The Great British pound rose slightly earlier today, paring some of the losses made yesterday. The declines happened after the House of Commons voted on a number of amendments on Brexit. The members votes backed Theresa May’s efforts to rewrite her own draft treaty, a measure that has ben rejected by Brussels. The MPs voted by 317 to 301 to endorse a government-backed amendment that will replace the Irish backstop to alternate arrangements. In response to the vote, EU’s Donald Tusk said that Brussels was committed to the existing Brexit agreement that was negotiated over two years. For now, there are uncertainties on what will happen next as deadline nears.

The Australian dollar rose sharply after positive inflation numbers. Data from the Australian bureau of statistics showed that Q4’s CPOI rose by 1.8%, which was higher than the consensus estimate of 1.7%. This was lower, however, than Q3’s inflation growth of 1.9%. On a QoQ basis, the CPI increased by 0.5%, higher than the expected 0.4%. The CPI index number for the fourth quarter was 114.10 while the weighted mean CPI rose by 1.7%. These numbers could make a case for the RBA to raise rates later this year or early next year as they approach the target 2.0%.

It will be an important day for the USD and markets in general as traders prepare for important information. ADP research will release its reading for January’s nonfarm employment change. Investors expect it to show that more than 170K people were employed in the month, down from 271K in December. This number will be released two days before the official government jobs numbers. Traders will then receive the first reading of the US Q4 GDP numbers. Investors expect the numbers to show that the economy expanded by 2.6%. Later, they will receive the interest rates decision by the Fed. While the bank is not expected to hike, its statement will provide guidance on what to expect in the next meetings.

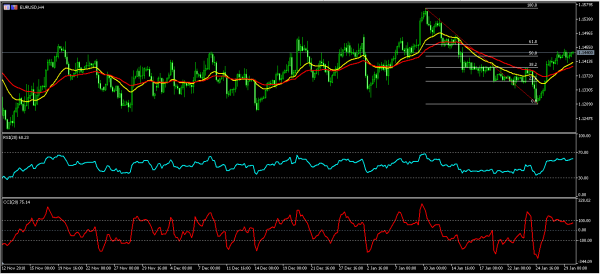

EUR/USD

The EUR/USD pair was little moved ahead of key economic data from the United States. The pair remained closer to the YTD high of 1.1450. On the four-hour chart, the current price is closer to the 50% Fibonacci Retracement level of 1.1430. The price is also above the 21-day and 42-day EMA while the RSI has remained unchanged below the 70 level. The same is true with the commodities channel index, which has been relatively unchanged. There is a likelihood that the pair will see some major movements today as key US data is released.

AUD/USD

The AUD/USD pair jumped today after the CPI numbers from Australia. The pair moved from a low of 0.7135 to a high of 0.7195. This price is above the 21-day and 42-day EMAs while the RSI has moved closer to the 70 level. While the upward trend of the pair could continue, there may be some volatility after the US data that will affect the US dollar. The key points to watch for the pair will be 0.7225 and 0.7170 as shown below.

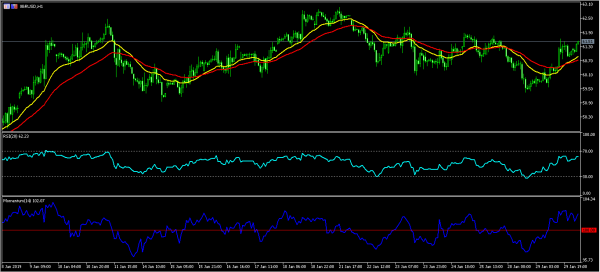

XBR/USD

The XBR/USD pair rose today after API released weaker-than-expected inventory numbers. The pair reached an intraday high of 61.50. The price is above the 21-day and 42-day EMAs while the RSI has continued to move up. The same is true with the momentum indicator, which is currently above 100. The pair could potentially continue to move up to the 62 level.