Monday January 7: Five things the markets are talking about

In Asia overnight, investors’ appetite for risk was boosted by ‘dovish’ comments from the Fed, positive U.S jobs data and China’s monetary policy easing on Friday.

However, market enthusiasm has waned a tad in the handover to the European session as U.S stock futures pared some of the overnight gains as dealers await word of progress from trade negotiations that begin today between the U.S and China in Beijing.

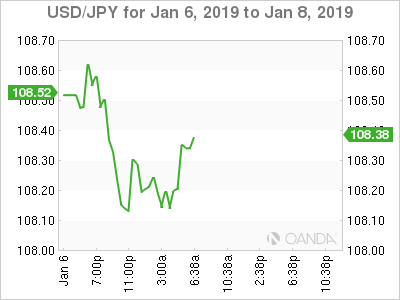

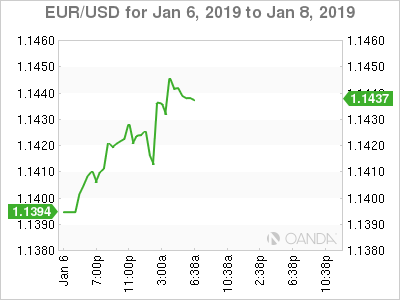

The improved appetite for risk has pushed the U.S dollar to two-month lows against G7 pairs, while sterling has eased against the euro as U.K lawmakers seek to avoid a no-deal Brexit. Elsewhere, U.S treasuries edged up a tad after Friday fall that backed up 10’s to to +2.67%.

Note: U.S 10-year yields remain more than -50 bps lower than where they peaked in mid November.

Some events that the market will be focusing on this week will include the two-day trade meeting in Beijing between the U.S and China beginning today.

On Wednesday, the market will see the release of minutes from the Fed’s Dec. 18-19 policy meeting (02:00 pm EDT) and the Bank of Canada (BoC) monetary policy announcement (10:00 am EDT). Fed Chair Powell will speak to the Economic Club of Washington D.C. on Thursday.

In the U.K, Parliament resumes a debate on the Brexit withdrawal bill, with PM Theresa May seeking to avoid defeat in a vote set for sometime next week (rumoured to be Jan 15).

1. Friday’s U.S stock rally supports global bourses

Shares in the Asia-Pacific region started the week with large gains, after U.S. stocks surged in the previous session on fresh signs of economic strength, coupled with Fed Powell’s comments that officials are “listening carefully” to financial markets.

In Japan, the Nikkei 225 led the rally. The benchmark closed +2.4% higher, more than offsetting a -2.3% slide from Friday. Equities were helped by a calmer yen, which trades steady atop of ¥108.20 after sharply appreciating last week. The broader Topix was +2.8% higher.

Down-under, Australia’s S&P/ASX 200 benchmark rallied +1.1% to a five-week high, supported by mining companies and energy stocks, as oil prices continued to rebound. In S. Korea, the Kospi climbed +1.3%, with heavyweight Samsung Electronics Co. gaining +3.5%.

In China and Hong Kong, equities ended higher overnight after the People’s Bank of China (PBoC) moved to support economic growth with a broad cut in the amount of cash banks must hold as reserves. However, gains have been capped by domestic economic uncertainty. At the close, the Shanghai Composite index was up +0.72%, while the blue-chip CSI300 index was up +0.61%.

In Hong Kong, at the close of trade, the Hang Seng index was up +0.82%, while the Hang Seng China Enterprises index rose +0.94%.

In Europe, shares edged lower, tracking lower U.S futures following a strong session in Asia.

U.S stocks are set to open small in the ‘red’ (-0.5%).

Indices: Stoxx600 -0.31% at 342.32, FTSE -0.43% at 6,808.25, DAX -0.26% at 10,739.49, CAC-40 -0.42% at 4,717.34, IBEX-35 -0.10% 8,725.00, FTSE MIB +0.19% at 18,867.50, SMI -0.74% at 8,548.60, S&P 500 Futures -0.05%

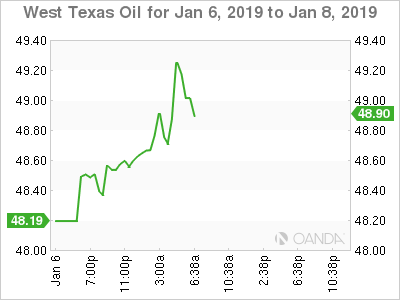

2. Oil prices rally on Sino-U.S trade hopes, supply cuts, gold higher

Oil prices have rallied overnight on hopes that talks in Beijing can resolve a trade war between the U.S and China, while supply cuts by OPEC+ is also supporting crude. However, expect gains to be capped by U.S supply numbers.

