- US dollar edges up from lows as risk sentiment improves, but expectations that the Fed could soon pause its rate hike cycle limit gains

- US Treasury yields fall sharply on Wall Street Journal report that Fed is considering “wait-and-see” approach

- Pound steady despite May pondering whether to delay Brexit vote

- Oil under pressure again as OPEC struggles to reach output agreement, awaits for Russia to join talks before making decision

Dollar firmer ahead of nonfarm payrolls report

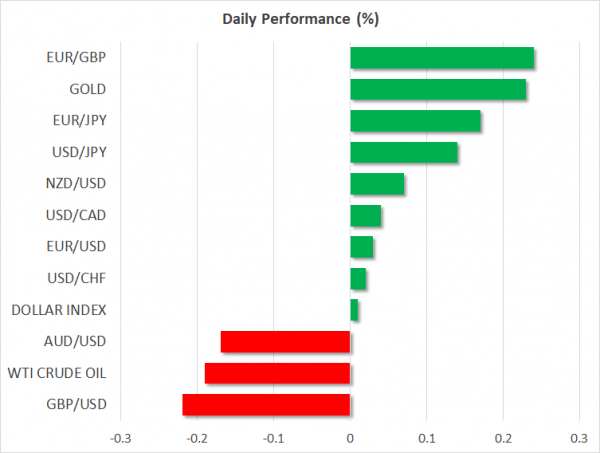

The US dollar managed to bounce off one-month lows versus the yen despite reports from the Wall Street Journal that the Federal Reserve is considering whether it should adopt a “wait-and-see” approach before making further rate hikes. The Fed next meets on December 18-19 and another rate hike is widely priced in by the markets. But emerging expectations that the Fed could pause after December have pulled the yield on US Treasury note sharply lower, leading to a partial inversion in the yield curve.

The yield on 10-year notes touched a 3-month low of 2.826% yesterday, but despite this weighing on the dollar, the US currency’s declines have been relatively modest as trade tensions continue to provide the greenback some safe-haven support. Dollar/yen was last trading at 112.76, while the dollar index was marginally higher at 96.83.

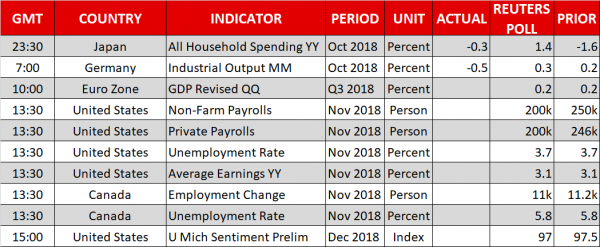

Traders will now be looking to the November jobs report out of the US, due at 1330 GMT, for fresh clues on the health of the US economy. In remarks on Thursday, Fed Chairman Jerome Powell said the US labour market was “very strong”. But any signs of weakness in today’s report could fuel speculation that the Fed is nearing the end of its rate hike cycle.

Stocks make tepid recovery as risk sentiment improves

Asian stocks attempted to recover from the recent sell-off as shares on Wall Street pared earlier sharp losses. Stocks in Europe also opened higher, but markets remain fragile amid doubts about whether the trade truce agreed between the US and China at last weekend’s G20 summit will hold. The arrest of a senior Huawei executive in Canada for extradition to the US risks upsetting relations at a time when the two sides appear to be making some progress in resolving their months-long trade dispute.

Hopes remain though, that the US and China will be able to negotiate some sort of a trade deal after President Trump tweeted overnight that he agreed with Chinese officials’ statement that an agreement can be reached within the next 90 days.

Euro and pound flat, supported by softer dollar

The euro and the pound struggled for direction on Friday as Italy’s coalition government appeared no closer to agreeing how to reduce the country’s deficit for 2019 in a way that would satisfy the European Commission, while in the UK, the prime minister, Theresa May, is reportedly considering postponing the Brexit deal vote on December 11.

May has been warned by her party that she is headed for a landslide defeat if she goes ahead with the vote next Tuesday. Delaying the vote could give her more time to find ways to make the deal more sellable to MPs. But as UK politicians struggle to find common ground, talk of a second referendum has been increasing in recent days.

The euro was last down slightly at $1.1365 and sterling was 0.3% lower at $1.2744.

Oil prices slip as OPEC fails to reach agreement; Russia to join talks

OPEC countries were unable to reach an agreement on cutting output at a meeting in Vienna on Thursday amid opposition from Iran. But OPEC delegates are hoping that a decision can be made once Russia joins the talks later today.

In the meantime, oil prices faced more downside pressure on the lack of progress by major producers to decide on output levels. WTI and Brent both fell by more than 5% at one point yesterday before recouping some of their losses, helped by a much bigger-than-expected drawdown in US crude stocks last week. WTI was last down 0.4% at $51.30 a barrel and is at risk of a further sell-off if OPEC+ countries fail to reach any agreement.

The Canadian dollar also stands to fall steeply if there is no output cut. The loonie has already been on the backfoot this week after the Bank of Canada took a more cautious stance on the pace of future rate hikes at its policy meeting on Wednesday. A deeper slide in oil prices would make it more difficult for the BoC to hike rates again in the near term and the loonie would likely break below yesterday’s 1½-year low of C$1.3443 per US dollar. However, there could be some support for the loonie from today’s Canadian employment numbers, due at 1330 GMT, if they point to a strong jobs market.

In other commodities, the weaker dollar helped propel gold to 20-week highs. The precious metal last stood around $1240.50 an ounce.