Friday January 25: Five things the markets are talking about

Global equities and U.S futures are trying to close out the week on firmer footing. Equity direction continues to depend on investors weighing up corporate earnings reports and concerns about the global economy.

Market fears of slumping global growth has been taking the shine off a better-than-expected U.S corporate earnings season. Are the world’s two largest economies making progress? Yesterday, U.S Commerce Secretary Ross said that the U.S is “miles and miles” from a trade deal, but there is a fair chance a deal will get done.

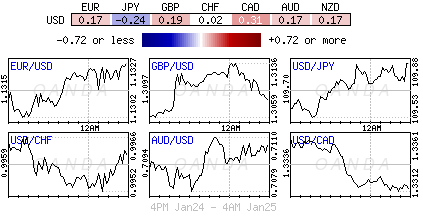

Heading into the N. American session, the ‘big’ dollar trades under pressure against most G10 currency pairs, while U.S treasury yields back up along with some Euro sovereign bonds. Sterling hit a new 20-month high overnight on rumored reports that N. Ireland’s DUP would be backing PM May’s Brexit Plan B next week.

Note: Brexit – PM May is expected to table her Plan B to Parliament on Jan 29. As per the last go around, MP’s will then table amendments and the speaker will choose which will be voted on.

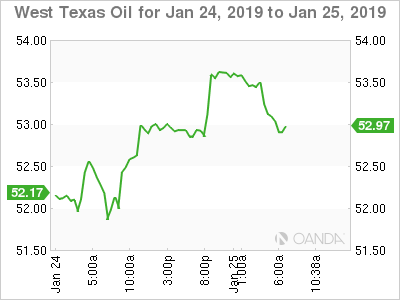

In commodities, crude oil prices rally as a “deepening crisis” in Venezuela threatens to make OPEC+’s job of balancing global oil supplies a tad bit more difficult. Even a surprise in U.S inventories has been unable to keep the ‘black stuff’ down.

Yesterday, the European Central Bank (ECB) did what was expected, left rates on hold, while turning a tad more ‘dovish’ than in December. Basically, there is no sign of any fundamental change in their monetary policy stance – other tools remain at the disposal of the central bank to help return to higher levels of core-inflation.

Capital markets will now have to wait for March when there should be more clarity on issues with regard to the risks stemming from Brexit, the U.S government shutdown and the Sino-U.S trade dispute.

On tap: There are no major economic ccalendar releases on the weekend. Down-under, it’s a bank holiday in Australia (Jan 27/28).

1. Stocks see green

In Japan, the Nikkei rallied overnight as chip-related firms extended gains, mirroring gains from their U.S counterparts, while investors looked to major events next week for direction (Sino-U.S trade talks and NFP). The Nikkei share average rose +1.0% at the close, while the broader Topix gained +0.9%.

Down-under, Aussie stocks rallied overnight, capping their third consecutive week of gains, as higher commodity prices supported energy and mining stocks. The S&P/ASX 200 index closed up +0.7%, advancing +0.4% for the week. In S. Korea, chip makers helped lifted the Kospi +1.5%, its biggest daily gain in nearly two-weeks. For the week, the benchmark index gained +2.5%, while it jumped +6.7% on the month.

In China, stocks rallied, helped by strength in banking stocks, after regulators unveiled measures to help lenders replenish capital. However, ongoing worries over Sino-U.S trade talks continue to cap gains. At the close, the blue-chip CSI300 index rose +0.8%, while the Shanghai Composite Index gained +0.4%.

In Europe, regional bourses trade higher across the board following on from a stronger session in Asia and higher futures in the U.S.

U.S stocks are set to open in the ‘black’ (+0.6%).

Indices: Stoxx600 +0.6% at 357.8, FTSE +0.1% at 6827, DAX +1.1% at 11256, CAC-40 +0.6% at 4902, IBEX-35 +0.2% at 9170, FTSE MIB +0.6% at 19673, SMI +0.1% at 8950, S&P 500 Futures +0.6%

2. Oil prices climb on threat of sanctions against Venezuela, gold higher

Ahead of the U.S open, global oil prices remain bid as turmoil in Venezuela has generated concerns that its crude exports could soon be disrupted.

Brent futures are at +$61.62 a barrel, up +53c or +0.9% – Brent has lost about -1.8% this week and remains on track to post its first week of losses in four-weeks, while U.S West Texas Intermediate (WTI) crude futures are at +$53.70 per barrel, up +57c, or +1.1%.

Note: In Venezuela this week, opposition leader Juan Guaido declared himself interim president, winning backing from U.S and and large parts of Latin America.

Despite plummeting supplies in recent years, the market has been pricing in the risk to Venezuela’s crude production – approx. +1M bpd. However, global markets remain well supplied (U.S production has increased by +2M bpd in 2018) and should cap price rallies in the short-term.