Brent crude futures are at +$58.04 per barrel, up +98c, or +1.7%, from Friday’s close. U.S West Texas Intermediate (WTI) crude oil futures are at +$48.85 per barrel, up +89c, or +1.9%.

This relief rally is being supported by market expectations that Sino-U.S trade talks, beginning today in Beijing, would lead to an easing in tensions between the world’s two largest economies.

Despite the markets fears of a pending economic slowdown beginning this year, crude prices are also being supported by supply cuts started late last year by OPEC+.

OPEC oil supply fell last month by -460K bpd, to +32.68M bpd, led by cuts from top exporter Saudi Arabia.

Note: The cuts are aimed at reining in swelling supply, especially in the U.S.

Because of record U.S crude oil production, EIA of +11.7M bpd, U.S fuel stockpiles are rising. Data last week by the EIA showed that oil inventories rose by +7K barrels in the week that ended on Dec. 28, to +441.42M barrels, more than +5M barrels above their five-year average.

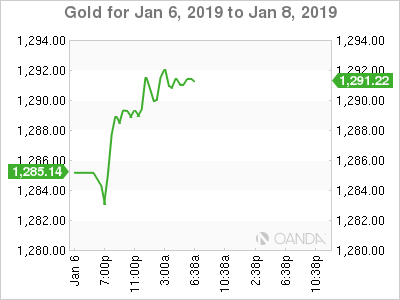

Ahead of the U.S open, gold is rallying this morning, helped by a weaker U.S dollar on expectations that the Fed may ‘apply the brakes’ on further rate hikes, although an improved investor risk appetite should limit gains for the safe haven metal. Spot gold is up about +0.4% at +$1,290.42 per ounce, while U.S gold futures have gained +0.5% to +$1,291.90 per ounce.

3. Sovereign bonds steady as worst fears about growth ease

Sovereign bond yields have fallen sharply since the beginning of December 2018 on concerns about the outlook for the global economy.

However, bond yields in Europe and the U.S found support last Friday, jumping higher as U.S data showed stronger-than-expected jobs growth in December and Fed chief Powell said the U.S central bank “will be patient and sensitive to market risks.”

The yield on U.S 10-year Treasuries fell -1 bps to +2.65%. In Germany, the 10-year Bund yield decreased less than -1 bps to +0.21%, while in the U.K, the 10-year Gilt yield dipped -1 bps to +1.262%.

Note: Euro-fixed income dealers will be shifting their focus to this week’s heavy government bond supply – Netherlands, Austria, Germany, France and Italy are all expected to sell bonds – Dealers will be expected to back up their curves to take down supply.

On Wednesday (10:00 am EDT), the Bank of Canada (BoC) announces its monetary-policy decision. The market widely expects the central bank to keep its benchmark interest rate at +1.75%.

4. Dollar trades on the soft side

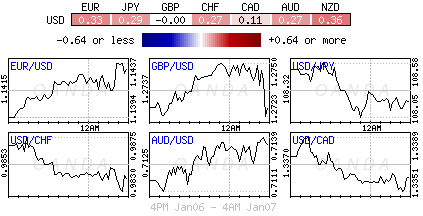

The ‘mighty’ USD remains on soft footing for a third consecutive session after Fed Chair Powell signalled last week a change in the policy reaction function of the Fed to being more “nimble and flexible.” Fixed income dealers were beginning to price in no rate hikes for 2019, in contrast to the feds dot-plot plan of two rate hikes announced in late Q4. Also cramping the U.S dollars style is the resumption of U.S/China trade talks, which are helping to shed of some the dollars safe-haven appeal.

EUR/USD (€1.1441) is higher by almost +0.4% as the pair approaches the mid-€1.14 region. Analysts believe a move above €1.15 handle could trigger some strong stop-loss buying, which would definitely cause some technical damage to the greenbacks bull-run.

GBP/USD (£1.2736) is a tad lower as investors turn their attention to the UK Parliament, which has returned from the Christmas recess. The highly anticipated vote appears to be set for next Tuesday Jan 15. The market will be looking for clarity whether PM May’s Brexit deal would pass to avoid a potential hard-Brexit for Britain. Sterling’s direction is likely to remain unclear while implied sterling volatility stays elevated.

5. German factory orders fall

Data this morning showed that German manufacturing orders posted an unexpectedly sharp drop in November amid weak demand from other eurozone countries.

New German factory orders fell -1% in November compared with the previous month in adjusted terms, coming in below the -0.4% decline expected by the street.

Digging deeper, the decline was driven by weak foreign orders, which fell -3.2% on month in contrast to domestic orders, which increased by +2.4%.

New orders from the euro area were down -11.6%, while new orders from other countries increased +2.3% compared with October’s data, 2018.