In the American session, we get BoC’s interest rate decision and the bank is widely expected to remain on hold at +1.75%, after October’s 25 basis points rate hike, with CAD OIS currently implying a probability for the bank to remain on hold of 94.78%. Fundamentals behind the Loonie could suggest a wait and see position for the bank, as oil prices were dropping until recently. The headline inflation rate could support a more hawkish stance, while the GDP and recent employment data, could be advising caution. We would concentrate our focus for the Loonie, on whether the wording of the accompanying statement could provide any clues about the next rate hike (maybe in January), as well as the OPEC meeting on Thursday could fundamentally influence oil prices.

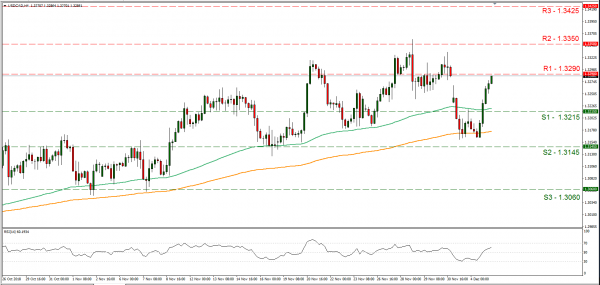

USD/CAD rallied yesterday breaking the 1.3215 (S1) resistance line (now turned to support). We could see the pair stabilising ahead of BoC’s interest rate decision later today and depending on the decision and the contents of the accompanying statement decide the direction of the next leg. Should the pair find fresh buying orders along its path, we could see it breaking the 1.3290 (R1) resistance line and aim for the 1.3350 (R2) resistance hurdle. Should the pair come under selling interest, we could see it breaking the 1.3215 (S1) support line and aim for lower grounds.

Brexit fears intensify as May loses critical votes in UK Parliament

The pound experienced some more choppy trading yesterday, as Brexit headlines were reeling in throughout the day. Early during the European morning, a media report stated that an EU’s high court (ECJ) indicated that the UK could unilaterally reverse Brexit. Then UK’s PM Theresa May, suffered three defeats in the UK Parliament, as she tried to convince it for her Brexit deal. Two vote counts found the UK government in contempt of Parliament and forced the PM to release a secret government legal advice (due out today) on her Brexit plan. The third vote, gives the Parliament the power to shape the final Brexit settlement if her plan doesn’t pass the House of Commons. We consider the defeats in parliament, as further indications that May’s Brexit deal may not pass on the 11th of December. Volatility is expected to continue today and the pound may remain under pressure as difficulties mount for Theresa May. Despite cable rising during the European session and the breaking the 1.2780 (R2) resistance line, later on it dropped heavily, breaking consecutively the 1.2780 (R2) and the 1.2700 (R1) support lines (now turned to resistance). We could see cable continuing to trade in a bearish market as Brexit headlines are expected to continue reeling in. We expect market focus to be on Brexit today for GBP traders, however some support could be provided for the pound by the release of UK’s November Services PMI. Should the bears continue to dictate the pair’s direction we could see it breaking the 1.2630 (S1) support line and aim for the 1.2555 (S2) support barrier. Should on the other hand the bulls take over, we could see the pair, breaking the 1.2700 (S1) support line and aim for the 1.2780 (S2) support hurdle.

In today’s other economic highlights:

In today’s European session, we get Eurozone’s final Composite PMI for November and retail sales growth rate for October. Also during the European session we get UK services PMI for November. As for speakers, ECB’s president Mario Draghi will be speaking during the European session today and please note that the US markets are expected to be closed as former US president George H.W. Busch will be remembered.

USD/CAD H4

Support: 1.3215(S1), 1.3145 (S2), 1.3060 (S3)

Resistance: 1.3290 (R1), 1.3350 (R2), 1.3425 (R3)

GBP/USD H4

Support: 1.2630 (S1), 1.2555 (S2), 1.2485 (S3)

Resistance: 1.2700 (R1), 1.2780 (R2), 1.2850 (R3)