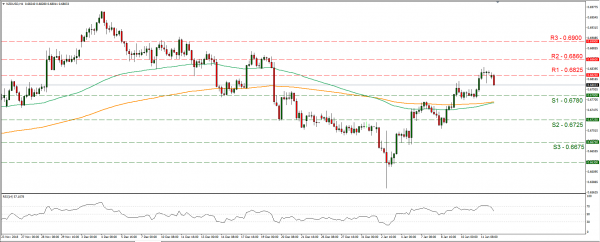

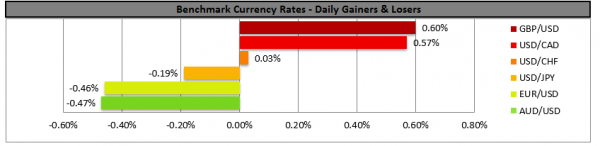

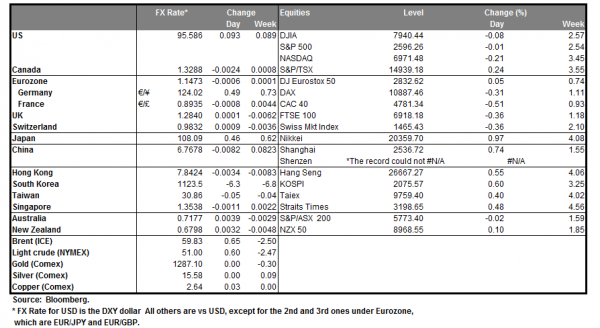

The Kiwi and the Aussie weakened during the Asian session today as the Chinese Trade data were released. Despite the data showing a widened trading surplus reaching 57 billion USD (vs. 51.5B expected), the import and export growth rates showed a substantial contraction. Both the Kiwi and the Aussies weakened as concerns about a possible sharp Chinese economic slowdown increased. The data was in contrast to the market sentiment which was boosted by the improving US-Sino relationships and the stimulus provided by Chinese authorities. Analysts point out though that the market may be overestimating China’s economic slowdown. NZD/USD dropped during the Asian session today, breaking clearly the 0.6825 (R1) support line (now turned to resistance). We could see the Kiwi staying on a bearish mood currently, as the Chinese trade data show a significant contraction of the import rate. Should the pair remain under the market’s selling interest, we could see it breaking the 0.6780 (S1) support line and aim for the 0.6725 (S2) support barrier. Should the market favor the pair’s long positions, we could see the pair breaking the 0.6825 (R1) resistance line and aim for the 0.6860 (R2) resistance hurdle.

Possible Brexit delay lifts pound, however outlook seems bearish

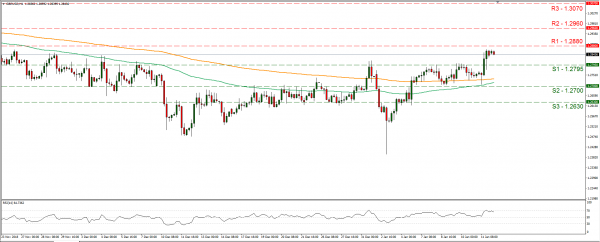

The GBP was lifted against the USD on Friday on growing market expectations that Brexit could be delayed beyond 29th of March. Theresa May still has to face a UK parliament vote on Tuesday though about Brexit and most analysts point out that she may lose the vote. The UK Prime Minister has warned that Parliament will kill Brexit by voting down her plan, while blocking Brexit could be a disaster for British democracy. Should the UK government lose the vote in the UK parliament on Tuesday, the opposition Labour party has vowed to proceed with a confidence vote. Analysts also point out that the increased UK political uncertainty, has widened the range of possible prices for cable as either case is possible and no forecast about the final Brexit outcome can currently be reliable. We maintain a bearish outlook for the pound, as Brexit uncertainty continues to dominate its direction. Cable got a lift on Friday breaking the 1.2795 (S1) resistance line, now turned to support and stabilised later on. Never the less we maintain a bearish outlook for the pair as Brexit uncertainty continues to pressure the pound. Should the pair find fresh buying orders along its path, we could see the pair breaking the 1.2880 (R1) resistance line and aim for the 1.2960 (R2) resistance level. Should on the other hand the pair’s direction be dictated by the bears, we could see it breaking the 1.2795 (S1) support line and aim for the 1.2700 (S2) support area.

In today’s other economic highlights:

In today’s European session, we get Sweden’s CPI rates for December and later on Eurozone’s industrial production growth rate for November.

As for the week ahead:

On Tuesday, we get France’s final CPI (EU Norm.) rate for December, Germany’s annual GDP for 2018 and from the US the New York Fed Mfg index for January. On Wednesday, we get Japan’s Corporate Goods Prices for December and machinery orders growth rate for November, Germany’s final HICP rate for December, Turkey’s CBRT interest rate decision, and UK’s headline and core inflation rate and the PPI Input rate, all for December. Form theUS we get the retail sales growth rate for December. On Thursday, we get Eurozone’s final HICP rate for December and from the US the Philly Fed Index for January. On Friday, we get Japan’s inflation rates for December, UK’s retail sales growth rates for December, Canada’s inflation rates for December and from the US the industrial production growth rate for December and the preliminary U. Michigan Sentiment Index for January.

GBP/USD H4

Support: 1.2795 (S1), 1.2700 (S2), 1.2630 (S3)

Resistance: 1.2880 (R1), 1.2960 (R2), 1.3070 (R3)

NZD/USD H4

Support: 0.6780 (S1), 0.6725 (S2), 0.6675 (S3)

Resistance: 0.6825 (R1), 0.6860 (R2), 0.6900 (R3)