US stocks had another day of gains as investors continued to wait on details of the ongoing China-US negotiations. The first round of the talks ended yesterday but no major details were shared. The Dow and the S&P gained by 90 and 50 points respectively. These gains spread to Asia where the Shanghai Composite Index and Hang Seng increased by 5 and 100 points respectively. The rally also extended to the crude oil market, which continued the rally started early this year.

The US dollar fell against major peers after dovish Fed statements. Officials said that they could now afford to be patient with the market before making any interest rate decisions. The statement said:

Many participants expressed the view that, especially in the environment of muted inflation pressures, the FOMC could afford to be patient about further policy firming.

The minutes also said that the Fed would change its policies swiftly if conditions warranted. In December, officials rose interest rates by 25 basis points and guided for two more rate hikes this year.

The Canadian dollar was little moved against the USD after the Bank of Canada made the first interest rates decision this year. The bank left interest rates unchanged and lowered expectations for a rate hike this year. The decision will likely bring some relief to Canadians who have been worried about higher interest rates. This was the second month in a row that the bank has not made a rate hike.

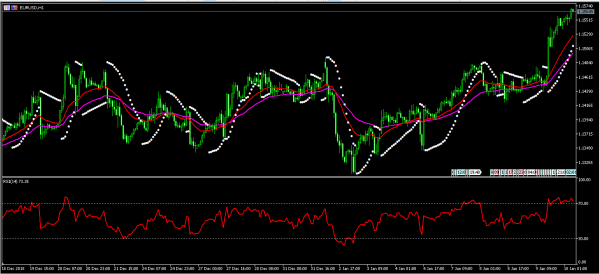

EUR/USD

The EUR/USD pair jumped sharply in overnight trading, reaching a high of 1.1570. This is a major milestone for a pair that started the year at the 1.1300 level. On the hourly chart, the pair’s price is above the 42-day and 21-day EMA while the RSI has remained in the overbought level of 70. The Parabolic SAR shows that the pair could continue moving up. If it does, the next important level to watch will be 1.1600.

USD/CAD

The USD/CAD pair was little moved after two dovish statements by the Fed and the BOC. The pair remains near the multi-month low of 1.3180. On the hourly chart, the pair’s current price is along the shorter-term 21-day EMA and lower than the longer-term EMA of 42. The RSI has moved from the oversold level to the current 48 while the Accumulation/Distribution indicator remains at significant lows. There is a likelihood that the pair will continue moving up. If it does, the important level to is the 23.6% Fibonacci Retracement level of 1.3310.

USD/CHF

The USD/CHF pair continued the downward momentum after the dovish statement by the Fed. The pair also reacted to the sharp loss announced by the Swiss National Bank. On the four-hour chart, the pair’s current price of 0.9720 is lower than the short and longer-term moving averages. The RSI and the stochastics indicators are in the oversold category. The pair could continue to decline and if it does, it will test the 0.9600 support level.