The euro remained lower against the USD as investors grew wary about cracks in the European economy. This was after data from Europe showed that the economy was softening. Yesterday, data from Eurostat showed that the industrial production declined by 3.3% in November. This was a continuation of the weak data that has emerged from the EU in recent months. Last week, data showed that German manufacturing production declined by minus 1.9% while business confidence in the region declined as well. Previously, PMIs from the EU also declined sharply.

The sterling rose today as traders waited for the vote in the house of commons on Theresa May’s Brexit bill. Most investors expect the parliament to vote against the bill, a move that will leave the country in uncharted territory. Yesterday, Theresa May pleaded with the members to vote for the bill, saying that it was the best deal that the country could have got. Meanwhile, the European Union seems open to the idea of delaying the March deadline to later this year, a move that has been rejected by a number of Eurosceptic members of parliament.

Yesterday, the price of crude oil declined as traders grew wary about the slowing demand from China. This happened after data from the country pointed to weaker growth. The price recovered in overnight trading and rallied by more than 1% as traders started to focus on the supply cuts announced by OPEC.

XTI/USD

The XTI/USD pair rose by more than 1% in overnight trading and is currently trading at 51.32. This is lower than last week’s high of 53.55. On the hourly chart, the price is slightly above the Envelopes indicator while the Parabolic SAR indicator points to more downward moves. The Momentum indicator has also moved above the 100 level. There is a likelihood that the price will resume the downward momentum later today. If it does, it will test the important support of 50.

EUR/USD

The EUR/USD pair remained closer to Friday lows as traders waited for the Brexit vote in parliament. The pair is now trading at 1.14900, which is along the 42-day and 21-day EMA. The Relative Vigor Index (RVI) has moved below the neutral level while the Accumulation/Distribution indicator has flattened. The pair will likely head lower if Theresa May loses the Brexit vote today.

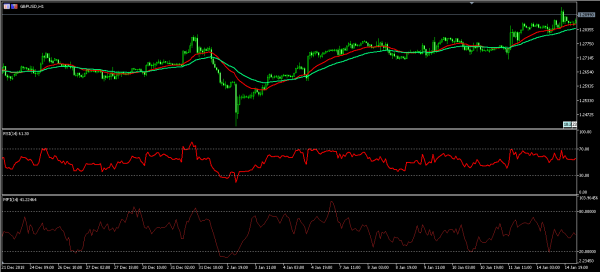

GBP/USD

The GBP/USD remained closer to the 7-week high as traders waited for a decision on Brexit. The pair is now trading at 1.2896 level, which is closer to the weekly high of 1.2928. On the hourly chart, the pair’s price is above the short and medium-term moving averages while the RSI remains flat along the 61 level. The Money Flow index, which is similar to the RSI is also flat along the 41 level. Today, the price could move in either way depending on how the vote goes.