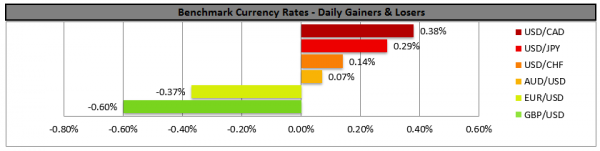

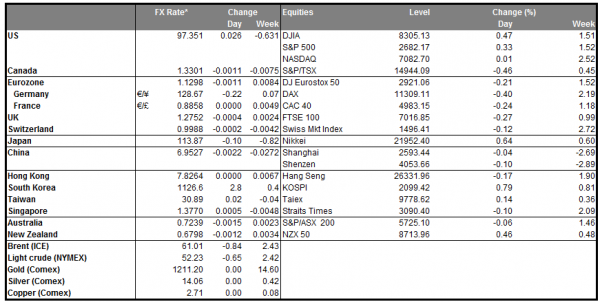

The USD strengthened as US trade tensions intensified yesterday, while at the same time Fed officials made some hawkish comments. Media stated, that the US President could impose tariffs on imported cars, in which case the German and Japanese economies would be hit. The article of a German magazine, cited “EU sources” stating that tariffs could be imposed on imported cars of 25%, as early as next week. Meanwhile China warned of dire consequences, if US hardliners try to separate the US and Chinese economies. As trade wars intensify and widen, markets turn their attention to the G20 meeting, which could prove to be landmark date. At the same time Fed’s Richard Clarida, supported further hikes by the Fed, though the rate hike path may prove to be data dependent. Market focus could be turned to today’s financial releases as well as Jerome Powell’s speech, as volatility could rise for USD pairs.

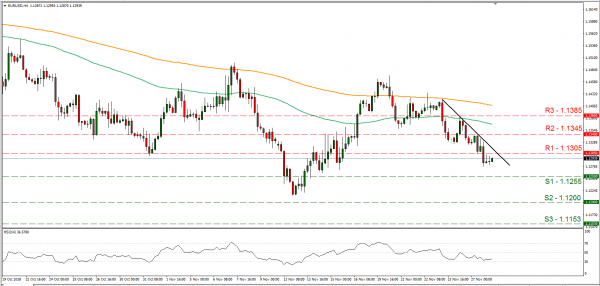

EUR/USD dropped yesterday, as it broke the 1.1305 (R1) support line (now turned to resistance). We maintain our bearish outlook for the pair, as the downward trendline incepted since the 23rd of November, remains intact. Should the bears continue to dictate the pair’s direction, we could see the pair, breaking the 1.1255 (S1) support line. On the other hand should the bulls take over, we could see the pair breaking the 1.1305 (R1) resistance line and aim for the 1.1345 (R2) resistance barrier.

Sterling weakens as Brexit is in the Balance

The sterling weakened yesterday as doubts increased whether Theresa May will be able to get UK Parliament’s approval for her Brexit deal. According to media, Theresa May has stopped any efforts of preventing lawmakers rewriting her Brexit plans. If the media are correct, then it could signal that MPs will be able to call for a different deal or even a new referendum. Analysts point out that the markets may be pricing in the scenario of the deal not passing through parliament, at least not the first time. We expect there to be increased volatility for the pound for the next two weeks as UK Parliament’s vote looms until December 11th.

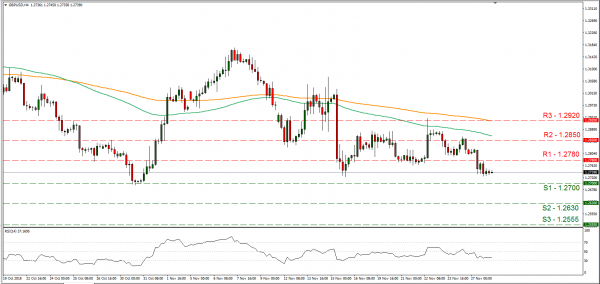

Cable dropped as the pair broke the 1.2780 (R1) support line (now turned to resistance). Should the pound continue to weaken, we could see the pair dropping even further. Should the pair be under the market’s selling interest we could see it breaking the 1.2700 (S1) key support level and aiming for the 1.2630 (S2) support zone. Should on the other hand the market favor the pair’s long positions, we could see the pair breaking the 1.2780 (R1) resistance line and aim for the 1.2850 (R2) resistance area.

In today’s other economic highlights:

In the European session today, we get Germany’s GfK Consumer climate indicator for December, while in the American session, we get from the US the 2nd release of the GDP growth rate for Q3, the trade balance figure and the new home sales figure, both for October. Later on oil prices may have increased volatility, as the EIA crude oil inventories figure is due out. Also please be advised, that BoE will release its financial stability report along with the results of its stress tests for UK banks. As for speakers, ECB’s Praet, BoE Governor Mark Carney and Fed’s Chairman Jerome Powell speak.

GBP/USD H4

Support: 1.2700 (S1), 1.2630 (S2), 1.2555 (S3)

Resistance: 1.2780 (R1), 1.2850 (R2), 1.2920 (R3)

EUR/USD H4

Support: 1.1255 (S1), 1.1200 (S2), 1.1153 (S3)

Resistance: 1.1305 (R1), 1.1345 (R2), 1.1385 (R3)