- Sterling spikes higher, looks to parliamentary vote on Brexit deal tomorrow

- Risk aversion returns after Chinese trade data disappoint

- Euro inches lower as ECB officials strike a more concerned tone

Pound outperforms on reports of Article 50 delay

The British pound advanced against all its major peers on Friday, after UK media reported that the government is considering delaying the official deadline for exiting the EU on March 29, if it loses the crucial Brexit-deal vote in Parliament tomorrow. Although the Prime Minister’s office denied this, the market reaction suggests that investors nevertheless consider it a very real possibility, particularly given the lack of any other pragmatic options.

In truth, with Parliament increasingly taking control over the Brexit process lately, and most lawmakers being intent on avoiding a no-deal exit at all costs, the biggest tail risk for the pound seems to be abating. Meanwhile, the probability for other sterling-positive scenarios – such as a revised version of May’s deal eventually passing or even a second referendum– has likely risen. Yet, the pound has not really reacted to this shift in the big picture yet, most likely due to the short-term downside risks that are currently at play. Hence, while sterling may drop tomorrow in case PM May loses the vote, any downside may be relatively limited and perhaps viewed as a renewed buying opportunity by some investors – though a lot may depend on the margin of the defeat as well.

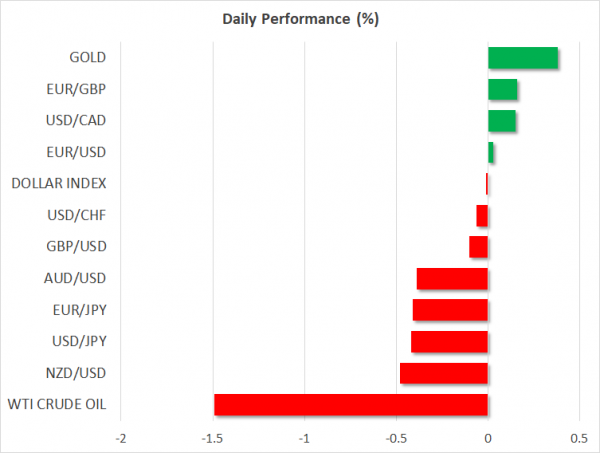

Aussie and kiwi weighed down by poor Chinese trade data

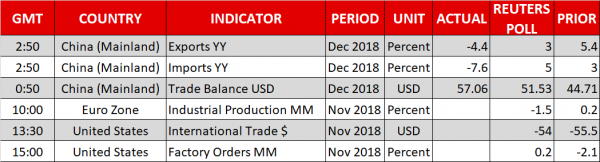

Fears that the Chinese economy is slowing resurfaced overnight, after the nation released a batch of particularly disappointing trade data for December. Both exports and imports fell from a year earlier, missing forecasts for a yearly rise, and providing the latest piece of evidence that the trade dispute with the US is “starting to bite”.

The news sent the China-sensitive aussie and kiwi lower, as markets likely priced in a dimmer outlook for exports from Australia and New Zealand to China. Beyond the antipodeans, futures tracking the major US equity indices – like the S&P 500 – are pointing to a lower open today, while the defensive Japanese yen is outperforming. Indeed, these trade figures could cause Trump to be even more hawkish in his demands, as he may view them as a sign China is suffering more than the US. Yet, it remains more likely than not that a deal will eventually be struck, given that Trump wants to support markets and score a “victory” before the 2020 election, while Xi seeks to stabilize Chinese growth.

ECB officials appear worried – prelude of next week’s meeting?

The euro was among the worst performers on Friday, and the dollar capitalized on that weakness. Although the catalysts for this drop in euro/dollar weren’t clear, the move coincided with a dovish shift in tone by ECB officials. Specifically, Governing Council members Nowotny and Makúch both seemed worried in their latest comments, highlighting the recent slowdown in growth, most notably in Germany.

To put things into context, the central bank will meet next week and the question is whether it will downgrade its assessment of growth risks to “tilted to the downside”, from “roughly balanced” now – something it hinted at the previous meeting. Given that the bloc’s data pulse has weakened further since then, and combining that with cautious-sounding comments from typically hawkish officials like Nowotny, it looks increasingly likely such a downgrade may indeed take place.

Today, the bloc’s industrial production figures for November are due out, though this is usually not a major marker mover.