The US dollar was largely unmoved overnight after the US President continued to criticize the Federal Reserve and the Chairman he selected. In an interview with Washington Post, the President said that he was ‘not even a little bit happy’ with Jerome Powell and the Fed in general slating the recent rate hikes. Under his presidency, the Fed has hiked rates six times and is expected to do the same in December. Today, traders will look forward to Powell’s statement at the economic club of New York. They will also focus on housing market data and the second preliminary reading of the second quarter GDP.

Larry Kudlow, Trump’s top economic advisor talked to reporters at the White House about the upcoming meeting between the US President and China’s Xi Jinping. In the interview, he raised the possibility of a breakthrough in the talks that will happen on Saturday night. His interview came a day after the president told the Wall Street Journal (WSJ) that he believed he was unlikely to suspend the proposed $261 billion tariffs that are expected to go into effect in January. According to WSJ, Chinese officials have complained about the proposed tariffs and said that they won’t negotiate under threats.

The price of crude oil remained at session lows after data from the American Petroleum Institute (API) showed a significant rise in inventories. Over the past week, oil stocks rose to 3.45 million barrels, which was higher than last week’s drawdown of 1.54 million barrels. This data was released ahead of the official government data on inventories. Later today, the EIA’s data is expected to show an increase of inventories by 0.769 million barrels, which will be lower than last week’s increase of 4.85 million barrels. Oil investors are also cautious ahead of the G20 meeting this week and OPEC’s meeting the following week.

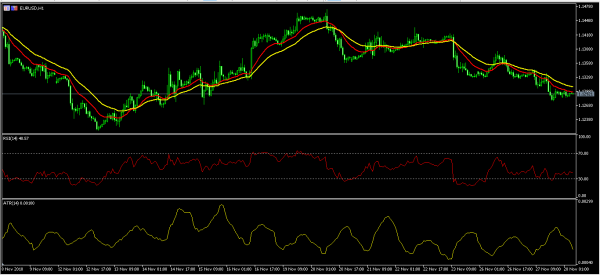

EUR/USD

The EUR/USD pair was unmoved in overnight trading as traders waited for US GDP numbers. As of this writing, the pair is trading at 1.1290, which is close to the lowest level since November 16. This week, it has continued with a downward trend that was started on Tuesday last week. The 15-day and 30-day EMA on the hourly chart show that the pair could continue the downward trend. The overnight pause has led to reduced volatility in the pair as shown by the Average True Range indicator below. With no major data expected from the EU today, focus will be on the United States, which will release the GDP and housing data.

XBR/USD

The price of crude oil was unchanged in overnight trading even after the API inventory data. The XBR/USD pair is trading at 60.80, which is close to the yearly low of 58.65. The double EMA show that the pair could have reached a bottom as the 15-day EMA try to cross the 30-day EMA on the four-hour chart below. This could be the case because of the upcoming OPEC and G20 meetings.

GBP/USD

The volatility in the GBP/USD pair has continued as traders take time to analyze the odds of a no-Brexit deal. This has made the pair make some extreme upward and downward swings as shown in the eight-hour chart below. In the past two days, the 15-day and 30-day EMA have pointed to a continued downward trend. This could continue as the pair tries to test the important support of 1.2690. However, because of the news that could arise on Brexit, the pair will likely have more swings.