The core Personal Consumption Expenditure (PCE) price index will be the highlight of the US economic calendar on Friday and the last important release out of the US before the year-end as investors gather evidence that could shape potential tweaks in the Fed’s rate hiking path in the near future. Consensus is for the gauge to have gained some steam in November, but stronger improvement might be needed to guarantee at least one more rate rise next year.

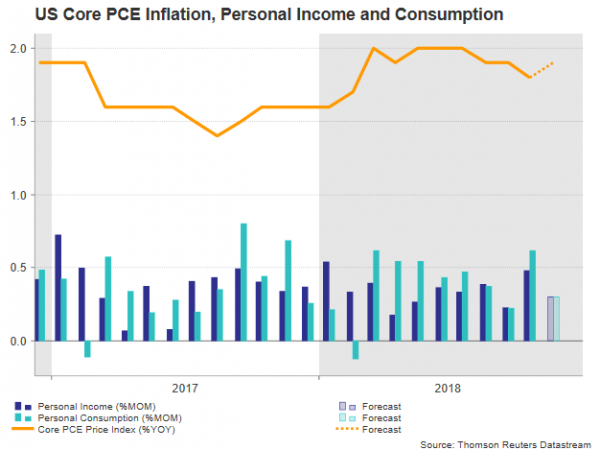

On Friday at 1330 GMT, November’s figure for the core PCE price index is expected to arrive slightly higher at 0.2% month-on-month compared to 0.1% seen in October, pushing the yearly measure up to 1.9% from 1.8% before. Last week, the core CPI figure for the month of November recorded a minor pickup in inflationary pressures as well, increasing optimism that the Fed’s favourite inflation tracker could behave in the same manner to approach the Bank’s 2.0% price target again.

In theory, the tightening US labour market should reflect further growth in prices as firms continue to hire, keeping the unemployment rate at the lowest since 1969 and wage growth at the highest in almost a decade. The Fed’s latest Beige book also noted that businesses in most districts have started to offer better non-wage benefits to attract the best suitable candidates because of worker shortages. Yet estimates on personal consumption and personal income, which will accompany the PCE numbers on Friday are not so encouraging, suggesting instead a softer increase of 0.3% for both indicators versus 0.6% and 0.5% marked respectively in October.

On the other hand, stomach churning losses on Wall Street, the ongoing US-Sino trade turmoil and even the worrying movements between the shorter and longer-term Treasury yields throw cold water on whether the US economy can handle two more rate increases next year as December’s dot plot chart suggests. An economic slowdown in key partners such as China, Japan and Germany, which could weigh on demand for US exports sooner or later, is another reason why the Fed is likely to slow down the pace of rate hikes in 2019.

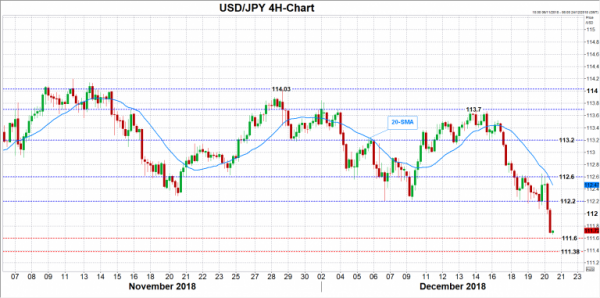

Turning to the impact in FX markets, a disappointing core PCE index could delay the timing of rate increases in 2019, adding more downside to the dollar on Friday. In this case dollar/yen could retest the 111.60-111.38 area which acted as support back in October. A violation of this region would then open the way towards the 110.83-110.37 area before eyes turn to the 109.76 bottom reached on August 21.

Alternatively, better-than-forecast inflation readings could improve chances for further monetary tightening in 2019, pushing dollar/yen probably up to 112.20. Higher, the bulls may stall somewhere between 112.60 and 113.20 before the door opens for the 113.70 resistance. Investors though would likely want to see inflation rising above the 2.0% target to be reassured that the Fed will stay on course.

It is also worth noting that core durable goods orders for the month of November and final GDP growth figures for the third quarter could also affect investors sentiment on Friday. The University of Michigan will be also revising its Consumer Sentiment index for the month of December in the same day.