A Lull in the action

There was a slight improvement in market sentiment heading into week’s end but likely driven by weekend position trimming, Brazil turbulence abating and market fatigue setting in.Indeed pressure on risk assets has lessened, but caution persists.

Last week’s sharp spike in market demand for volatility suggests investors are unlikely to reload risk assets anytime soon and would be more disposed to await some clarity on the US political landscape.Given the market was positioned for a low volatility long carry trade summer, Wednesday moves were likely amplified as positions unwound from the most crowded and up until that time, the most profitable low volatility carry trade positions.

Political noise is very tough to trade and to cut through the constant babble and headline risk even more so. While we’re likely to face additional challenging conditions and the madness can start up just as suddenly as it stopped, but on balance, I maintain a guardedly positive long-term outlook for US markets, as I expect a favourable response to US policy changes that are on the horizon. But the timing of these policies amongst broader political concerns is likely to persist and will continue to weigh on the dollar near term.

In the meantime, one needs to respect the blanket of political upheaval and investors rotation to non-USD safe havens. At the same time, however, the political noise could be grossly exaggerated.Regardless of the view, given discovery surrounding the political melodrama in the Foggy Dew will be a long drawn out fact finding mission, we could be in for an extended period of uncertainty. And it’s market uncertainty which poses the greatest challenge for both bulls and bears

While political risk will continue to be a factor, as it has been since President Trump took office, Fed Speak could be this week’s number one priority as the market searches for policy clarity especially in the wake of recent market turmoil. So far, Fed members have been shrugging off the market volatility, but this week’s calendar is jammed with 2017 voters, so dealers will be looking for any suggestions, other than staying the course, which could send the greenback topsy-turvy and dollar bulls looking for life buoys to stay afloat. Fed minutes on Wednesday should play second fiddle to the plethora of Fed speak as the minute’s views are dated given last week’s tumult

In addition to Fed Speak, we have the all-important OPEC meeting on May 25. Amidst widespread expectations of an oil supply cut extension. Expect continued moves into petrol currencies like the CAD and MXN, and to a lesser extent, hard commodity plays like the AUD, all of which should l stand to gain over the short term. However, the longevity of these currency moves will greatly depend on OPEC. Unless the oil cartel comes through with deeper supply cuts, in the face of rising US shale production, forward selling pressure will likely intensify even more so with U.S. drillers adding more rigs by the week.

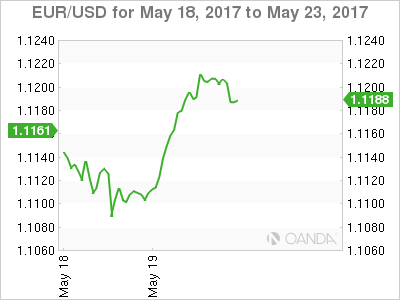

In commodity markets, crude oil soared 2% with Saudi Arabia’s energy minister stating that “We think we have everybody on board” to extend output restrictions out to the end of March next year. Riding on Oil price coattails, Metals also enjoyed a bumper session, with both copper and iron ore both rising close to 2%. However, the Greenback continued to struggle and lost ground against most G10 currencies. Losses were more pronounced against the Euro as the EURUSD march higher has virtually gone unopposed and closed above 1.12 for the first time since October last year.

News flow was light over the weekend, and at the open, FX markets are trading around their Friday New York closing levels as dealers await the next catalyst.

Euro

The ECB rhetoric is starting to gather steam, but the Euro rapid ascent has seen traders cut longs into week’s end despite a one-way street mentality on Thursday and Friday. Overall uncertainty is running high, and dealers will err on the side of caution when it comes to weekend headline risk.

The long term prospect for the Euro remains bright as capital inflows should continue to accelerate while an anticipated shift in ECB rhetoric in June should keep the Euro supported in a market looking for any excuse to sell the greenback.

Japanese Yen

Narrowing of US -JPY bond differentials and investors intent on non-US dollar safe havens should cap USD rallies near term. While the positive momentum in Euro ( EURJPY )trade has underpinned the USDJPY of late, if the greenback remains out of favour, given the escalation of US political risk, and without some hawkish rhetoric from the Feds, we could test 110 before a reversal above 113. Whether it’s US politics, regional geopolitical risk or even Japanese domestic economic data, there are few reasons to sell JPY in this risk unfriendly environment.

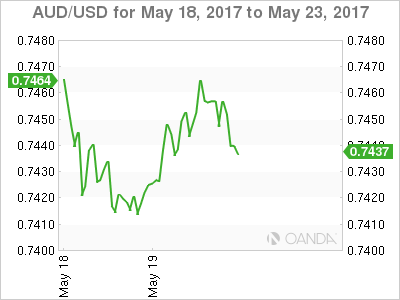

Australian Dollar

There could be tactical buying ahead of the OPEC meeting as the knock on effect of the rising oil prices will likely underpin commodities in general. Whether this ends up little more than 15 minutes of fame type trade will greatly depend on OPEC. Also, the Aussie may get some support from tactical plays as the currency could play catch up to other G-10 moves as more US political concerns could turn into a broader US dollar sell-off.

Friday’s price action was a mix of uncertainty coupled with short covering ahead of weekend headline risk with oil prices surging.Aussie bears have increased gross shorts to the largest level in three months according to the Commitment of Traders reporting week ending May 16, which may have factored into play

All in all, too many questions and not enough answers in the Aussie trade which should keep current ranges in place.

EM Asia

Dealers will pay close attention to both the open and market follow through in Indonesia capital markets after late Friday afternoon exhilaration on local EM desks when S&P lifted Indonesia’s sovereign rating to BBB- (investment grade)from BB+.While the market was expecting this upgrade earlier in the year after a successful tax amnesty boosted the government coffers by $11 billion in revenue, it was a surprise none the less as investors were starting to give up hope. This rating upgrade will open the door to a panacea of investors which should prove to be a long-term boost to the Jakarta Composite Index and could underpin near term movements in the Rupiah

May is typically a weak month for EM risk, and when compounded with the latest political turmoil in the US, investors will likely shy away from of risk exposure, and if anything may continue to reduce expose in the most crowded EM Asia positions.