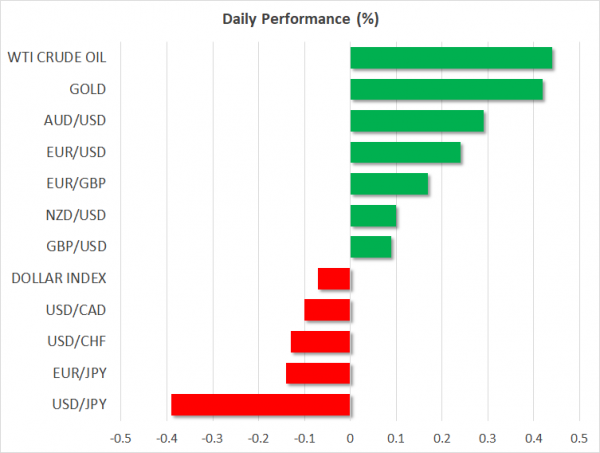

- Dollar drops as Powell appears ‘dovish’. However, markets may have overreacted, hence today’s Fed minutes (1900 GMT) could be crucial

- Equities and commodity-linked currencies lifted by Powell’s remarks

- Pound capitalizes on dollar’s pullback and signs voters may support May’s deal

Dollar drops as Powell appears ‘cautious’, but Fed minutes crucial

Fed Chair Powell’s speech yesterday was widely perceived as dovish. The comment that grabbed most attention was that rates ‘remain just below the broad range of estimates that would be neutral for the economy’. The implication is that if rates are just below neutral, the Fed won’t raise them much further from here. Consequently, the dollar fell sharply as investors priced out rate increases in 2019; markets now expect the Fed to hike rates a single time next year, versus the three 25bps hikes penciled in by the central bank itself.

While his remarks do seem cautious at first glance, a closer look might reveal otherwise. He specifically said rates are near the ‘range’ of estimates for neutral; this is a rather wide range, and the comment is simply an acknowledgement of reality. Moreover, while he noted he’s paying ‘close attention’ to the data, he made it clear he expects solid US growth, low unemployment, and near-target inflation. Overall, his comments were hardly those of a central banker attempting to signal he might hit the pause button on hikes before long.

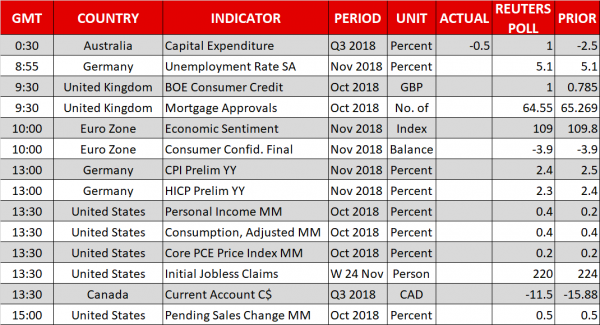

Hence, the current pricing for just one quarter-point hike next year may be somewhat of an overreaction on the part of investors, which runs the risk of being corrected later today in case the latest Fed minutes due at 1900 GMT strike a more balanced tone. Ahead of the minutes at 1330 GMT, the core PCE price index for October will be released alongside personal consumption and income data – these may also be crucial for the dollar. Meanwhile, regional Fed Presidents Mester, Evans, Harker, Kashkari, Kaplan, and Rosengren will participate in a panel at 1930 GMT.

Equities soar alongside commodity currencies; focus still on trade

Stock markets liked Powell’s dovish-perceived comments, with US indices like the S&P 500 (+2.30%) and Nasdaq Composite (+2.95%) posting meaningful gains. Speculation for lower interest rates for longer is typically a blessing for stocks, as investors bet that companies’ borrowing costs will remain minimal, boosting profitability.

The aussie and kiwi outperformed in this risk-on environment, with kiwi/dollar touching a 5-month high. Meanwhile, gold rose on the back of a weaker dollar, but still trades within a triangle. The upcoming US data today could also impact these assets via the risk sentiment channel, but note that how trade discussions play out may prove more important. In this respect, China’s President Xi Jinping said yesterday his nation will make efforts to open its markets and protect intellectual property, perhaps laying the groundwork for a ‘ceasefire’ when he meets Trump this week.

Pound rebounds amid signs ‘Brexit tide’ may be turning

An opinion poll that flew largely under the radar yesterday showed that support for May’s deal among voters is above 50%, suggesting the PM’s recent efforts to ‘sell’ her agreement may be bearing fruit. While a single opinion poll doesn’t mean much, if public support for the accord continues to rise, Parliament risks a major backlash in rejecting it – underscoring that May could ultimately manage to turn the tide. Sterling/dollar rebounded to cross back above 1.2800, not least due to dollar weakness. Any further signs the Parliamentary vote may be closer than markets currently anticipate could be a game changer for the currency’s near-term prospects.

Other highlights

Ahead of the US data today, Germany’s preliminary inflation data for November are due out at 1300 GMT. The nation’s EU-harmonized CPI rate is projected to tick down to 2.3% in yearly terms, from 2.4% previously. The regional German CPIs will be released ahead of the nationwide print, so any moves in the euro may occur before the official release time.

As for other public appearances, the BoC’s Wilkins will deliver remarks at 1500 GMT and the ECB’s Villeroy de Galhau at 1700 GMT.