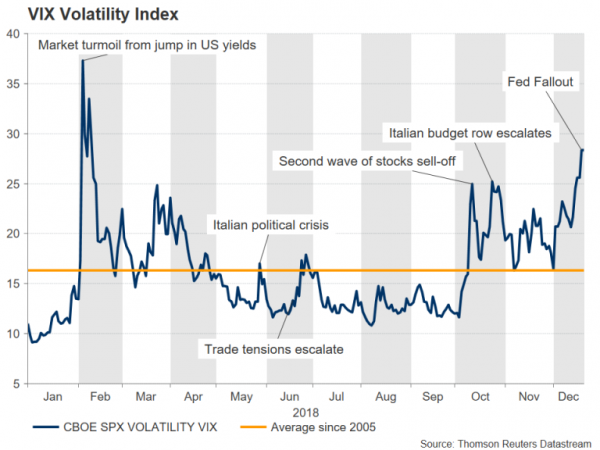

As the holiday period begins, markets will go into quiet mode for the next two weeks with little on the economic agenda to keep traders at their desks. However, with the market sentiment being stuck in risk-off mood, there is a threat that thin trading conditions could lead to some unexpected volatility, particularly from any headlines that would fuel concerns of a major global economic downturn in 2019.

Japanese data to dominate

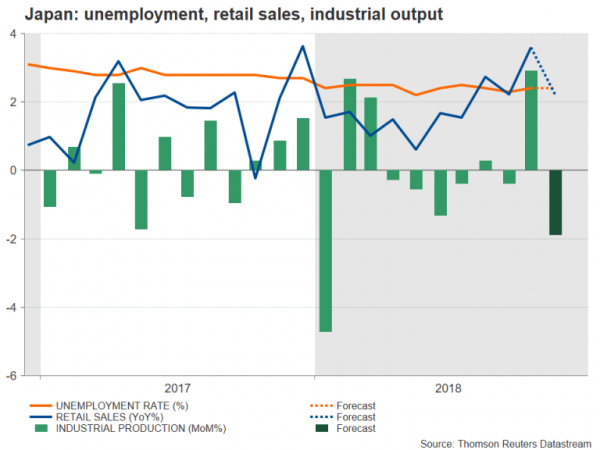

The Japanese market will be the busiest next week with a number of key indicators due for release on Friday. Tokyo inflation figures for December, which are seen as forward looking for the nationwide measure, will be published first, to be shortly followed by data on the labour market, industrial output and retail sales.

Industrial output posted a surprise 2.9% increase in October following the third quarter contraction in GDP. Expectations aren’t high, however, for November, with forecasters predicting a month-on-month drop of 1.9% in the preliminary print. Retail sales had also risen by more than expected in October, but they’re not anticipated to have held up in November either as the annual growth is forecast to slow from 3.5% to 2.2%. The unemployment rate, meanwhile, which had inched slightly higher to 2.4% in October, is expected to stay unchanged at that level, though this is still close to the recent lows last seen in the early 1990s.

A strong set of figures could magnify the yen’s appreciation should investors continue to fret about the deteriorating outlook for the world economy and maintain their expectations that the Fed won’t be able to match its predicted number of rate hikes in 2019.

Apart from the data, the Bank of Japan will be attracting some attention too as it releases the minutes of its October policy meeting (Wednesday) and the Summary of Opinions of the December meeting (Friday). Given that the BoJ stood pat in both meetings and Governor Kuroda’s frequent press briefings, there’s unlikely to be any new revelations in the published views of board members. However, traders will still be looking out for any emphasis on the rising negative risks to the economy.

Second-tier US data unlikely to be dollar’s saviour

A not-so-dovish Fed hasn’t really done the US dollar any favours following this week’s FOMC meeting, as markets continue to focus on the worst-case scenario that a deep economic slowdown in the US and the rest of the world in 2019 will tie the Fed’s hands in raising interest rates further. Dollar bulls will probably struggle to find many catalysts from next week’s releases despite a relatively busy calendar.

In fact, the risks to the greenback from the data are to the downside. The housing market will move to the fore again next week as the S&P CoreLogic Case-Shiller 20-city home price index is due on Wednesday, followed by new home sales on Thursday and pending home sales on Friday. America’s housing industry has been showing some signs of weakness lately as higher borrowing costs have started to dampen demand. The housing sector is usually the first to feel the bite from tighter monetary policy and so any further weakness from next week’s figures would only reinforce the view that Fed policy is too aggressive.

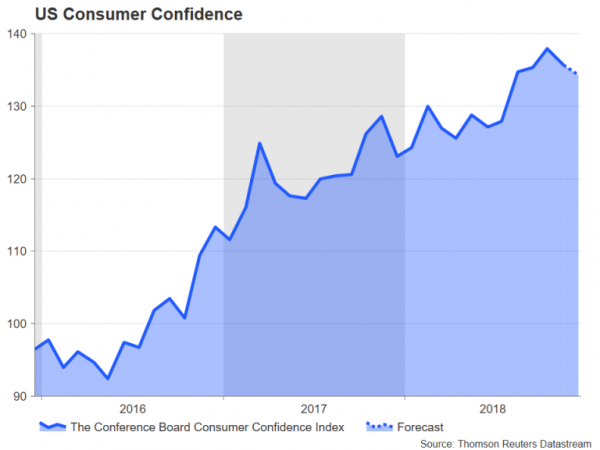

The other highlight next week will be the Conference Board’s consumer confidence index on Thursday. The closely-watched gauge is projected to fall to 134.3 in December from 135.7 in the prior month. Also of interest will be the Chicago PMI for December on Friday.

2018 to end with market tantrum?

With economic data not likely to excite nor support the market in the remaining days of the year, there is a real risk the gloomy sentiment could turn into a deeper market panic. With equity markets being in such a fragile state and amid an expected thin liquidity over the Christmas and New Year period, any negative headlines could trigger an even sharper sell-off in stocks. Investors had to contend with an array of worrying developments in recent months, namely, Brexit, the Italian budget row, trade tensions, a slowdown in China, and the absence of enough reassuring words from Fed Chair Jerome Powell, which have all led to markets throwing a tantrum.

In the currency world, the greenback is likely to be the biggest victim from extended losses in stocks, as observed this week, while the safe-haven yen stands to gain the most from further turbulence along with gold.