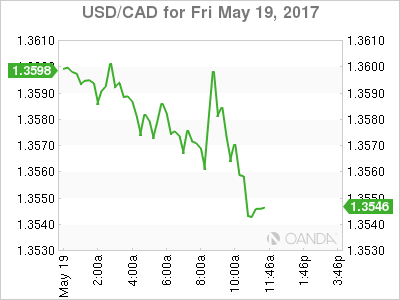

The USD/CAD pair is trading at 1.3569 the lowest level for the USD as the Canadian dollar appreciates on Friday. Higher oil prices have boosted the loonie versus the greenback but mixed economic data released this morning pared some of those gains. Retail sales in April beat expectations with a 0.7 percent gain, but stripping away the more volatile components such as auto sales disappointed with a 0.2 percent contraction when a 0.2 percent gain was anticipated. Inflation missed the target with a 0.4 percent gain as falling food prices offset the rise of gasoline.

The week of May 15 to 19 was on paper a quiet one with few major releases scheduled. Political risk as has been the case since last summer took over as the main driving factor in global markets. The Brazilian president’s troubles joined the US political turmoil and drove safe havens higher as uncertainty in two major economies adding to two elections , one in the United Kingdom and the Parliamentary elections in France coming in June.

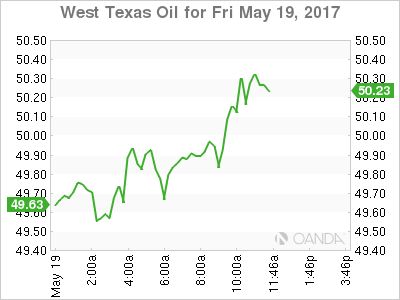

The Canadian dollar is trading at a tree week high as two of the three major factors for the loonie have stabilized. The price of crude has risen after the Organization of the Petroleum Exporting Countries (OPEC) and Russia have announced a commitment to an extension which will probably be announced in full on their May 25 meeting. The USD is lacking momentum as investors struggle to price in the turmoil in Washington that could end with the impeachment of President Trump. Despite the FBI and Russia distractions the Trump administration has carried out the first step in NAFTA renegotiations and has started to brief Congress and the House giving 90 days to being formal talks with Canada and Mexico. The 14 month low of the Canadian dollar came as tariffs and stronger statements about NAFTA were issued earlier in the month.

The USD/CAD lost 0.267 percent in the last 24 hours. The pair is trading at 1.3560. The USD has retreated versus the loonie by 1.077 on a weekly basis as political drama has engulfed the Trump administration and President’s Trump handling of information with Russia. The price of oil is rising after a 1.8 million barrel drawdown in weekly US crude inventories and the continued press releases by OPEC members supporting the extension of the production cut agreement.

The Bank of Canada (BoC) will release its rate statement on Wednesday, May 24 at 10:00 am EDT. The central bank is heavily expected to hold rates unchanged despite growing pressure from a heating up house market in major cities. The financial troubles at alternative lender Home Capital Group was responsible for Moody’s downgrading the six Canadian banks as their risk has grown. Canadian household debt is reaching record levels as historic low rates have fuelled an appetite for credit that has turned the real estate market into a bubble. There has been multiple warnings but its almost a running joke as home owners dismiss the statements from the OECD, World Bank, ratings agencies, the government and the central bank as the boy who cries wolf. The reality is that without higher rates the wolf will certainly not come, but rates will be higher as macro conditions could force the BoC into a raising rates and then it will find Canadian households even deeper in debt.

Oil prices gained 2.81 percent on Friday. The price of West Texas Intermediate is trading at $50.19 closing a week where crude gained 5.4 percent after the Saudi Arabia and Russia press release on the OPEC cut extension and the drawdown in weekly oil inventories in the US. The market will be watching next week’s inventories released on Wednesday at 10:30 am and the OPEC meeting on May 25 where more details about the extension will be announced. The oil market has been caught between the OPEC’s efforts to reduce the glut of oil in the market, but as prices have risen so has the levels of US shale production.

Market events to watch this week:

Tuesday, May 23

- 4:00 am EUR German Ifo Business Climate

- 5:00 am GBP Inflation Report Hearings

Wednesday, May 24

- 8:45am EUR ECB President Draghi Speaks

- 10:00 am CAD BOC Rate Statement

- 10:00 am CAD Overnight Rate

- 10:30 am USD Crude Oil Inventories

- 2:00 pm USD FOMC Meeting Minutes

- 10:00pm NZD Annual Budget Release

Thursday, May 25

- 4:30 am GBP Second Estimate GDP q/q

- All Day ALL OPEC Meetings

- 8:30 am USD Unemployment Claims

Friday, May 26

- 8:30 am USD Core Durable Goods Orders m/m

- 8:30 am USD Prelim GDP q/q

*All times EDT