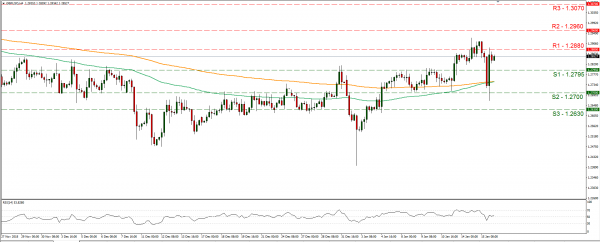

The UK government suffered a substantial defeat yesterday, as the UK Parliament rejected Theresa May’s Brexit plan with a difference of 230 votes, marking the worst parliamentary defeat for a government in over a century. The Labour party moved swiftly tabling a motion for a confidence vote, right after the results came out. The confidence vote is expected to be debated and voted on tonight around 19:00 (GMT). The DUP seems to be backing the government in order to avoid general elections and Theresa May could survive another political battle. Should Theresa May win the confidence vote we could see the UK Labour party backing the scenario of a new referendum, should on the other hand Theresa May loose her position, the UK Parliament will have 14 days to elect a new government or else move on to general elections. Should Theresa May survive the confidence vote today, we expect chances for a new referendum rising, as such a scenario could attract also a number conservative MPs, which favour the UK remaining in the EU. Also, it should be noted that the possibility of an extension for Brexit beyond the end of March seems very likely and the EU seems to be of the same mind. We expect volatility for the pound to continue, albeit not at the same pace as yesterday and UK financial releases as well as Mark Carney’s scheduled speech could add further uncertainty for the pound. Cable broke consecutively all support lines yesterday, however recovered most ground lost after the announcement of the voting result, testing the 1.2880 (R1) resistance line. We could see the pair continuing to have substantial volatility today as the confidence vote, today’s financial releases and Mark Carney’s scheduled testimony could increase uncertainty for the pound. Should the bears dictate the pair’s direction, we could see cable breaking the 1.2795 (S1) support line and aim for the 1.2700 (S2) support barrier. Should on the other hand the bulls take over the reins, we could see the pair breaking the 1.2880 (R1) resistance line and aim for the 1.2960 (R2) resistance hurdle.

CBRT’s interest rate decision

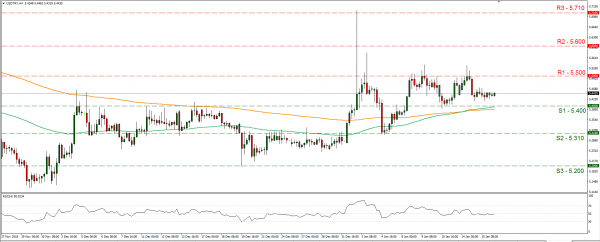

In Turkey, CBRT is to meet an interest rate decision (11:00, GMT) and is expected to remain on hold at +24.00%, despite the Turkish CPI slowing down recently. The decision gets the attention of TRY traders as Turkey is currently at a pre-election state and pressure from Turkey’s President towards the bank to loosen up its monetary policy could be rising. On the other hand, CBRT had promised to provide monetary tightening after TRY’s mini crisis in the summer. USD/TRY maintained a sideways movement over the past few sessions, between the 5.400 (S1) and the 5.500 (R1) resistance line. Should the bank decide to remain on hold, we could see the pair dropping somewhat while if the it cuts rates we expect the pair to rise substantially, reflecting a possible weakening of the TRY side of the pair. Should the pair come under the selling interest of the market, we could see it breaking the 5.400 (S1) support line and aim for the 5.310 (S2) support area. Should on the other hand the market favour the pair’s long positions, we could see it breaking the 5.500 (R1) resistance line and aim if not break the 5.600 (R2) resistance level. Please be advised that the market may have an asymmetrically wider response to a possible rate cut.

Today’s other economic highlights

In today’s European session, we get Germany’s final HICP reading and UK’s headline and core CPI rates, as well as PPI Input growth rate, all for December. In the American session, we get from the US, the Retail sales growth rates for December and the EIA weekly crude oil inventories figure. As for speakers, don’t forget Mark Carney’s scheduled testimony before UK parliament’s Treasury Committee.

GBP/USD H4

Support: 1.2795 (S1), 1.2700 (S2), 1.2630 (S3)

Resistance: 1.2880 (R1), 1.2960 (R2), 1.3070 (R3)

USD/TRY H4

Support: 5.400 (S1), 5.310 (S2), 5.200 (S3)

Resistance: 5.500 (R1), 5.600 (R2), 5.710 (R3)