- Dollar falls sharply after Fed signals it will be ‘patient’; a slew of key speakers will be in focus today

- Euro advances, and attention now turns to the ECB minutes at 1230 GMT

- BoC stands pat, keeping further gradual hikes on the table

- China stokes trade optimism, but US stock futures flashing red

Dollar capitulates on Fed speak, extends losses after FOMC minutes

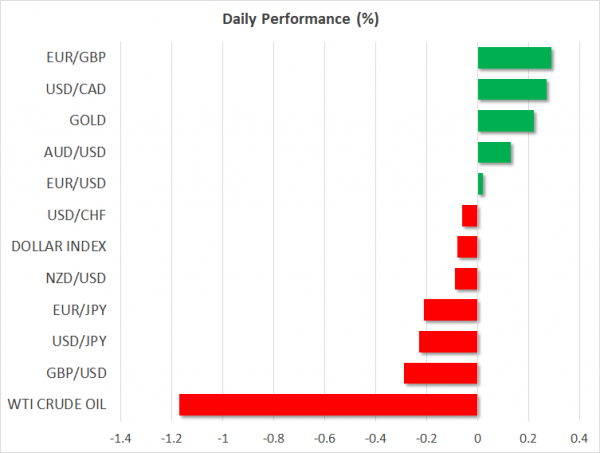

The main mover in FX markets yesterday was the US dollar, which fell significantly and across the board even before the latest FOMC minutes were released. The greenback started to slide after regional Fed Presidents Evans and Bostic struck a cautious tone, hinting the Fed should probably wait a while for fresh data before making any more moves. Then a few hours later, the minutes from the latest FOMC meeting confirmed exactly that, indicating that ‘many’ officials felt the Committee could be ‘patient’ about further tightening.

The overarching message was – as Powell hinted last week – that the Fed is listening to market concerns and won’t rush into any further hikes unless, and until, incoming data warrant as much. The result was a further pricing out of the already-scarce market rate expectations for 2019, which hurt the dollar but propelled US stock indices higher. Overall, the dollar’s sources of support seem to be diminishing following this shift in the Fed’s reaction function, so it wouldn’t be surprising to see the currency remain on the back foot for now, particularly in case trade tensions subside further.

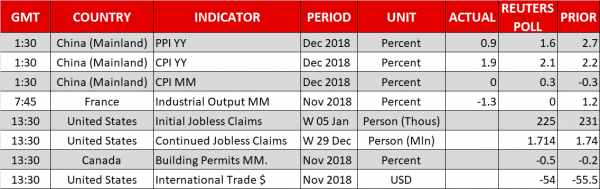

Today, there’s a slew of Fed speakers on the agenda, including Chair Powell (1745 GMT), Vice Chair Clarida (2350 GMT), and regional Fed Presidents Barkin (1335 GMT), Bullard (1730 GMT), Evans (1800 GMT), and Kashkari (1820 GMT).

Euro capitalizes on dollar weakness, looks to ECB minutes

The key beneficiary of the greenback’s softness was the single currency, with euro/dollar touching a three-month high. Today, all eyes will turn to the minutes from the ECB’s December meeting, due at 1230 GMT. Markets will look at whether policymakers are even more worried about growth than President Draghi let on at that gathering, and whether the next meeting could see another dovish shift in language. Especially since the bloc’s economic data pulse has weakened further since.

While such signals may work against the euro, note that the currency has remained resilient in the face of bad news recently, so any downside may be limited. Namely, with markets pricing out all future Fed tightening but ECB rate pricing remaining stable, yield differentials between US and Eurozone are narrowing in Europe’s favor, effectively keeping a ‘floor’ under euro/dollar – evident by the pair’s higher lows lately.

Loonie undecided as BoC seems less dovish than expected

The BoC remained on hold yesterday as expected, and appeared somewhat less cautious than many had anticipated, by sticking to its guidance that further hikes will probably be needed over time. Although the Bank appeared quite cautious on many subjects, the mere fact it didn’t signal a clear intention to pause hikes stood out. Dollar/loonie fell in the aftermath, though that may have also reflected broad dollar weakness, as the Canadian currency lost ground versus the euro for example, even in a session where oil prices soared after Saudi Arabia hinted at more production cuts.

China say trade talks went well, but stock futures dive

The US-China trade talks lasted one day longer because both sides were serious about making progress, China’s Commerce Ministry said earlier today, amplifying hopes that these negotiations may ultimately bear fruit. Despite this optimism, Asian equity markets were mixed while futures tracking the major US indices are pointing to a much lower open today.

The catalysts behind this shift may have been reports that the two sides are still ‘far’ apart on Chinese subsidies to state firms, as well as news that President Trump may cancel his trip to Davos this month, where he was anticipated to meet Chinese officials. Dissapointing Chinese PPI data overnight may have also contributed, as slowing producer prices may be a signal factory demand for raw materials is cooling, feeding the narrative that global growth is losing momentum.