The swell in U.S output has resulted in huge U.S fuel inventories. EIA data yesterday showed U.S gas inventories have rallied for an eighth consecutive week in the week to Jan. 18, by +4.1M barrels to a record +259.6M barrels, while crude inventories rose by +8M barrels.

Global demand may begin to wane even further as a global economic slowdown is likely to dent fuel consumption.

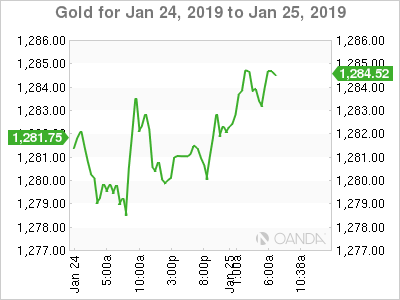

Gold prices are closing out the week better bid on concerns about a prolonged U.S government shutdown and as markets wait on Sino-U.S trade talks due next week. Spot gold has rallied +0.3% to +$1,284.31 per ounce since Thursday’s close, while U.S gold futures have climbed +0.2% to +$1,283.10 per ounce.

3. Bad news for EU growth is good news for bonds

Core-eurozone bond yields are struggling to find traction, a day after falling sharply due to downbeat comments from the ECB who acknowledged weaker economic growth at yesterday’s monetary policy meeting.

Core bond yields fell to two-week low after the ECB’s news conference at which Draghi acknowledged key economic risks, ranging from trade wars to Brexit. His ‘dovish’ comments have pushed back further along the curve market expectations of when the ECB will next hike rates.

Note: The ECB expects key interest rates to remain at their present levels at least through the summer of 2019, while markets have already pushed out the first hike expectations to June 2020.

The yield on Germany’s 10-year Bund, fell -4.6 bps yesterday, its biggest one-day drop since January 2. In France, 10-year government OAT yields also fell by almost -5 bps to +0.59%, while Spanish 10-year government bond yields dropped -8.2 bps, the biggest one-day fall in seven months, to +1.25%.

Elsewhere, the yield on 10-year Treasuries has gained less than +1 bps to +2.72%, while in the U.K, the 10-year Gilt yield has gained +1 bps to +1.279%.

4. Dollar sees red across the board

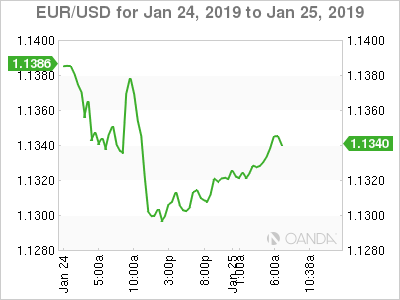

The EUR (€1.334) continues to hover within striking distance of its three-year low, but trades above the psychological €1.13 level after the ECB revised their language on economic risks at yesterday’s monetary policy announcement. Many believe, despite the change in ECB’s copy, the regional impact does not have any immediate impact on the ECB’s monetary policy stance, but the change in sentiment on risks infers ECB rate hike delay to its current guidance of the first potential hike after summer 2019. Today’s German IFO data (see below) should reinforce this view.

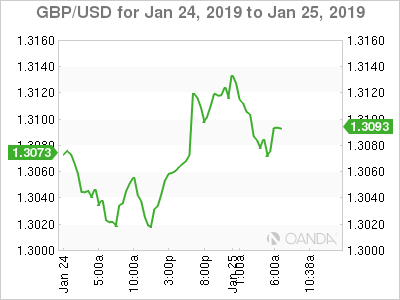

GBP/USD (£1.3076) is again looking to approach the £1.31 area for its 20-month high, supported by rumored reports overnight that Northern Ireland’s DUP party would back PM May’s Brexit withdrawal deal in parliament next week when she ‘toughened it up’ (looking to implement a ‘time limit’ on the Irish border).

Some risk appetite sentiment helped the USD/JPY (¥109.82) pair edge closer to the psychological ¥110 handle.

5. German business sentiment drops to a three-year low

Data this morning showed that German business sentiment deteriorated sharply this month, further proof that H2 German economic troubles are spreading into Q1, 2019.

The Ifo Institute said that its business-climate index fell to 99.1 points in January from 101.0 points in December. Market expectations were looking for a 100.6 forecast print. Today’s headline marks the lowest level since February 2016.

“The German economy is experiencing a downturn,” Ifo President Clemens Fuest said. In manufacturing, the business climate deteriorated in all of the key business sectors apart from chemicals, the Ifo said.

Note: A survey of purchasing managers by IHS Markit yesterday showed that German manufacturing activity contracted at the start of the year, while services activity picked up in January.

Weaker German data this week is firm evidence that the eurozone’s strongest economy is stalling.