one-month net job loss since mid-2016. Together, these two industries shed over 40k workers which suggests some mean reversion into 2019. Meanwhile, goods-producing employment will face a headwind from layoffs across the energy sector, a likely result of government mandated caps on oil production, and a giveback in manufacturing employment after 24k jobs were added last month, a post-crisis record. Elsewhere we also look for a recovery in private sector job growth following last month’s rotation into self-employment. Job growth of 15k should leave the unemployment rate unchanged at the current cycle low of 5.6% while wage growth should firm modestly to 1.7% y/y, still well below levels associated with a tight labour market.

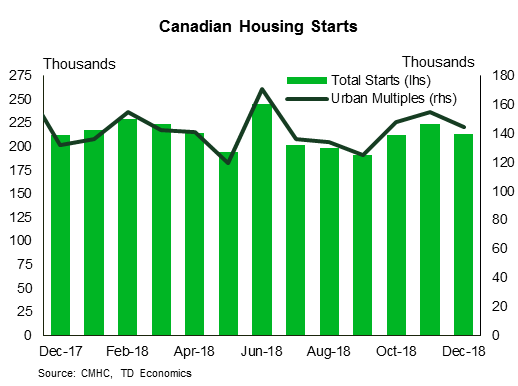

Canadian Housing Starts – January

- Release Date: February 8, 2019

- Previous: 213k

- TD Forecast: 205k

- Consensus: N/A

TD looks for residential construction to slow to an annualized 205k units in January on a pullback in multi-unit starts. Permit issuance for multi-unit projects has waned in recent months on a slowdown in new home sales and softer conditions in the resale market, while single family permit issuance continues to sit near the 2008/09 lows. Cold weather in late January will also weigh on construction due to harsh conditions for outdoor workers.