- Dollar briefly inches up after Powell; US CPI data today will be crucial

- Swiss franc drops, with SNB likely behind the move

- US-China trade optimism boosts aussie and kiwi

- Brexit uncertainty lingers ahead of next week’s Parliamentary vote

Powell helps dollar to rebound briefly, but mind the upcoming inflation data

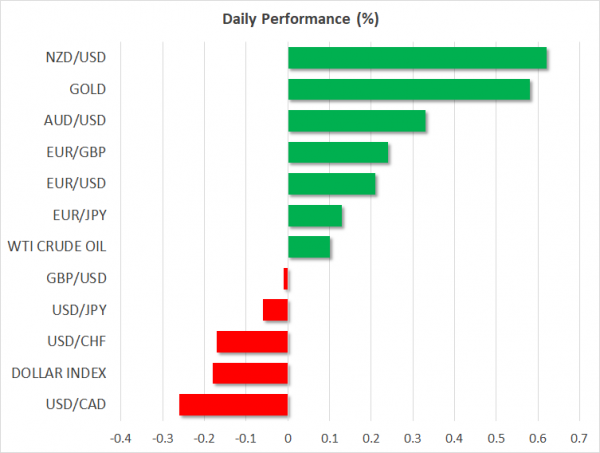

Fed Chair Powell mostly “stuck to the script” yesterday, reiterating the recent shift in the Fed’s reaction function. He said his central bank can afford to be patient with further policy adjustments given the muted inflationary backdrop. Yet, he also noted the Fed still intends to “substantially” shrink its balance sheet, to an extent keeping more policy tightening on the table. That seemingly caught some investors off guard, boosting the dollar a little. However, Vice Chair Clarida was more dovish, indicating the Fed doesn’t have to wait for the economy to slow before responding, dragging the greenback back down early on Thursday.

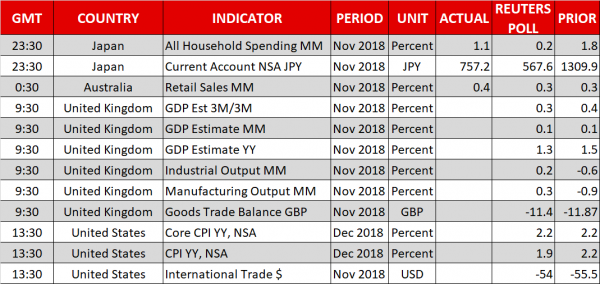

Today, all eyes will turn to the US CPI data for December; remember that as long as the partial government shutdown continues the core PCE data won’t be released, so the CPIs are the only inflation data “in town” for now. Forecasts point to a drop in the headline CPI rate in yearly terms, something likely owed to falling energy prices, as the core rate is expected unchanged at 2.2%. As for the dollar, given the Fed’s dovish shift, it may stand to lose more from a disappointing CPI data set than it stands to gain from a robust report; the bar for markets to re-price in rate hikes is probably quite high at this point.

Swiss franc crumbles: SNB to blame?

A major mover yesterday was the Swiss franc, which fell sharply, in the absence of any major catalyst. Yes, risk sentiment was for the most part in positive territory throughout the day, with the defensive yen pulling back and US stock markets managing to post some gains, but the magnitude of those moves was nowhere near the one in the franc.

Hence, this sell-off seems to have the SNB’s fingerprints all over it, with the Bank potentially intervening to weaken the safe-haven currency, which had been appreciating overall in this fragile risk environment as of late. Overall, this serves as a reminder that although less frequently, the SNB still probably meddles in the market, and will fight off any sustained franc strength if risk aversion continues to push it higher.

Mnuchin stokes trade optimism, but stocks don’t buy it

US Treasury Secretary Mnuchin was on the wires overnight, stating that China’s Vice Premier Liu He will visit the US for trade talks later this month, fueling hopes that a deal may be inching closer – or at least that progress is being made. The headlines propelled higher trade-sensitive currencies such as the kiwi and the aussie, though interestingly enough, futures tracking the major US stock indices are pointing to a marginally lower open today.

Brexit uncertainties rumble on

In the UK, the dominant theme is the Parliamentary vote on PM May’s Brexit deal, scheduled for Tuesday. The consensus remains that May will lose the vote, perhaps by a wide margin. A heavy defeat for the government could even see the opposition Labour party attempt to trigger early elections. The political landscape is thus unlikely to clear anytime soon.

Note though, that lots of “doom and gloom” is probably priced into sterling already. Hence, any development that suggests May could ultimately push her deal through (for instance a very narrow loss in Parliament), or that makes a second EU referendum more likely, could be met with an explosive rebound in the UK currency. Today, UK GDP data for November are due out, but with Brexit at such a crucial stage, economics may continue playing second fiddle to politics.