Sterling rose in early trading as investors looked ahead to the important vote in the House of Commons tomorrow. Parliamentarians will make a decision on whether they approve or disapprove the Brexit plan proposed by Theresa May. The consensus among investors is that members will reject the plan. In a speech today, Theresa May will spell out the dangers of going against her strategy. EU’s Jean-Claude Juncker will also try to save the deal struck with May by reassuring members of parliament about the contentious backstop issue.

In the United States, the government shutdown continued over the weekend making it the longest shutdown in history. With no end in sight, investors are starting to worry about its impact on the economy. Just last week, Fitch released a statement saying that it was likely to downgrade US AAA bonds if the shutdown continues.

Asian markets declined in early trading as investors looked forward to earnings from the United States. The same sharp decline was experienced in the US and European futures. In the United States, the Dow futures declined by more than 200 points. In Europe, the DAX and Stoxx futures declined by 80 and 25 points respectively. Today, the earnings season will start with earnings from Citi, Bank of America, JP Morgan, and Well Fargo. In the past year, these banks have been laggards, losing more than $200 billion in value.

EUR/USD

The EUR/USD pair declined sharply in late Friday trading. Today, the pair remained closer to these lows as traders looked ahead to a speech by Jerome Powell later today. It is now trading at 1.1470. On the four-hour chart, the pair’s price is below the 21-day and 42-day EMA while the Average True Range (ATR) moved lower. The RSI too has continued to move lower but is still above the oversold level. Therefore, the pair could continue moving lower today.

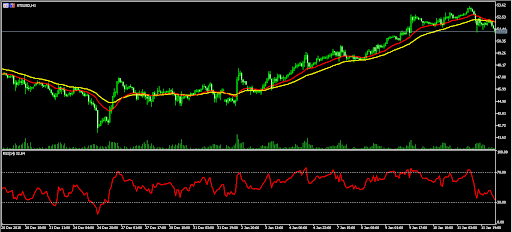

XTI/USD

After last week’s gains, the price of crude oil declined as investors started to worry about the magnitude of the supply cuts announced by OPEC. The price of US crude dipped from last week’s high of $53.59 to a low of $51.21. On the hourly chart, the price is below the 21-day and 42-day EMA while the RSI has continued to decline to 33, which is near the oversold level. While the price could decline further, there is a likelihood that this decline is just a correction that will take the price higher.

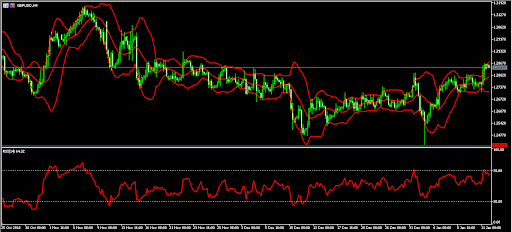

GBP/USD

The GBP/USD pair remained at higher levels today as traders looked ahead to the Brexit vote, which is scheduled for tomorrow. It is now trading at 1.2840, which is close to the highest level since November last year. This price is along the upper band of the Bollinger Bands while the RSI has continued to move closer to the overbought level. At this point, and with the kind of volatility that is expected, traders will likely wait and see before they make the next moves.