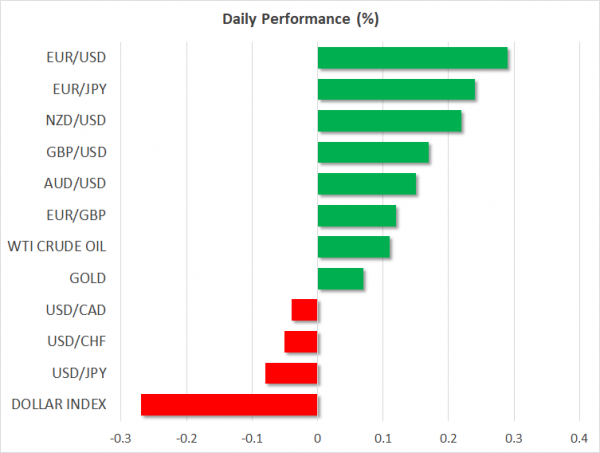

- The spotlight today is on the Fed’s decision; markets seem positioned for an extremely “dovish hike”, which poses an upside risk for the dollar

- The BoJ will also meet, though that gathering may be less exciting

- Meanwhile, oil prices resumed their broader collapse

Fed may strike a less dovish tone than investors anticipate

The main event today will be the Fed’s policy decision at 1900 GMT, which will be followed by a press conference from Chair Powell. A quarter-point rate increase is widely expected and assuming no surprises there, the focus will turn to the accompanying statement, the rate projections for 2019, and Powell’s remarks. Markets seem positioned for a “dovish hike”, where the Fed raises rates but lowers it rate-path projections for next year and strikes a cautious tone.

Market pricing is extremely dovish. Assuming a hike is delivered today, investors assign less than a 30% probability for a single rate increase in the whole of 2019, which is worlds apart from the three hikes the Fed penciled in back in September. More importantly, US economic data remain healthy overall, hardly supporting a pricing this dovish. Therefore, although the Fed may indeed revise down its rate forecasts today, it’s unlikely to go as far as signal the broader pause in rate hikes that market pricing currently implies, consequently generating an upside risk for the dollar.

Specifically, the risks surrounding the dollar may be asymmetric, and skewed to the upside. Given the market’s pessimism, a downward revision in the rate forecasts won’t be much of a surprise and is thus unlikely to generate a major reaction, with any losses staying fairly limited. On the flipside, if the projections are kept unchanged or Powell pushes back against this dovishness, it would be a surprise, and the greenback could therefore soar.

BoJ decision next on the agenda after Fed

With so much focus on the Fed, the BoJ’s own policy meeting – which will conclude during the Asian session on Thursday – has flown largely under the radar. And with good reason, as it seems quite unlikely to prove exciting. The Japanese inflation picture remains subdued and the economy contracted in Q3, both of which argue for no change in the Bank’s massive stimulus program.

As for the yen, it probably won’t respond much if the BoJ simply maintains its policy and tone unchanged; it may instead continue to be driven mainly by shifts in global risk appetite given its safe-haven status. Note though, that if there is going to be any change in the BoJ’s tone, it may be towards a more cautious-sounding narrative.

Oil resumes freefall

After a brief lull in recent weeks, oil prices resumed their broader collapse on Tuesday, with both WTI and Brent breaking decisively below their recent lows. Optimism that OPEC production cuts would be enough to stabilize the market has faded, given the cartel’s inability to deliver a major reduction, and fears of a supply glut have resurfaced. This, at a time when global risk sentiment remains fragile, adding another dimension to the precious liquid’s troubles.

With OPEC having just met, it’s difficult to envision a scenario under which oil prices rebound in the near-term, barring some unforeseen supply outage or a substantial recovery in risk appetite. Attention now turns to the weekly EIA data, due today at 1530 GMT. Market chatter suggests these figures may improve in coming weeks as Saudi Arabia will reduce its exports to the US to prevent a further buildup in stockpiles. Although this is by no means significant from a global perspective, it may be enough to support sentiment in the short-term and gradually help prices stabilize.

UK and Canadian inflation data due

On the data front, the highlights today will be inflation data for November out of the UK and Canada. The UK figures will be scrutinized ahead of the Bank of England’s policy gathering tomorrow, though note that politics are more important than economics for the pound right now.

As for the Canadian prints, even if they surprise to the upside, any rallies in the loonie may remain relatively short-lived in an environment where crude prices remain under pressure.

New Zealand’s GDP data for Q3 are also due.