US stocks ended the day higher after a speech by Federal Reserve Chairman Jerome Powell. Addressing the Economic Club of New York, he said that the country’s interest rates were near neutral. The neutral level is one that neither causes growth to accelerate nor to slow down. This led to the US stock market to have the best day since March this year. The Dow and S&P gained by more than 2%. At the same time, the US dollar index fell sharply from $97.35 to an intraday low of $96.50. During the speech, he also defended the Fed’s policy of gradual tightening but said they will continue to watch out for new economic data.

The price of crude dropped yesterday after the EIA released inventory data. Over the past week, inventories rose to 3.577 million barrels. This was higher than the consensus estimate of 0.769M but lower than last week’s 4.85 million barrels. The data came a day after the American Petroleum Institute data showed an increase of 3.45 million barrels. These numbers continue to show the amount of crude that American producers are pumping every day. In the Asian session however, the price moved up a bit as traders wait for the statement by OPEC.

The yen rose sharply against the USD. This was because of the statement by the Fed and the retail sales data from Japan. In October, the retail sales rose by 3.5%, which was better than the 2.7% that traders were expecting. It was also higher than September’s growth of 2.2% which was the sharpest growth since December last year.

EUR/USD

The EUR/USD pair rose sharply after the Fed Chairman’s statement yesterday. It rose from an intraday low of 1.1265 to a high of 1.1387. The pair is headed towards the important resistance level shown below. This is supported by the double EMA and the Bulls Power indicator as shown below. It is likely that the pair will continue moving up and possibly test the resistance of 1.1400.

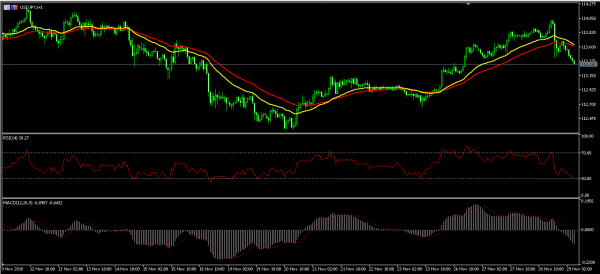

USD/JPY

After a week of gains, the USD/JPY fell sharply overnight. The reversal was supported by the Fed Chair’s statement and accelerated by Japanese retail sales. It is now trading at 113.35, which is significantly lower than yesterday’s high of 114.00. The 50-day EMA and the 30-day EMA have made a bearish crossover, which is an indication that the pair could likely continue moving lower. This is supported by the RSI, which has dropped from 70 to 30 and the MACD as shown below.

XTI/USD

The price of the XTI/USD pair dropped to an intraday low of 50 after the inventory data yesterday. Overnight, the price moved up a bit as the pair struggled to trade below the 50 barrier. In the past week, the pair has been consolidating within this level, a sign that sharp movements could happen ahead or before OPEC ministers meet in Vienna. Therefore, while the pair could continue moving lower, traders should be cautious about going short.